Benjamin Edwards Inc. boosted its position in ASML Holding (NASDAQ:ASML - Free Report) by 603.5% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 3,250 shares of the semiconductor company's stock after acquiring an additional 2,788 shares during the period. Benjamin Edwards Inc.'s holdings in ASML were worth $2,709,000 at the end of the most recent reporting period.

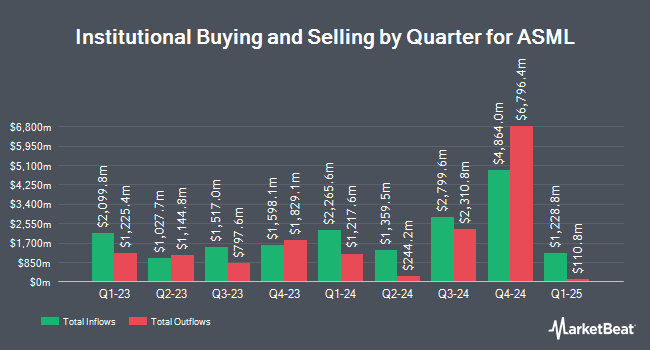

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. Mercer Global Advisors Inc. ADV grew its position in shares of ASML by 4,379.6% during the 2nd quarter. Mercer Global Advisors Inc. ADV now owns 889,875 shares of the semiconductor company's stock valued at $910,102,000 after buying an additional 870,010 shares during the last quarter. International Assets Investment Management LLC grew its stake in shares of ASML by 94,079.7% in the 3rd quarter. International Assets Investment Management LLC now owns 491,618 shares of the semiconductor company's stock worth $4,096,410,000 after purchasing an additional 491,096 shares during the last quarter. Van ECK Associates Corp lifted its position in shares of ASML by 37.0% during the 3rd quarter. Van ECK Associates Corp now owns 1,757,049 shares of the semiconductor company's stock valued at $1,464,061,000 after acquiring an additional 474,653 shares during the last quarter. Tairen Capital Ltd increased its stake in ASML by 321.2% in the 2nd quarter. Tairen Capital Ltd now owns 202,946 shares of the semiconductor company's stock worth $207,559,000 after purchasing an additional 154,760 shares in the last quarter. Finally, Mediolanum International Funds Ltd purchased a new stake in shares of ASML in the 3rd quarter valued at approximately $125,952,000. Hedge funds and other institutional investors own 26.07% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently commented on ASML shares. Wells Fargo & Company lowered their price target on shares of ASML from $1,000.00 to $790.00 and set an "overweight" rating on the stock in a report on Thursday, October 17th. Sanford C. Bernstein cut their target price on ASML from $815.00 to $767.00 and set an "outperform" rating on the stock in a report on Friday, November 29th. BNP Paribas assumed coverage on shares of ASML in a research report on Tuesday. They set an "outperform" rating and a $858.00 target price for the company. Susquehanna cut their target price on shares of ASML from $1,300.00 to $1,100.00 and set a "positive" rating for the company in a research note on Friday, October 11th. Finally, Morgan Stanley downgraded shares of ASML from an "overweight" rating to an "equal weight" rating in a report on Friday, September 20th. Three research analysts have rated the stock with a hold rating, ten have issued a buy rating and two have issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $943.83.

Read Our Latest Report on ASML

ASML Price Performance

Shares of ASML stock traded down $8.42 on Thursday, reaching $711.50. 1,799,330 shares of the stock were exchanged, compared to its average volume of 1,457,259. ASML Holding has a one year low of $645.45 and a one year high of $1,110.09. The firm has a market cap of $279.92 billion, a PE ratio of 37.36, a P/E/G ratio of 2.08 and a beta of 1.49. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.84 and a current ratio of 1.55. The firm's 50 day moving average is $726.48 and its 200-day moving average is $860.97.

ASML (NASDAQ:ASML - Get Free Report) last posted its earnings results on Tuesday, October 15th. The semiconductor company reported $5.80 earnings per share for the quarter, topping analysts' consensus estimates of $5.24 by $0.56. ASML had a net margin of 26.40% and a return on equity of 47.61%. The firm had revenue of $8.21 billion for the quarter, compared to analyst estimates of $7.66 billion. As a group, analysts anticipate that ASML Holding will post 20.68 EPS for the current fiscal year.

ASML Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, November 7th. Stockholders of record on Tuesday, October 29th were paid a $1.407 dividend. The ex-dividend date was Tuesday, October 29th. This represents a $5.63 annualized dividend and a dividend yield of 0.79%. ASML's dividend payout ratio is currently 29.21%.

ASML Company Profile

(

Free Report)

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers. It offers advanced semiconductor equipment systems, including lithography, metrology, and inspection systems. The company also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various range of semiconductor nodes and technologies.

Recommended Stories

Before you consider ASML, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ASML wasn't on the list.

While ASML currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.