Benjamin Edwards Inc. increased its position in shares of Royal Caribbean Cruises Ltd. (NYSE:RCL - Free Report) by 74.3% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,601 shares of the company's stock after acquiring an additional 1,962 shares during the quarter. Benjamin Edwards Inc.'s holdings in Royal Caribbean Cruises were worth $816,000 at the end of the most recent quarter.

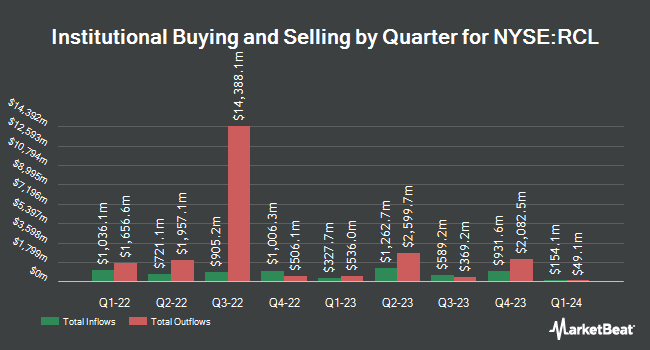

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in RCL. FSM Wealth Advisors LLC grew its holdings in shares of Royal Caribbean Cruises by 3.2% in the 3rd quarter. FSM Wealth Advisors LLC now owns 1,636 shares of the company's stock valued at $290,000 after buying an additional 51 shares during the period. Venturi Wealth Management LLC grew its stake in Royal Caribbean Cruises by 20.9% in the third quarter. Venturi Wealth Management LLC now owns 353 shares of the company's stock valued at $63,000 after acquiring an additional 61 shares during the period. Venture Visionary Partners LLC increased its holdings in shares of Royal Caribbean Cruises by 4.8% in the third quarter. Venture Visionary Partners LLC now owns 1,366 shares of the company's stock worth $242,000 after acquiring an additional 62 shares in the last quarter. Empower Advisory Group LLC raised its position in shares of Royal Caribbean Cruises by 3.7% during the third quarter. Empower Advisory Group LLC now owns 1,755 shares of the company's stock worth $311,000 after purchasing an additional 63 shares during the period. Finally, Ipswich Investment Management Co. Inc. lifted its holdings in shares of Royal Caribbean Cruises by 3.3% during the 3rd quarter. Ipswich Investment Management Co. Inc. now owns 2,201 shares of the company's stock valued at $390,000 after purchasing an additional 70 shares in the last quarter. 87.53% of the stock is owned by institutional investors.

Insider Buying and Selling

In other Royal Caribbean Cruises news, CAO Henry L. Pujol sold 6,723 shares of the stock in a transaction that occurred on Wednesday, October 30th. The stock was sold at an average price of $208.51, for a total transaction of $1,401,812.73. Following the transaction, the chief accounting officer now directly owns 9,964 shares in the company, valued at approximately $2,077,593.64. This represents a 40.29 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Harri U. Kulovaara sold 3,256 shares of Royal Caribbean Cruises stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $234.62, for a total transaction of $763,922.72. Following the completion of the sale, the executive vice president now owns 22,348 shares of the company's stock, valued at $5,243,287.76. This represents a 12.72 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 404,332 shares of company stock valued at $94,299,521 over the last quarter. Insiders own 7.95% of the company's stock.

Analysts Set New Price Targets

RCL has been the topic of a number of research analyst reports. Barclays raised their price objective on shares of Royal Caribbean Cruises from $244.00 to $245.00 and gave the stock an "overweight" rating in a report on Wednesday, October 30th. Stifel Nicolaus upped their price objective on Royal Caribbean Cruises from $250.00 to $310.00 and gave the stock a "buy" rating in a research report on Friday. Citigroup lifted their target price on Royal Caribbean Cruises from $253.00 to $257.00 and gave the company a "buy" rating in a research report on Wednesday, October 30th. Wells Fargo & Company lifted their price objective on shares of Royal Caribbean Cruises from $180.00 to $232.00 and gave the company an "overweight" rating in a report on Wednesday, October 30th. Finally, Sanford C. Bernstein initiated coverage on shares of Royal Caribbean Cruises in a report on Tuesday, November 26th. They set an "outperform" rating and a $290.00 target price for the company. Three research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company. According to MarketBeat, Royal Caribbean Cruises currently has a consensus rating of "Moderate Buy" and a consensus price target of $233.63.

Read Our Latest Report on RCL

Royal Caribbean Cruises Price Performance

Shares of RCL stock traded up $6.95 on Friday, hitting $258.09. 1,896,459 shares of the company's stock were exchanged, compared to its average volume of 1,553,753. The company has a 50 day moving average of $215.38 and a 200 day moving average of $178.94. The stock has a market cap of $69.40 billion, a P/E ratio of 26.53, a price-to-earnings-growth ratio of 0.66 and a beta of 2.59. The company has a debt-to-equity ratio of 2.63, a current ratio of 0.19 and a quick ratio of 0.16. Royal Caribbean Cruises Ltd. has a 12 month low of $113.10 and a 12 month high of $258.21.

Royal Caribbean Cruises (NYSE:RCL - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The company reported $5.20 earnings per share for the quarter, topping analysts' consensus estimates of $5.05 by $0.15. Royal Caribbean Cruises had a return on equity of 52.92% and a net margin of 16.21%. The business had revenue of $4.89 billion for the quarter, compared to analyst estimates of $4.89 billion. During the same quarter in the previous year, the company posted $3.85 EPS. Royal Caribbean Cruises's quarterly revenue was up 17.5% compared to the same quarter last year. On average, equities research analysts predict that Royal Caribbean Cruises Ltd. will post 11.64 EPS for the current year.

About Royal Caribbean Cruises

(

Free Report)

Royal Caribbean Cruises Ltd. operates as a cruise company worldwide. The company operates cruises under the Royal Caribbean International, Celebrity Cruises, and Silversea Cruises brands, which comprise a range of itineraries. As of February 21, 2024, it operated 65 ships. Royal Caribbean Cruises Ltd.

See Also

Before you consider Royal Caribbean Cruises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Caribbean Cruises wasn't on the list.

While Royal Caribbean Cruises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.