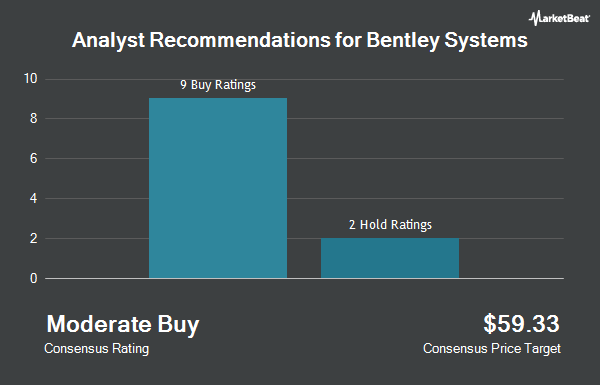

Bentley Systems, Incorporated (NASDAQ:BSY - Get Free Report) has earned a consensus rating of "Moderate Buy" from the eight research firms that are presently covering the company, Marketbeat Ratings reports. Two investment analysts have rated the stock with a hold rating and six have given a buy rating to the company. The average 12 month price objective among analysts that have issued ratings on the stock in the last year is $58.43.

BSY has been the subject of several analyst reports. Rosenblatt Securities restated a "buy" rating and set a $62.00 price target on shares of Bentley Systems in a research note on Friday, November 8th. JPMorgan Chase & Co. assumed coverage on shares of Bentley Systems in a research report on Monday. They set a "neutral" rating and a $52.00 price objective for the company. Finally, Piper Sandler lifted their target price on shares of Bentley Systems from $63.00 to $65.00 and gave the company an "overweight" rating in a report on Friday, November 8th.

View Our Latest Stock Report on BSY

Bentley Systems Stock Performance

Bentley Systems stock traded down $1.12 during midday trading on Friday, hitting $47.13. 754,416 shares of the company's stock were exchanged, compared to its average volume of 1,191,755. The company has a debt-to-equity ratio of 1.37, a quick ratio of 0.52 and a current ratio of 0.52. The stock has a market cap of $13.70 billion, a price-to-earnings ratio of 42.46, a price-to-earnings-growth ratio of 4.04 and a beta of 1.03. Bentley Systems has a 12-month low of $43.82 and a 12-month high of $57.19. The firm's 50 day simple moving average is $48.97 and its 200 day simple moving average is $49.40.

Bentley Systems (NASDAQ:BSY - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The company reported $0.24 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.24. The firm had revenue of $335.17 million for the quarter, compared to analyst estimates of $340.36 million. Bentley Systems had a return on equity of 29.50% and a net margin of 27.73%. The business's revenue was up 9.3% on a year-over-year basis. During the same quarter last year, the company posted $0.18 earnings per share. Equities research analysts predict that Bentley Systems will post 0.88 EPS for the current year.

Bentley Systems Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, December 12th. Stockholders of record on Tuesday, December 3rd were issued a $0.06 dividend. The ex-dividend date was Tuesday, December 3rd. This represents a $0.24 dividend on an annualized basis and a dividend yield of 0.51%. Bentley Systems's dividend payout ratio is presently 21.62%.

Insider Buying and Selling

In other news, Director Barry J. Bentley sold 50,000 shares of the firm's stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $50.20, for a total value of $2,510,000.00. Following the completion of the transaction, the director now owns 12,298,230 shares in the company, valued at $617,371,146. This trade represents a 0.40 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Over the last 90 days, insiders have sold 234,987 shares of company stock valued at $11,667,821. Corporate insiders own 21.12% of the company's stock.

Institutional Investors Weigh In On Bentley Systems

Institutional investors and hedge funds have recently made changes to their positions in the business. International Assets Investment Management LLC acquired a new position in Bentley Systems during the third quarter worth about $59,400,000. Needham Investment Management LLC purchased a new position in shares of Bentley Systems during the 3rd quarter worth approximately $2,134,000. Mirabella Financial Services LLP raised its position in shares of Bentley Systems by 1,155.0% during the 3rd quarter. Mirabella Financial Services LLP now owns 100,800 shares of the company's stock worth $5,018,000 after purchasing an additional 92,768 shares during the last quarter. Montanaro Asset Management Ltd lifted its stake in Bentley Systems by 8.8% in the 3rd quarter. Montanaro Asset Management Ltd now owns 331,416 shares of the company's stock valued at $16,839,000 after buying an additional 26,741 shares in the last quarter. Finally, Clearline Capital LP acquired a new stake in Bentley Systems during the 2nd quarter valued at $6,999,000. 44.16% of the stock is currently owned by hedge funds and other institutional investors.

About Bentley Systems

(

Get Free ReportBentley Systems, Incorporated, together with its subsidiaries, provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. The company offers open modeling engineering applications, such as MicroStation, OpenBridge, OpenBuildings, OpenCities, OpenComms, OpenFlows, OpenPlant, OpenRail, OpenRoads, OpenSite, OpenTower, OpenTunnel, OpenUtilities, and OpenWindowPower; and open simulation engineering applications, including ADINA, AutoPIPE, CUBE, DYNAMEQ, EMME, LEGION, Power Line Systems, RAM, SACS, SPIDA, and STAAD; and geoprofessional applications for modeling and simulation of near and deep subsurface conditions, including AGS, Central, GeoStudio, Imago, Leapfrog, MX Deposit, Oasis montaj, OpenGround, and PLAXIS.

Further Reading

Before you consider Bentley Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bentley Systems wasn't on the list.

While Bentley Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report