Citigroup Inc. reduced its holdings in shares of Berry Global Group, Inc. (NYSE:BERY - Free Report) by 8.6% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 212,120 shares of the industrial products company's stock after selling 19,971 shares during the period. Citigroup Inc. owned about 0.19% of Berry Global Group worth $14,420,000 at the end of the most recent reporting period.

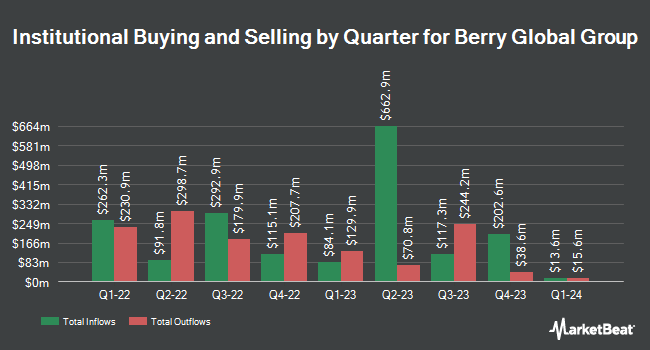

Other institutional investors have also made changes to their positions in the company. Altshuler Shaham Ltd acquired a new stake in shares of Berry Global Group during the 2nd quarter valued at about $27,000. Quest Partners LLC boosted its position in Berry Global Group by 54,800.0% in the second quarter. Quest Partners LLC now owns 549 shares of the industrial products company's stock valued at $32,000 after buying an additional 548 shares in the last quarter. LRI Investments LLC boosted its position in Berry Global Group by 1,309.1% in the second quarter. LRI Investments LLC now owns 620 shares of the industrial products company's stock valued at $36,000 after buying an additional 576 shares in the last quarter. DekaBank Deutsche Girozentrale acquired a new position in Berry Global Group in the second quarter valued at about $42,000. Finally, American Capital Advisory LLC acquired a new position in Berry Global Group in the second quarter valued at about $44,000. 95.36% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at Berry Global Group

In other Berry Global Group news, Director Evan Bayh sold 14,000 shares of the company's stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $70.13, for a total value of $981,820.00. Following the completion of the sale, the director now owns 30,228 shares of the company's stock, valued at approximately $2,119,889.64. This represents a 31.65 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 4.00% of the company's stock.

Berry Global Group Trading Up 1.2 %

Shares of BERY traded up $0.84 on Thursday, reaching $71.57. 2,053,661 shares of the company's stock were exchanged, compared to its average volume of 1,091,444. The company has a current ratio of 0.41, a quick ratio of 0.26 and a debt-to-equity ratio of 2.57. The stock has a market capitalization of $8.20 billion, a P/E ratio of 16.30, a price-to-earnings-growth ratio of 1.42 and a beta of 1.14. The business has a 50 day moving average price of $68.45 and a two-hundred day moving average price of $64.65. Berry Global Group, Inc. has a 12 month low of $54.06 and a 12 month high of $73.31.

Berry Global Group Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Monday, December 2nd will be paid a dividend of $0.31 per share. This represents a $1.24 dividend on an annualized basis and a dividend yield of 1.73%. This is an increase from Berry Global Group's previous quarterly dividend of $0.28. The ex-dividend date of this dividend is Monday, December 2nd. Berry Global Group's payout ratio is 25.06%.

Analyst Ratings Changes

A number of research firms have commented on BERY. Morgan Stanley began coverage on shares of Berry Global Group in a research report on Wednesday, September 4th. They issued an "equal weight" rating and a $76.00 price target on the stock. JPMorgan Chase & Co. restated an "overweight" rating and issued a $76.00 price target (up from $70.00) on shares of Berry Global Group in a research report on Monday. Barclays boosted their price target on shares of Berry Global Group from $64.00 to $75.00 and gave the company an "equal weight" rating in a research report on Wednesday. Royal Bank of Canada boosted their price target on shares of Berry Global Group from $69.00 to $73.00 and gave the company a "sector perform" rating in a research report on Thursday, November 21st. Finally, Truist Financial reiterated a "hold" rating and set a $72.00 target price (down from $74.00) on shares of Berry Global Group in a research report on Wednesday, November 20th. Nine equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $73.73.

View Our Latest Report on BERY

Berry Global Group Company Profile

(

Free Report)

Berry Global Group, Inc manufactures and supplies non-woven, flexible, and rigid products in consumer and industrial end markets in the United States, Canada, Europe, and internationally. The company operates through Consumer Packaging International; Consumer Packaging North America; Engineered Materials; and Health, Hygiene & Specialties segments.

Featured Articles

Before you consider Berry Global Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Berry Global Group wasn't on the list.

While Berry Global Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.