Bessemer Group Inc. lessened its stake in shares of Novanta Inc. (NASDAQ:NOVT - Free Report) by 10.4% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 145,612 shares of the technology company's stock after selling 16,861 shares during the quarter. Bessemer Group Inc. owned about 0.41% of Novanta worth $22,245,000 at the end of the most recent reporting period.

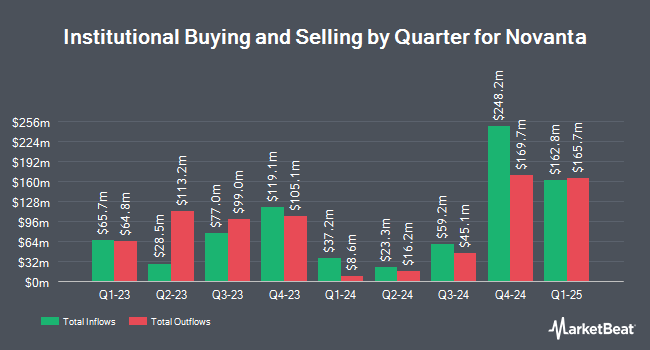

Other hedge funds and other institutional investors also recently modified their holdings of the company. Vanguard Group Inc. boosted its holdings in Novanta by 1.5% during the fourth quarter. Vanguard Group Inc. now owns 4,123,828 shares of the technology company's stock worth $629,997,000 after buying an additional 62,585 shares in the last quarter. State Street Corp lifted its position in shares of Novanta by 2.0% during the 3rd quarter. State Street Corp now owns 1,298,419 shares of the technology company's stock valued at $232,313,000 after acquiring an additional 24,929 shares during the last quarter. Alliancebernstein L.P. boosted its stake in shares of Novanta by 6.2% during the 4th quarter. Alliancebernstein L.P. now owns 1,004,879 shares of the technology company's stock worth $153,515,000 after acquiring an additional 58,864 shares in the last quarter. William Blair Investment Management LLC grew its holdings in shares of Novanta by 1.2% in the 4th quarter. William Blair Investment Management LLC now owns 975,841 shares of the technology company's stock worth $149,079,000 after acquiring an additional 11,361 shares during the last quarter. Finally, Geneva Capital Management LLC raised its position in shares of Novanta by 9.3% during the fourth quarter. Geneva Capital Management LLC now owns 852,638 shares of the technology company's stock worth $130,257,000 after purchasing an additional 72,592 shares during the period. Institutional investors own 98.35% of the company's stock.

Analyst Ratings Changes

Separately, Robert W. Baird dropped their price target on Novanta from $169.00 to $160.00 and set a "neutral" rating on the stock in a research note on Monday, March 3rd.

View Our Latest Analysis on NOVT

Novanta Trading Down 0.3 %

Shares of NOVT stock traded down $0.39 during trading hours on Tuesday, reaching $114.09. 290,281 shares of the stock traded hands, compared to its average volume of 194,163. The company has a quick ratio of 1.81, a current ratio of 2.79 and a debt-to-equity ratio of 0.61. The firm has a market capitalization of $4.10 billion, a PE ratio of 68.32 and a beta of 1.42. Novanta Inc. has a 1-year low of $98.76 and a 1-year high of $187.12. The business has a fifty day moving average price of $133.98 and a 200 day moving average price of $153.27.

Novanta (NASDAQ:NOVT - Get Free Report) last announced its earnings results on Tuesday, February 25th. The technology company reported $0.76 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.71 by $0.05. The company had revenue of $238.10 million for the quarter, compared to the consensus estimate of $240.29 million. Novanta had a net margin of 6.52% and a return on equity of 15.20%. The company's revenue was up 12.5% on a year-over-year basis. During the same period in the previous year, the business earned $0.63 EPS. On average, equities research analysts forecast that Novanta Inc. will post 3.03 EPS for the current year.

About Novanta

(

Free Report)

Novanta, Inc engages in the provision of core technology solutions to healthcare and advanced industrial original equipment manufacturers. It operates through the following segments: Photonics, Vision, and Precision Motion. The Photonics segment designs, manufactures, and markets photonics-based solutions, including laser scanning and laser beam delivery, CO2 laser, continuous wave and ultrafast laser, and optical light engine products.

Read More

Before you consider Novanta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novanta wasn't on the list.

While Novanta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.