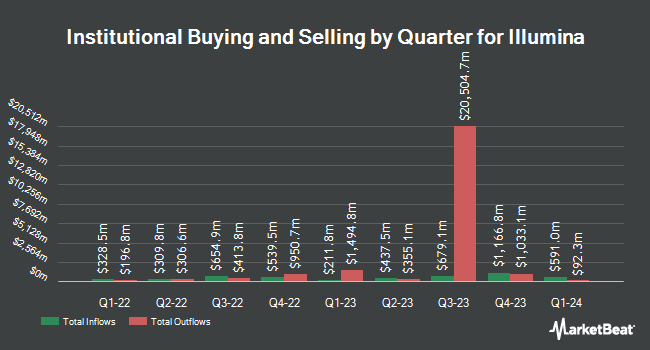

BI Asset Management Fondsmaeglerselskab A S grew its holdings in shares of Illumina, Inc. (NASDAQ:ILMN - Free Report) by 170.7% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 42,404 shares of the life sciences company's stock after buying an additional 26,737 shares during the period. BI Asset Management Fondsmaeglerselskab A S's holdings in Illumina were worth $5,666,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other institutional investors and hedge funds have also made changes to their positions in the company. Capital World Investors grew its stake in Illumina by 408.6% during the 4th quarter. Capital World Investors now owns 18,025,301 shares of the life sciences company's stock worth $2,408,721,000 after buying an additional 14,481,232 shares during the last quarter. WCM Investment Management LLC grew its position in shares of Illumina by 26.6% during the fourth quarter. WCM Investment Management LLC now owns 4,129,855 shares of the life sciences company's stock worth $551,625,000 after acquiring an additional 867,673 shares during the last quarter. Bank of New York Mellon Corp raised its position in Illumina by 0.8% in the 4th quarter. Bank of New York Mellon Corp now owns 3,402,057 shares of the life sciences company's stock valued at $454,617,000 after purchasing an additional 27,618 shares during the last quarter. Norges Bank acquired a new stake in Illumina during the 4th quarter worth $228,714,000. Finally, Bessemer Group Inc. grew its position in Illumina by 32,837.5% during the 4th quarter. Bessemer Group Inc. now owns 1,348,131 shares of the life sciences company's stock worth $180,152,000 after purchasing an additional 1,344,038 shares during the last quarter. 89.42% of the stock is owned by institutional investors and hedge funds.

Illumina Stock Down 3.2 %

ILMN opened at $71.21 on Monday. Illumina, Inc. has a one year low of $68.70 and a one year high of $156.66. The company has a market cap of $11.27 billion, a price-to-earnings ratio of -9.27, a PEG ratio of 1.60 and a beta of 1.38. The business's fifty day moving average is $84.61 and its two-hundred day moving average is $120.16. The company has a debt-to-equity ratio of 0.63, a quick ratio of 1.42 and a current ratio of 1.77.

Illumina (NASDAQ:ILMN - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The life sciences company reported $0.86 EPS for the quarter, missing analysts' consensus estimates of $0.92 by ($0.06). Illumina had a negative net margin of 27.95% and a positive return on equity of 13.37%. Analysts anticipate that Illumina, Inc. will post 4.51 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of brokerages have recently commented on ILMN. Piper Sandler upped their target price on shares of Illumina from $185.00 to $190.00 and gave the company an "overweight" rating in a report on Monday, February 10th. Robert W. Baird decreased their price objective on Illumina from $127.00 to $90.00 and set a "neutral" rating for the company in a research report on Wednesday, March 5th. Guggenheim lowered their target price on Illumina from $170.00 to $150.00 and set a "buy" rating on the stock in a research note on Friday, February 7th. TD Cowen cut Illumina from a "buy" rating to a "hold" rating and cut their price target for the stock from $177.00 to $140.00 in a research note on Friday, February 7th. Finally, HSBC lowered shares of Illumina from a "buy" rating to a "hold" rating and set a $100.00 price objective on the stock. in a research report on Friday, February 28th. One research analyst has rated the stock with a sell rating, ten have issued a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $138.70.

Read Our Latest Stock Report on Illumina

Illumina Profile

(

Free Report)

Illumina, Inc offers sequencing- and array-based solutions for genetic and genomic analysis in the United States, Singapore, the United Kingdom, and internationally. It operates through Core Illumina and GRAIL segments. The company offers sequencing and array-based instruments and consumables, which include reagents, flow cells, and library preparation; whole-genome sequencing kits, which sequence entire genomes of various size and complexity; and targeted resequencing kits, which sequence exomes, specific genes, and RNA or other genomic regions of interest.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Illumina, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Illumina wasn't on the list.

While Illumina currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.