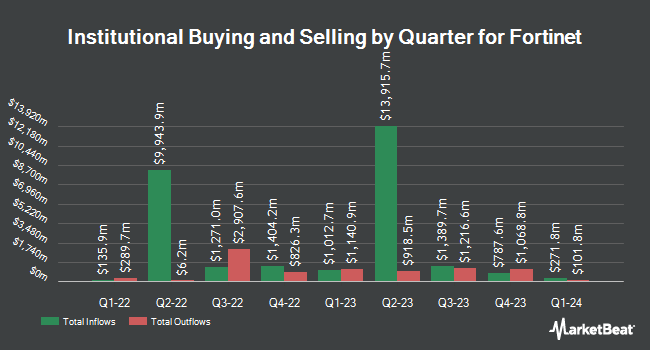

BI Asset Management Fondsmaeglerselskab A S purchased a new position in shares of Fortinet, Inc. (NASDAQ:FTNT - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 296,366 shares of the software maker's stock, valued at approximately $28,001,000.

A number of other hedge funds have also recently made changes to their positions in FTNT. Edmond DE Rothschild Holding S.A. purchased a new stake in Fortinet during the fourth quarter valued at about $27,000. Oarsman Capital Inc. lifted its position in Fortinet by 188.9% in the fourth quarter. Oarsman Capital Inc. now owns 416 shares of the software maker's stock valued at $39,000 after purchasing an additional 272 shares during the last quarter. Graney & King LLC purchased a new stake in shares of Fortinet during the fourth quarter valued at approximately $43,000. Golden State Wealth Management LLC bought a new position in shares of Fortinet in the fourth quarter worth approximately $46,000. Finally, Runnymede Capital Advisors Inc. purchased a new position in shares of Fortinet in the fourth quarter worth $56,000. 83.71% of the stock is currently owned by institutional investors.

Insider Buying and Selling at Fortinet

In other Fortinet news, CFO Keith Jensen sold 23,500 shares of the stock in a transaction that occurred on Wednesday, February 19th. The shares were sold at an average price of $113.56, for a total transaction of $2,668,660.00. Following the completion of the sale, the chief financial officer now directly owns 4,736 shares of the company's stock, valued at $537,820.16. This trade represents a 83.23 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CEO Ken Xie sold 206,000 shares of Fortinet stock in a transaction that occurred on Monday, March 10th. The shares were sold at an average price of $96.93, for a total transaction of $19,967,580.00. Following the sale, the chief executive officer now owns 51,391,879 shares in the company, valued at approximately $4,981,414,831.47. The trade was a 0.40 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 576,944 shares of company stock valued at $56,944,064 over the last 90 days. 18.00% of the stock is currently owned by corporate insiders.

Fortinet Stock Performance

Shares of NASDAQ FTNT traded up $4.06 during midday trading on Thursday, hitting $101.06. 2,273,350 shares of the company's stock traded hands, compared to its average volume of 5,073,878. The company has a debt-to-equity ratio of 0.67, a quick ratio of 1.39 and a current ratio of 1.47. The stock has a market capitalization of $77.71 billion, a price-to-earnings ratio of 44.75, a price-to-earnings-growth ratio of 4.19 and a beta of 1.09. The firm has a fifty day moving average of $99.80 and a 200 day moving average of $95.52. Fortinet, Inc. has a 1 year low of $54.57 and a 1 year high of $114.82.

Fortinet (NASDAQ:FTNT - Get Free Report) last issued its quarterly earnings results on Thursday, February 6th. The software maker reported $0.67 earnings per share for the quarter, topping the consensus estimate of $0.60 by $0.07. Fortinet had a net margin of 29.30% and a return on equity of 256.53%. On average, analysts forecast that Fortinet, Inc. will post 2.09 earnings per share for the current year.

Wall Street Analysts Forecast Growth

FTNT has been the topic of a number of analyst reports. Wells Fargo & Company boosted their price objective on shares of Fortinet from $85.00 to $105.00 and gave the company an "equal weight" rating in a research report on Friday, February 7th. Susquehanna upped their price target on Fortinet from $90.00 to $110.00 and gave the company a "neutral" rating in a research report on Monday, February 10th. UBS Group set a $123.00 price objective on Fortinet in a research report on Tuesday, March 18th. Raymond James restated a "market perform" rating on shares of Fortinet in a report on Tuesday, January 14th. Finally, Rosenblatt Securities lifted their price target on shares of Fortinet from $115.00 to $125.00 and gave the company a "buy" rating in a report on Friday, February 7th. One research analyst has rated the stock with a sell rating, twenty-one have given a hold rating, eleven have issued a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $104.77.

View Our Latest Research Report on FTNT

Fortinet Company Profile

(

Free Report)

Fortinet, Inc provides cybersecurity and convergence of networking and security solutions worldwide. It offers secure networking solutions focus on the convergence of networking and security; network firewall solutions that consist of FortiGate data centers, hyperscale, and distributed firewalls, as well as encrypted applications; wireless LAN solutions; and secure connectivity solutions, including FortiSwitch secure ethernet switches, FortiAP wireless local area network access points, FortiExtender 5G connectivity gateways, and other products.

Featured Stories

Before you consider Fortinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortinet wasn't on the list.

While Fortinet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.