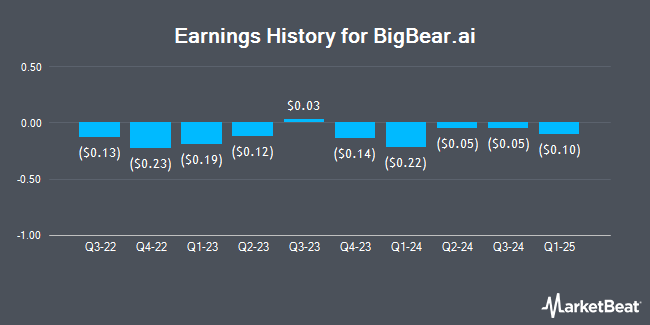

BigBear.ai (NYSE:BBAI - Get Free Report) will likely be posting its Q4 2024 quarterly earnings results after the market closes on Thursday, March 6th. Analysts expect BigBear.ai to post earnings of ($0.05) per share and revenue of $54.62 million for the quarter. BigBear.ai has set its FY 2025 guidance at EPS.

BigBear.ai (NYSE:BBAI - Get Free Report) last announced its quarterly earnings results on Thursday, March 6th. The company reported ($0.04) earnings per share for the quarter, topping analysts' consensus estimates of ($0.05) by $0.01. BigBear.ai had a negative return on equity of 138.35% and a negative net margin of 109.90%. On average, analysts expect BigBear.ai to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

BigBear.ai Stock Performance

NYSE:BBAI traded down $0.60 during midday trading on Thursday, reaching $4.21. 53,220,876 shares of the company traded hands, compared to its average volume of 20,887,436. The firm has a market capitalization of $1.06 billion, a price-to-earnings ratio of -4.62 and a beta of 3.17. The company has a fifty day moving average price of $5.32 and a 200 day moving average price of $3.12. The company has a debt-to-equity ratio of 2.08, a current ratio of 2.06 and a quick ratio of 2.06. BigBear.ai has a twelve month low of $1.17 and a twelve month high of $10.36.

Insider Activity

In related news, CEO Amanda Long sold 200,000 shares of the firm's stock in a transaction that occurred on Thursday, December 26th. The shares were sold at an average price of $4.25, for a total transaction of $850,000.00. Following the transaction, the chief executive officer now owns 2,583,254 shares in the company, valued at $10,978,829.50. This trade represents a 7.19 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Sean Bernard Battle sold 44,813 shares of the business's stock in a transaction that occurred on Thursday, January 2nd. The stock was sold at an average price of $4.46, for a total value of $199,865.98. Following the sale, the director now directly owns 137,838 shares in the company, valued at approximately $614,757.48. The trade was a 24.53 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 310,953 shares of company stock valued at $1,347,496. Company insiders own 1.40% of the company's stock.

Analyst Upgrades and Downgrades

BBAI has been the subject of a number of analyst reports. HC Wainwright boosted their target price on shares of BigBear.ai from $3.00 to $7.00 and gave the company a "buy" rating in a research note on Monday, December 30th. Cantor Fitzgerald reiterated an "overweight" rating and set a $3.50 price objective on shares of BigBear.ai in a research report on Wednesday, November 6th.

Get Our Latest Analysis on BBAI

BigBear.ai Company Profile

(

Get Free Report)

BigBear.ai Holdings, Inc provides artificial intelligence-powered decision intelligence solutions. It offers national security, supply chain management, and digital identity and biometrics solutions. The company also provides data ingestion, data enrichment, data processing, artificial intelligence, machine learning, predictive analytics, and predictive visualization solutions and services.

Read More

Before you consider BigBear.ai, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BigBear.ai wasn't on the list.

While BigBear.ai currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.