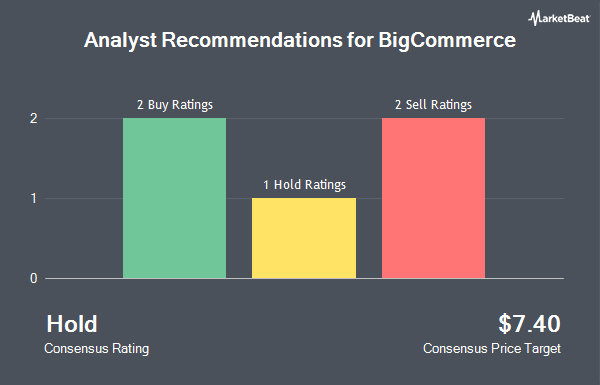

Shares of BigCommerce Holdings, Inc. (NASDAQ:BIGC - Get Free Report) have been assigned an average rating of "Hold" from the eight analysts that are covering the firm, MarketBeat reports. Two analysts have rated the stock with a sell recommendation, four have assigned a hold recommendation and two have assigned a buy recommendation to the company. The average 12-month target price among brokerages that have issued a report on the stock in the last year is $8.31.

BIGC has been the topic of several research analyst reports. Barclays downgraded BigCommerce from an "equal weight" rating to an "underweight" rating and lowered their price objective for the company from $8.00 to $7.00 in a research report on Friday, January 10th. Needham & Company LLC restated a "buy" rating and issued a $10.00 price target on shares of BigCommerce in a research note on Monday, December 9th. Finally, Stifel Nicolaus reduced their price objective on shares of BigCommerce from $10.00 to $8.00 and set a "buy" rating on the stock in a research report on Thursday, October 3rd.

Get Our Latest Research Report on BIGC

BigCommerce Price Performance

Shares of BIGC traded down $0.01 during trading hours on Friday, reaching $6.13. 538,604 shares of the stock traded hands, compared to its average volume of 728,500. The company has a market cap of $480.47 million, a P/E ratio of -17.03 and a beta of 1.18. The company has a current ratio of 2.81, a quick ratio of 2.81 and a debt-to-equity ratio of 7.48. The company's 50-day moving average price is $6.64 and its two-hundred day moving average price is $6.42. BigCommerce has a 52-week low of $5.13 and a 52-week high of $8.98.

Institutional Investors Weigh In On BigCommerce

Hedge funds have recently bought and sold shares of the business. Clearline Capital LP increased its holdings in shares of BigCommerce by 69.7% in the 3rd quarter. Clearline Capital LP now owns 1,611,619 shares of the company's stock worth $9,428,000 after buying an additional 661,688 shares during the last quarter. Divisar Capital Management LLC bought a new stake in BigCommerce during the second quarter worth approximately $4,274,000. Connor Clark & Lunn Investment Management Ltd. raised its position in BigCommerce by 196.1% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 387,745 shares of the company's stock valued at $2,268,000 after purchasing an additional 256,783 shares during the period. 272 Capital LP lifted its stake in shares of BigCommerce by 40.0% in the 2nd quarter. 272 Capital LP now owns 884,750 shares of the company's stock valued at $7,131,000 after purchasing an additional 252,946 shares during the last quarter. Finally, Algert Global LLC boosted its holdings in shares of BigCommerce by 67.7% in the 3rd quarter. Algert Global LLC now owns 449,072 shares of the company's stock worth $2,627,000 after purchasing an additional 181,222 shares during the period. Hedge funds and other institutional investors own 79.21% of the company's stock.

About BigCommerce

(

Get Free ReportBigCommerce Holdings, Inc operates a software-as-a-service platform for enterprises, small businesses, and mid-markets in the United States, North and South America, Europe, the Middle East, Africa, and the AsiaPacific. The company provides a platform for launching and scaling an ecommerce operation, including store design, catalog management, hosting, checkout, order management, reporting, and pre-integration into third-party services.

Further Reading

Before you consider BigCommerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BigCommerce wasn't on the list.

While BigCommerce currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.