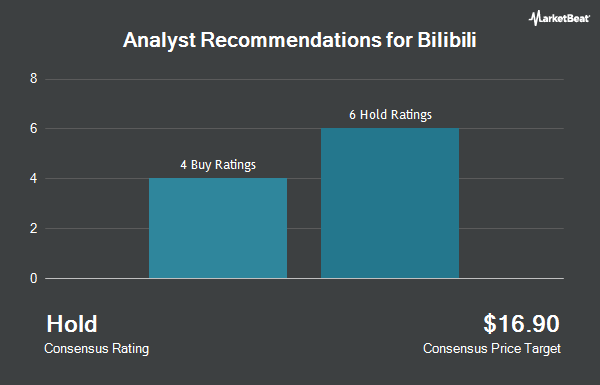

Shares of Bilibili Inc. (NASDAQ:BILI - Get Free Report) have been given an average rating of "Moderate Buy" by the fourteen research firms that are currently covering the stock, MarketBeat.com reports. Three analysts have rated the stock with a hold recommendation, nine have assigned a buy recommendation and two have issued a strong buy recommendation on the company. The average 12-month price target among analysts that have covered the stock in the last year is $19.69.

Several equities research analysts have commented on BILI shares. Benchmark upped their target price on shares of Bilibili from $16.00 to $24.00 and gave the company a "buy" rating in a research note on Friday, November 15th. Bank of America upped their price objective on shares of Bilibili from $19.00 to $22.50 and gave the company a "buy" rating in a research report on Friday, October 25th. Mizuho lifted their target price on Bilibili from $17.00 to $21.00 and gave the stock an "outperform" rating in a report on Tuesday, November 12th. Daiwa Capital Markets upgraded Bilibili from a "neutral" rating to a "buy" rating in a report on Friday, November 8th. Finally, Daiwa America upgraded Bilibili from a "hold" rating to a "strong-buy" rating in a report on Friday, November 8th.

Check Out Our Latest Report on BILI

Bilibili Stock Performance

NASDAQ:BILI traded down $0.52 on Friday, hitting $18.84. 3,715,203 shares of the stock were exchanged, compared to its average volume of 7,015,164. Bilibili has a 52 week low of $8.80 and a 52 week high of $31.77. The stock has a market capitalization of $7.81 billion, a price-to-earnings ratio of -20.48 and a beta of 0.80. The company's 50-day moving average price is $20.20 and its 200 day moving average price is $18.01.

Bilibili (NASDAQ:BILI - Get Free Report) last released its quarterly earnings data on Thursday, November 14th. The company reported $0.57 EPS for the quarter, beating analysts' consensus estimates of $0.10 by $0.47. The business had revenue of $7.31 billion during the quarter, compared to the consensus estimate of $7.14 billion. Bilibili had a negative return on equity of 15.17% and a negative net margin of 10.73%. The firm's revenue was up 25.8% on a year-over-year basis. During the same quarter in the prior year, the company posted ($0.39) earnings per share. As a group, equities research analysts predict that Bilibili will post -0.34 earnings per share for the current year.

Institutional Trading of Bilibili

Hedge funds have recently added to or reduced their stakes in the company. SIH Partners LLLP lifted its holdings in shares of Bilibili by 145.9% during the second quarter. SIH Partners LLLP now owns 1,195,420 shares of the company's stock worth $18,457,000 after buying an additional 709,200 shares in the last quarter. Y Intercept Hong Kong Ltd boosted its holdings in Bilibili by 1,064.9% in the 3rd quarter. Y Intercept Hong Kong Ltd now owns 190,275 shares of the company's stock valued at $4,449,000 after purchasing an additional 173,941 shares during the period. Healthcare of Ontario Pension Plan Trust Fund acquired a new position in shares of Bilibili during the 2nd quarter worth approximately $7,799,000. Connor Clark & Lunn Investment Management Ltd. increased its holdings in shares of Bilibili by 31.6% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 1,294,180 shares of the company's stock worth $30,258,000 after purchasing an additional 311,073 shares during the period. Finally, US Bancorp DE raised its position in shares of Bilibili by 882.4% in the third quarter. US Bancorp DE now owns 70,999 shares of the company's stock valued at $1,660,000 after buying an additional 63,772 shares in the last quarter. 16.08% of the stock is owned by institutional investors and hedge funds.

Bilibili Company Profile

(

Get Free ReportBilibili Inc provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic.

Recommended Stories

Before you consider Bilibili, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bilibili wasn't on the list.

While Bilibili currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.