Natixis Advisors LLC lifted its holdings in shares of Bilibili Inc. (NASDAQ:BILI - Free Report) by 206.8% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 35,721 shares of the company's stock after acquiring an additional 24,079 shares during the quarter. Natixis Advisors LLC's holdings in Bilibili were worth $647,000 as of its most recent SEC filing.

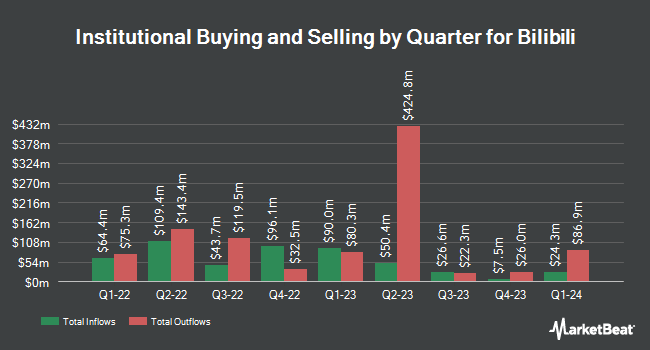

A number of other institutional investors have also made changes to their positions in the business. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its position in Bilibili by 26.3% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,528 shares of the company's stock worth $82,000 after purchasing an additional 735 shares during the period. Avior Wealth Management LLC boosted its holdings in shares of Bilibili by 1,817.7% during the 4th quarter. Avior Wealth Management LLC now owns 1,515 shares of the company's stock worth $27,000 after buying an additional 1,436 shares during the period. Blue Trust Inc. grew its stake in Bilibili by 147.8% in the 4th quarter. Blue Trust Inc. now owns 3,179 shares of the company's stock valued at $58,000 after buying an additional 1,896 shares during the last quarter. TD Private Client Wealth LLC bought a new position in Bilibili in the 3rd quarter valued at about $53,000. Finally, Quantinno Capital Management LP raised its holdings in Bilibili by 17.1% in the 3rd quarter. Quantinno Capital Management LP now owns 23,557 shares of the company's stock valued at $551,000 after acquiring an additional 3,439 shares during the period. 16.08% of the stock is owned by institutional investors and hedge funds.

Bilibili Price Performance

BILI traded down $0.94 on Friday, hitting $19.22. 3,921,784 shares of the stock were exchanged, compared to its average volume of 6,857,590. The firm has a market capitalization of $7.96 billion, a price-to-earnings ratio of -42.71 and a beta of 0.93. The company has a debt-to-equity ratio of 0.23, a current ratio of 1.34 and a quick ratio of 1.05. Bilibili Inc. has a 12 month low of $10.79 and a 12 month high of $31.77. The business has a 50-day moving average of $19.75 and a two-hundred day moving average of $19.80.

Bilibili (NASDAQ:BILI - Get Free Report) last issued its quarterly earnings results on Thursday, February 20th. The company reported $0.05 earnings per share for the quarter, topping analysts' consensus estimates of $0.03 by $0.02. Bilibili had a negative net margin of 5.01% and a negative return on equity of 8.23%. The company had revenue of $1.08 billion during the quarter, compared to the consensus estimate of $1.05 billion. Sell-side analysts forecast that Bilibili Inc. will post 0.16 EPS for the current fiscal year.

Analyst Ratings Changes

Several equities analysts have recently commented on BILI shares. Barclays upped their target price on Bilibili from $24.00 to $25.00 and gave the company an "overweight" rating in a research report on Friday, February 21st. Nomura Securities lowered Bilibili from a "strong-buy" rating to a "hold" rating in a report on Tuesday, February 25th. Finally, Benchmark lifted their target price on Bilibili from $24.00 to $30.00 and gave the stock a "buy" rating in a report on Friday, February 21st. Three analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $21.11.

View Our Latest Report on Bilibili

Bilibili Company Profile

(

Free Report)

Bilibili Inc provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic.

Recommended Stories

Before you consider Bilibili, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bilibili wasn't on the list.

While Bilibili currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.