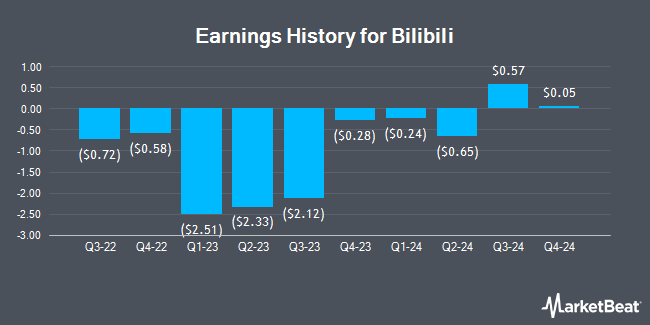

Bilibili (NASDAQ:BILI - Get Free Report) announced its earnings results on Thursday. The company reported $0.57 earnings per share for the quarter, beating the consensus estimate of $0.10 by $0.47, Briefing.com reports. The firm had revenue of $7.31 billion for the quarter, compared to the consensus estimate of $7.14 billion. Bilibili had a negative return on equity of 15.10% and a negative net margin of 10.73%. The firm's revenue for the quarter was up 25.8% on a year-over-year basis. During the same quarter in the previous year, the business earned ($0.39) EPS.

Bilibili Trading Down 1.6 %

NASDAQ BILI traded down $0.29 during trading on Friday, hitting $18.30. 7,703,189 shares of the company traded hands, compared to its average volume of 5,822,363. Bilibili has a 12 month low of $8.80 and a 12 month high of $31.77. The business has a fifty day simple moving average of $20.63 and a 200 day simple moving average of $17.02. The company has a market capitalization of $7.58 billion, a P/E ratio of -19.89 and a beta of 0.86.

Wall Street Analysts Forecast Growth

BILI has been the topic of several research analyst reports. Nomura Securities upgraded Bilibili from a "hold" rating to a "strong-buy" rating in a research report on Thursday, August 22nd. Mizuho lifted their price target on Bilibili from $17.00 to $21.00 and gave the company an "outperform" rating in a research report on Tuesday, November 12th. Daiwa America upgraded Bilibili from a "hold" rating to a "strong-buy" rating in a research report on Friday, November 8th. Bank of America lifted their price target on Bilibili from $19.00 to $22.50 and gave the company a "buy" rating in a research report on Friday, October 25th. Finally, The Goldman Sachs Group upgraded shares of Bilibili from a "neutral" rating to a "buy" rating and raised their target price for the stock from $16.50 to $22.60 in a report on Thursday, September 26th. Three investment analysts have rated the stock with a hold rating, nine have issued a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat, Bilibili presently has an average rating of "Moderate Buy" and a consensus price target of $19.24.

View Our Latest Analysis on Bilibili

Bilibili Company Profile

(

Get Free Report)

Bilibili Inc provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bilibili, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bilibili wasn't on the list.

While Bilibili currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.