Vanguard Group Inc. boosted its position in Bio-Rad Laboratories, Inc. (NYSE:BIO - Free Report) by 0.6% during the 4th quarter, according to its most recent Form 13F filing with the SEC. The fund owned 1,919,808 shares of the medical research company's stock after purchasing an additional 12,168 shares during the period. Vanguard Group Inc. owned about 6.86% of Bio-Rad Laboratories worth $630,676,000 as of its most recent SEC filing.

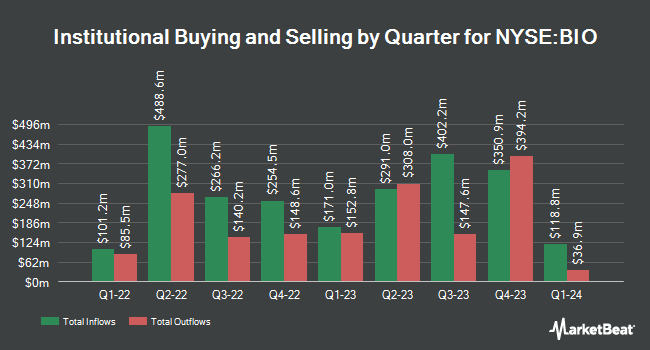

Several other hedge funds and other institutional investors have also recently made changes to their positions in BIO. Venturi Wealth Management LLC grew its position in Bio-Rad Laboratories by 2,175.0% during the fourth quarter. Venturi Wealth Management LLC now owns 91 shares of the medical research company's stock valued at $30,000 after buying an additional 87 shares during the period. Picton Mahoney Asset Management grew its position in shares of Bio-Rad Laboratories by 55.6% during the 4th quarter. Picton Mahoney Asset Management now owns 98 shares of the medical research company's stock valued at $32,000 after acquiring an additional 35 shares during the period. Asset Planning Inc purchased a new stake in shares of Bio-Rad Laboratories in the 4th quarter worth $33,000. UMB Bank n.a. increased its stake in shares of Bio-Rad Laboratories by 41.6% in the 4th quarter. UMB Bank n.a. now owns 109 shares of the medical research company's stock worth $36,000 after purchasing an additional 32 shares in the last quarter. Finally, Cape Investment Advisory Inc. bought a new position in Bio-Rad Laboratories in the 4th quarter worth $38,000. Hedge funds and other institutional investors own 65.24% of the company's stock.

Analyst Ratings Changes

Several analysts have issued reports on BIO shares. Wells Fargo & Company reduced their price target on Bio-Rad Laboratories from $360.00 to $345.00 and set an "equal weight" rating for the company in a research report on Wednesday, February 12th. StockNews.com lowered shares of Bio-Rad Laboratories from a "buy" rating to a "hold" rating in a report on Monday, February 17th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and set a $481.00 price target on shares of Bio-Rad Laboratories in a report on Tuesday, January 14th. Three analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $395.20.

Read Our Latest Report on Bio-Rad Laboratories

Bio-Rad Laboratories Price Performance

BIO traded down $9.54 on Friday, hitting $225.21. 766,924 shares of the company's stock traded hands, compared to its average volume of 300,791. The company's 50 day simple moving average is $281.98 and its 200-day simple moving average is $319.49. The company has a current ratio of 6.48, a quick ratio of 4.85 and a debt-to-equity ratio of 0.18. Bio-Rad Laboratories, Inc. has a one year low of $221.18 and a one year high of $387.99. The firm has a market cap of $6.31 billion, a price-to-earnings ratio of -3.46 and a beta of 0.98.

Bio-Rad Laboratories (NYSE:BIO - Get Free Report) last released its quarterly earnings data on Thursday, February 13th. The medical research company reported $2.90 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.86 by $0.04. Bio-Rad Laboratories had a negative net margin of 71.86% and a positive return on equity of 3.90%. As a group, research analysts anticipate that Bio-Rad Laboratories, Inc. will post 10.81 EPS for the current year.

About Bio-Rad Laboratories

(

Free Report)

Bio-Rad Laboratories, Inc manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America. It operates through two segments, Life Science and Clinical Diagnostics. The company develops, manufactures, and markets instruments, systems, reagents, and consumables to separate, purify, characterize, and quantitate biological materials such as cells, proteins, and nucleic acids for proteomics, genomics, biopharmaceutical production, cellular biology, and food safety markets.

Featured Articles

Before you consider Bio-Rad Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bio-Rad Laboratories wasn't on the list.

While Bio-Rad Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.