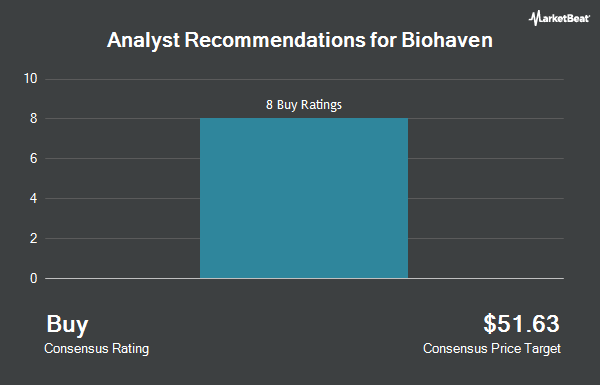

Shares of Biohaven Ltd. (NYSE:BHVN - Get Free Report) have received an average recommendation of "Buy" from the fifteen ratings firms that are currently covering the company, Marketbeat.com reports. Fourteen equities research analysts have rated the stock with a buy recommendation and one has given a strong buy recommendation to the company. The average 12 month price target among analysts that have issued a report on the stock in the last year is $63.15.

A number of analysts have recently weighed in on BHVN shares. Morgan Stanley reduced their target price on shares of Biohaven from $69.00 to $63.00 and set an "overweight" rating on the stock in a research report on Friday, March 7th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $61.00 target price on shares of Biohaven in a research report on Tuesday, March 4th. JPMorgan Chase & Co. reduced their target price on shares of Biohaven from $72.00 to $68.00 and set an "overweight" rating on the stock in a research report on Wednesday, March 5th. HC Wainwright reiterated a "buy" rating and issued a $54.00 price target on shares of Biohaven in a research note on Tuesday, March 4th. Finally, Deutsche Bank Aktiengesellschaft began coverage on shares of Biohaven in a research note on Tuesday, February 11th. They issued a "buy" rating and a $65.00 price target on the stock.

Check Out Our Latest Research Report on Biohaven

Biohaven Trading Up 6.5 %

Shares of Biohaven stock opened at $29.43 on Wednesday. The company's fifty day simple moving average is $37.39 and its two-hundred day simple moving average is $42.27. The company has a market cap of $3.00 billion, a P/E ratio of -3.15 and a beta of 1.27. Biohaven has a 12-month low of $26.80 and a 12-month high of $60.83.

Biohaven (NYSE:BHVN - Get Free Report) last released its earnings results on Monday, March 3rd. The company reported ($1.85) earnings per share for the quarter, missing analysts' consensus estimates of ($1.56) by ($0.29). Analysts predict that Biohaven will post -8.9 EPS for the current fiscal year.

Insider Buying and Selling at Biohaven

In other Biohaven news, Director John W. Childs acquired 29,000 shares of the stock in a transaction dated Monday, December 30th. The shares were purchased at an average price of $35.94 per share, for a total transaction of $1,042,260.00. Following the purchase, the director now directly owns 2,368,741 shares of the company's stock, valued at approximately $85,132,551.54. This trade represents a 1.24 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. Company insiders own 16.00% of the company's stock.

Hedge Funds Weigh In On Biohaven

Several institutional investors have recently made changes to their positions in BHVN. Spire Wealth Management bought a new position in shares of Biohaven in the 4th quarter worth approximately $56,000. US Bancorp DE increased its holdings in Biohaven by 57.1% in the 3rd quarter. US Bancorp DE now owns 2,173 shares of the company's stock worth $109,000 after acquiring an additional 790 shares in the last quarter. Amalgamated Bank increased its holdings in Biohaven by 21.9% in the 4th quarter. Amalgamated Bank now owns 2,929 shares of the company's stock worth $109,000 after acquiring an additional 527 shares in the last quarter. KBC Group NV increased its holdings in Biohaven by 24.5% in the 3rd quarter. KBC Group NV now owns 2,250 shares of the company's stock worth $112,000 after acquiring an additional 443 shares in the last quarter. Finally, Quarry LP purchased a new stake in Biohaven in the 4th quarter worth approximately $112,000. Institutional investors own 88.78% of the company's stock.

About Biohaven

(

Get Free ReportBiohaven Ltd., together with its subsidiaries, focuses on discovering, developing, and commercializing therapies for immunology, neuroscience, and oncology worldwide. The company's pipeline products include Troriluzole, which is in Phase 3 clinical trial for the treatment of neurological and neuropsychiatric illnesses; BHV-5500 that blocks glutamate signaling mediated by post-synaptic NMDA receptors; Taldefgrobep Alfa, which is in Phase 3 clinical trial for the treatment of spinal muscular atrophy and obesity; BHV-7000, a candidate in Phase 2/3 clinical trials for the treatment of focal and generalized epilepsy, bipolar disorder, and major depressive disorder; BHV-2100 that is in Phase 1 clinical trials for the treatment of migraines and neuropathic pain; and BHV-8000, a product candidate in Phase 1 clinical trials for the treatment of early Alzheimer's and Parkinson's disease, sclerosis, and amyloid-related imaging abnormalities.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Biohaven, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Biohaven wasn't on the list.

While Biohaven currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.