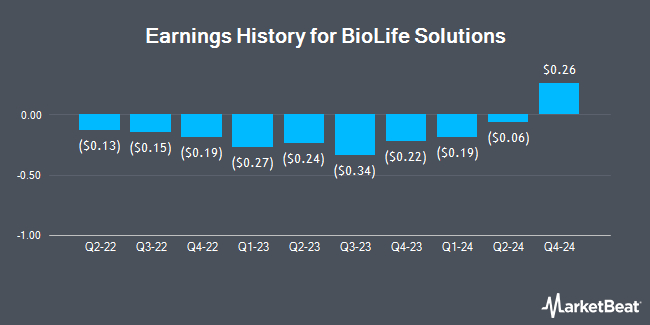

BioLife Solutions (NASDAQ:BLFS - Get Free Report) will release its earnings data after the market closes on Tuesday, November 12th. Analysts expect BioLife Solutions to post earnings of ($0.09) per share for the quarter. BioLife Solutions has set its FY 2024 guidance at EPS.Individual interested in listening to the company's earnings conference call can do so using this link.

BioLife Solutions (NASDAQ:BLFS - Get Free Report) last issued its earnings results on Thursday, August 8th. The medical equipment provider reported ($0.06) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.14) by $0.08. The firm had revenue of $28.33 million for the quarter, compared to analysts' expectations of $23.80 million. BioLife Solutions had a negative net margin of 59.88% and a negative return on equity of 10.75%. On average, analysts expect BioLife Solutions to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

BioLife Solutions Stock Performance

Shares of BLFS traded up $0.36 during mid-day trading on Tuesday, reaching $25.92. 300,320 shares of the company's stock traded hands, compared to its average volume of 367,044. The business's 50-day moving average price is $24.03 and its 200-day moving average price is $22.32. The stock has a market capitalization of $1.20 billion, a P/E ratio of -15.21 and a beta of 1.88. The company has a debt-to-equity ratio of 0.04, a quick ratio of 1.81 and a current ratio of 2.86. BioLife Solutions has a 12 month low of $9.92 and a 12 month high of $26.73.

Insider Activity at BioLife Solutions

In other news, CRO Garrie Richardson sold 3,070 shares of the stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $25.12, for a total transaction of $77,118.40. Following the sale, the executive now owns 114,773 shares in the company, valued at $2,883,097.76. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. In other BioLife Solutions news, CRO Garrie Richardson sold 3,070 shares of the stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $25.12, for a total value of $77,118.40. Following the transaction, the executive now directly owns 114,773 shares in the company, valued at approximately $2,883,097.76. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, EVP Aby J. Mathew sold 10,000 shares of the stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $23.90, for a total transaction of $239,000.00. Following the completion of the transaction, the executive vice president now owns 317,716 shares in the company, valued at $7,593,412.40. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 27,044 shares of company stock worth $645,105 in the last three months. 2.20% of the stock is owned by insiders.

Analyst Ratings Changes

A number of research analysts have recently commented on the stock. Northland Securities upped their price objective on shares of BioLife Solutions from $26.00 to $28.00 and gave the company an "outperform" rating in a research report on Friday, August 9th. HC Wainwright assumed coverage on BioLife Solutions in a report on Monday, September 30th. They set a "buy" rating and a $29.00 price target for the company. TD Cowen raised their price target on BioLife Solutions from $20.00 to $26.00 and gave the stock a "buy" rating in a research report on Wednesday, July 17th. Finally, Craig Hallum upped their target price on BioLife Solutions from $23.00 to $30.00 and gave the company a "buy" rating in a report on Monday, August 12th. One analyst has rated the stock with a sell rating and six have assigned a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $26.67.

View Our Latest Research Report on BioLife Solutions

About BioLife Solutions

(

Get Free Report)

BioLife Solutions, Inc develops, manufactures, and markets bioproduction tools and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally. The company's products are used in the basic and applied research, and commercial manufacturing of biologic-based therapies.

Featured Articles

Before you consider BioLife Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioLife Solutions wasn't on the list.

While BioLife Solutions currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.