Bird Construction (TSE:BDT - Get Free Report) had its price objective decreased by analysts at CIBC from C$31.00 to C$29.50 in a research report issued on Thursday,BayStreet.CA reports. CIBC's price objective would indicate a potential upside of 1.24% from the stock's current price.

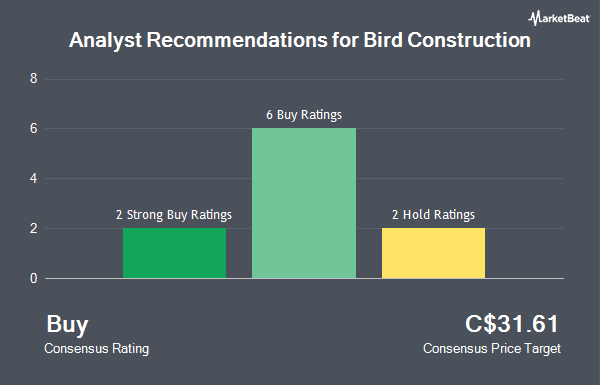

BDT has been the topic of a number of other reports. BMO Capital Markets lifted their price target on shares of Bird Construction from C$30.00 to C$35.00 in a report on Thursday, October 10th. National Bankshares lifted their target price on Bird Construction from C$23.00 to C$28.00 in a report on Thursday, October 10th. ATB Capital increased their price target on Bird Construction from C$33.00 to C$35.00 in a research note on Thursday, October 10th. TD Securities increased their target price on Bird Construction from C$31.00 to C$36.00 in a research report on Thursday, October 10th. Finally, Cibc World Mkts upgraded shares of Bird Construction to a "hold" rating in a research report on Friday, August 9th. Three investment analysts have rated the stock with a hold rating and six have given a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of C$32.44.

View Our Latest Research Report on Bird Construction

Bird Construction Price Performance

Shares of Bird Construction stock traded up C$0.78 during trading hours on Thursday, hitting C$29.14. The company's stock had a trading volume of 175,685 shares, compared to its average volume of 146,245. The company has a debt-to-equity ratio of 70.40, a quick ratio of 1.20 and a current ratio of 1.25. Bird Construction has a 12-month low of C$11.41 and a 12-month high of C$32.67. The business has a 50 day moving average price of C$26.10 and a two-hundred day moving average price of C$24.39. The company has a market cap of C$1.61 billion, a PE ratio of 18.91, a PEG ratio of 0.53 and a beta of 1.05.

Bird Construction (TSE:BDT - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The company reported C$0.69 earnings per share for the quarter, topping the consensus estimate of C$0.67 by C$0.02. The business had revenue of C$898.94 million during the quarter, compared to the consensus estimate of C$961.37 million. Bird Construction had a return on equity of 26.97% and a net margin of 2.68%. Analysts expect that Bird Construction will post 2.7598533 earnings per share for the current fiscal year.

About Bird Construction

(

Get Free Report)

Bird Construction Inc provides construction services in Canada. The company primarily focuses on projects in the industrial, and institutional, and infrastructure markets. It constructs large, complex industrial buildings, including manufacturing, processing, distribution, and warehouse facilities; and provides electrical and instrumentation, high voltage testing and commissioning services, as well as power line construction, structural, mechanical, and piping, including off-site metal and modular fabrication.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bird Construction, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bird Construction wasn't on the list.

While Bird Construction currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.