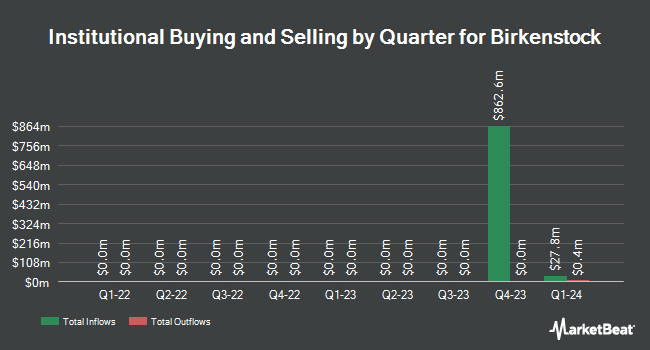

HighTower Advisors LLC boosted its holdings in Birkenstock Holding plc (NYSE:BIRK - Free Report) by 370.8% during the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 26,165 shares of the company's stock after acquiring an additional 20,607 shares during the quarter. HighTower Advisors LLC's holdings in Birkenstock were worth $1,289,000 at the end of the most recent quarter.

Several other institutional investors have also bought and sold shares of the stock. MetLife Investment Management LLC grew its holdings in shares of Birkenstock by 52.2% in the third quarter. MetLife Investment Management LLC now owns 688 shares of the company's stock valued at $34,000 after acquiring an additional 236 shares in the last quarter. GAMMA Investing LLC grew its stake in Birkenstock by 33.7% in the 3rd quarter. GAMMA Investing LLC now owns 893 shares of the company's stock valued at $44,000 after purchasing an additional 225 shares during the period. Amalgamated Bank increased its position in shares of Birkenstock by 51.8% during the 3rd quarter. Amalgamated Bank now owns 2,071 shares of the company's stock valued at $102,000 after purchasing an additional 707 shares during the last quarter. Acadian Asset Management LLC bought a new stake in shares of Birkenstock during the 2nd quarter worth $136,000. Finally, MSA Advisors LLC purchased a new position in shares of Birkenstock in the 2nd quarter worth about $223,000. Institutional investors own 19.93% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts recently commented on the company. UBS Group dropped their price objective on Birkenstock from $85.00 to $83.00 and set a "buy" rating on the stock in a research note on Tuesday, December 10th. BTIG Research set a $60.00 price objective on Birkenstock and gave the company a "buy" rating in a research note on Friday, October 18th. Hsbc Global Res upgraded shares of Birkenstock to a "strong-buy" rating in a research report on Tuesday, December 3rd. BMO Capital Markets reissued an "outperform" rating and issued a $60.00 price target on shares of Birkenstock in a research report on Friday, August 30th. Finally, Piper Sandler assumed coverage on shares of Birkenstock in a report on Tuesday, December 10th. They issued an "overweight" rating and a $65.00 price objective for the company. Two analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, Birkenstock presently has a consensus rating of "Moderate Buy" and an average price target of $66.13.

Read Our Latest Analysis on BIRK

Birkenstock Price Performance

Shares of BIRK traded up $0.35 during trading hours on Tuesday, reaching $56.08. 2,709,829 shares of the company's stock traded hands, compared to its average volume of 1,035,671. Birkenstock Holding plc has a 12 month low of $41.00 and a 12 month high of $64.78. The company has a current ratio of 2.91, a quick ratio of 1.49 and a debt-to-equity ratio of 0.55. The stock has a market cap of $10.53 billion, a PE ratio of 91.93, a price-to-earnings-growth ratio of 1.19 and a beta of 2.22. The firm's 50 day simple moving average is $49.65 and its 200-day simple moving average is $53.02.

Birkenstock Profile

(

Free Report)

Birkenstock Holding plc manufactures and sells footwear products. It also offers sandals, shoes, closed-toe silhouettes, skincare products, and accessories. The company sells its products through e-commerce sites and a network of owned retail stores, as well as business-to-business channels. It operates in the United States, Brazil, Canada, Mexico, Europe, APMA, and internationally.

Recommended Stories

Before you consider Birkenstock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Birkenstock wasn't on the list.

While Birkenstock currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.