The Manufacturers Life Insurance Company lifted its stake in BJ's Wholesale Club Holdings, Inc. (NYSE:BJ - Free Report) by 4.0% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 293,618 shares of the company's stock after acquiring an additional 11,205 shares during the quarter. The Manufacturers Life Insurance Company owned approximately 0.22% of BJ's Wholesale Club worth $24,218,000 as of its most recent filing with the Securities and Exchange Commission.

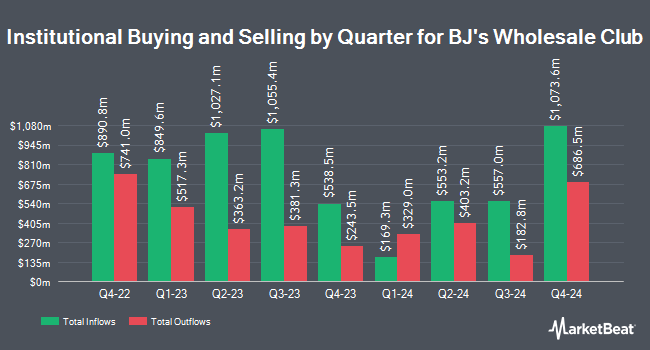

Several other hedge funds have also recently bought and sold shares of BJ. Creative Planning grew its stake in shares of BJ's Wholesale Club by 10.7% during the second quarter. Creative Planning now owns 9,298 shares of the company's stock worth $817,000 after purchasing an additional 898 shares during the period. Raymond James & Associates increased its position in shares of BJ's Wholesale Club by 99.9% during the 2nd quarter. Raymond James & Associates now owns 764,474 shares of the company's stock worth $67,151,000 after purchasing an additional 382,114 shares during the last quarter. Victory Capital Management Inc. raised its holdings in shares of BJ's Wholesale Club by 3.5% in the 3rd quarter. Victory Capital Management Inc. now owns 6,439,358 shares of the company's stock valued at $531,118,000 after purchasing an additional 217,385 shares during the period. Tidal Investments LLC boosted its stake in shares of BJ's Wholesale Club by 96.8% during the 1st quarter. Tidal Investments LLC now owns 19,840 shares of the company's stock worth $1,501,000 after acquiring an additional 9,759 shares during the period. Finally, LVW Advisors LLC bought a new position in BJ's Wholesale Club in the 2nd quarter valued at about $589,000. 98.60% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of equities research analysts have weighed in on the stock. Bank of America reduced their target price on shares of BJ's Wholesale Club from $95.00 to $90.00 and set a "buy" rating on the stock in a report on Friday, August 23rd. UBS Group increased their price target on BJ's Wholesale Club from $102.00 to $108.00 and gave the company a "buy" rating in a research report on Friday, November 22nd. Jefferies Financial Group lifted their price objective on shares of BJ's Wholesale Club from $105.00 to $110.00 and gave the company a "buy" rating in a research note on Thursday, November 21st. Melius Research began coverage on BJ's Wholesale Club in a research report on Monday, September 23rd. They set a "buy" rating and a $90.00 price target for the company. Finally, Roth Mkm boosted their target price on BJ's Wholesale Club from $75.00 to $87.00 and gave the company a "neutral" rating in a research note on Monday, November 25th. Six investment analysts have rated the stock with a hold rating and ten have issued a buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $93.25.

Check Out Our Latest Report on BJ's Wholesale Club

Insider Activity at BJ's Wholesale Club

In other news, CEO Robert W. Eddy sold 11,000 shares of the business's stock in a transaction dated Friday, November 1st. The shares were sold at an average price of $85.47, for a total transaction of $940,170.00. Following the transaction, the chief executive officer now owns 423,792 shares in the company, valued at approximately $36,221,502.24. The trade was a 2.53 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Insiders sold a total of 33,000 shares of company stock valued at $2,734,820 over the last ninety days. Insiders own 2.00% of the company's stock.

BJ's Wholesale Club Stock Down 0.5 %

NYSE BJ traded down $0.47 on Friday, reaching $96.30. The company had a trading volume of 928,408 shares, compared to its average volume of 1,628,452. The firm has a market capitalization of $12.77 billion, a PE ratio of 23.15, a P/E/G ratio of 4.53 and a beta of 0.24. BJ's Wholesale Club Holdings, Inc. has a 1 year low of $63.73 and a 1 year high of $99.91. The company has a debt-to-equity ratio of 0.23, a current ratio of 0.76 and a quick ratio of 0.14. The firm has a 50-day moving average of $87.48 and a 200-day moving average of $86.08.

BJ's Wholesale Club Profile

(

Free Report)

BJ's Wholesale Club Holdings, Inc, together with its subsidiaries, operates warehouse clubs on the eastern half of the United States. It provides groceries, general merchandise, gasoline and other ancillary services, coupon books, and promotions. The company sells its products through the websites BJs.com, BerkleyJensen.com, and Wellsleyfarms.com, as well as the mobile app.

Featured Stories

Before you consider BJ's Wholesale Club, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Wholesale Club wasn't on the list.

While BJ's Wholesale Club currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.