Black Swift Group LLC decreased its position in shares of TransMedics Group, Inc. (NASDAQ:TMDX - Free Report) by 19.3% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 38,500 shares of the company's stock after selling 9,200 shares during the quarter. TransMedics Group makes up 1.3% of Black Swift Group LLC's holdings, making the stock its 13th largest holding. Black Swift Group LLC owned about 0.11% of TransMedics Group worth $6,044,000 at the end of the most recent quarter.

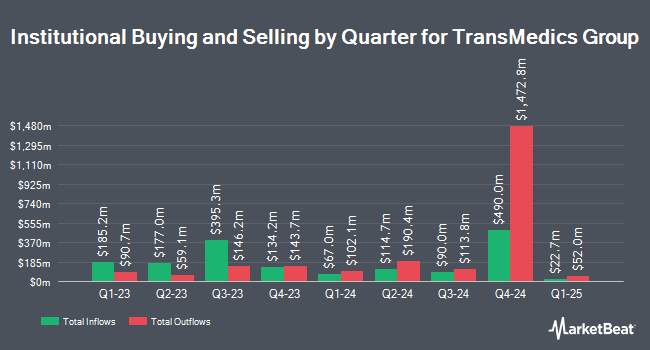

A number of other hedge funds also recently bought and sold shares of the stock. Oppenheimer & Co. Inc. raised its stake in TransMedics Group by 6.5% in the 3rd quarter. Oppenheimer & Co. Inc. now owns 44,893 shares of the company's stock worth $7,048,000 after acquiring an additional 2,748 shares during the last quarter. Victory Capital Management Inc. lifted its stake in TransMedics Group by 11.3% in the 3rd quarter. Victory Capital Management Inc. now owns 4,569 shares of the company's stock worth $717,000 after purchasing an additional 464 shares in the last quarter. Aigen Investment Management LP purchased a new stake in shares of TransMedics Group in the third quarter valued at about $523,000. Rakuten Securities Inc. purchased a new stake in TransMedics Group in the third quarter valued at $126,000. Finally, Entropy Technologies LP boosted its position in shares of TransMedics Group by 34.7% during the 3rd quarter. Entropy Technologies LP now owns 10,471 shares of the company's stock worth $1,644,000 after purchasing an additional 2,700 shares during the period. Hedge funds and other institutional investors own 99.67% of the company's stock.

TransMedics Group Price Performance

Shares of TMDX traded down $4.37 during trading hours on Thursday, hitting $88.36. 1,465,381 shares of the company were exchanged, compared to its average volume of 963,603. The company has a debt-to-equity ratio of 2.42, a current ratio of 8.20 and a quick ratio of 7.33. The company has a market capitalization of $2.97 billion, a PE ratio of 99.19 and a beta of 2.08. TransMedics Group, Inc. has a one year low of $63.85 and a one year high of $177.37. The firm has a fifty day simple moving average of $127.92 and a 200-day simple moving average of $139.56.

TransMedics Group (NASDAQ:TMDX - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The company reported $0.12 EPS for the quarter, missing analysts' consensus estimates of $0.29 by ($0.17). The company had revenue of $108.76 million for the quarter, compared to analysts' expectations of $115.00 million. TransMedics Group had a net margin of 8.14% and a return on equity of 18.74%. The business's revenue for the quarter was up 63.7% on a year-over-year basis. During the same period in the previous year, the firm posted ($0.12) earnings per share. As a group, sell-side analysts predict that TransMedics Group, Inc. will post 1.07 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on TMDX shares. JPMorgan Chase & Co. lowered their target price on shares of TransMedics Group from $173.00 to $116.00 and set an "overweight" rating for the company in a research note on Tuesday, October 29th. Oppenheimer reduced their price target on shares of TransMedics Group from $200.00 to $125.00 and set an "outperform" rating for the company in a research report on Tuesday, October 29th. Stephens lifted their target price on shares of TransMedics Group from $151.00 to $178.00 and gave the stock an "overweight" rating in a research report on Friday, August 2nd. Canaccord Genuity Group cut their target price on shares of TransMedics Group from $169.00 to $109.00 and set a "buy" rating for the company in a research note on Tuesday, October 29th. Finally, Robert W. Baird dropped their target price on TransMedics Group from $200.00 to $150.00 and set an "outperform" rating for the company in a research note on Tuesday, October 29th. One analyst has rated the stock with a hold rating, nine have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Buy" and an average target price of $144.80.

View Our Latest Analysis on TMDX

Insider Transactions at TransMedics Group

In related news, insider Nicholas Corcoran sold 10,000 shares of TransMedics Group stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $176.02, for a total value of $1,760,200.00. Following the completion of the transaction, the insider now directly owns 21,105 shares of the company's stock, valued at $3,714,902.10. The trade was a 32.15 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, Director Edward M. Basile sold 6,750 shares of TransMedics Group stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $83.55, for a total value of $563,962.50. Following the completion of the sale, the director now owns 732 shares of the company's stock, valued at approximately $61,158.60. The trade was a 90.22 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 36,958 shares of company stock worth $5,230,528 over the last three months. 7.00% of the stock is currently owned by insiders.

TransMedics Group Company Profile

(

Free Report)

TransMedics Group, Inc, a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers Organ Care System (OCS), a portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body.

See Also

Before you consider TransMedics Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransMedics Group wasn't on the list.

While TransMedics Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.