BlackSky Technology (NYSE:BKSY - Get Free Report)'s stock had its "buy" rating reissued by Benchmark in a report issued on Friday,Benzinga reports. They presently have a $17.00 target price on the stock. Benchmark's price target suggests a potential upside of 86.71% from the company's current price.

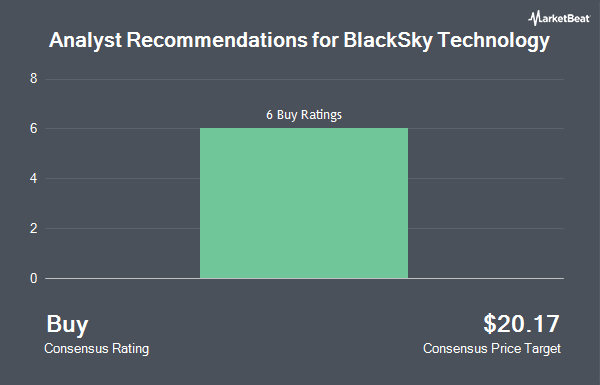

Several other research analysts also recently issued reports on the stock. HC Wainwright reiterated a "buy" rating and issued a $20.00 target price on shares of BlackSky Technology in a research note on Friday. Oppenheimer boosted their target price on BlackSky Technology from $10.00 to $30.00 and gave the stock an "outperform" rating in a research report on Wednesday, February 19th. Five research analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company has a consensus rating of "Buy" and a consensus target price of $21.80.

View Our Latest Research Report on BKSY

BlackSky Technology Stock Down 1.4 %

BlackSky Technology stock traded down $0.13 during mid-day trading on Friday, hitting $9.11. The company had a trading volume of 1,534,678 shares, compared to its average volume of 1,845,209. BlackSky Technology has a 12 month low of $3.86 and a 12 month high of $21.92. The company has a market capitalization of $280.24 million, a PE ratio of -4.03 and a beta of 1.27. The stock's 50 day moving average price is $13.63 and its two-hundred day moving average price is $10.06. The company has a current ratio of 5.68, a quick ratio of 5.68 and a debt-to-equity ratio of 0.89.

Hedge Funds Weigh In On BlackSky Technology

A number of institutional investors and hedge funds have recently made changes to their positions in BKSY. Mithril II GP LP bought a new position in BlackSky Technology in the fourth quarter worth approximately $11,116,000. Thompson Siegel & Walmsley LLC bought a new position in shares of BlackSky Technology in the third quarter worth about $3,674,000. Invesco Ltd. purchased a new position in shares of BlackSky Technology during the 4th quarter valued at about $3,868,000. Trexquant Investment LP lifted its position in shares of BlackSky Technology by 2,309.8% during the 4th quarter. Trexquant Investment LP now owns 301,590 shares of the company's stock valued at $3,254,000 after buying an additional 289,075 shares in the last quarter. Finally, Geode Capital Management LLC increased its holdings in BlackSky Technology by 94.2% in the 4th quarter. Geode Capital Management LLC now owns 551,444 shares of the company's stock worth $5,951,000 after acquiring an additional 267,427 shares in the last quarter. Hedge funds and other institutional investors own 27.15% of the company's stock.

About BlackSky Technology

(

Get Free Report)

BlackSky Technology Inc provides geospatial intelligence, imagery and related data analytic products and services, and mission systems that include the development, integration, and operation of satellite and ground systems for government and commercial customers in North America, the Middle East, the Asia Pacific, and internationally.

See Also

Before you consider BlackSky Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlackSky Technology wasn't on the list.

While BlackSky Technology currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.