Envestnet Portfolio Solutions Inc. raised its stake in shares of Blackstone Inc. (NYSE:BX - Free Report) by 21.2% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 14,029 shares of the asset manager's stock after purchasing an additional 2,453 shares during the quarter. Envestnet Portfolio Solutions Inc.'s holdings in Blackstone were worth $2,419,000 as of its most recent filing with the Securities and Exchange Commission.

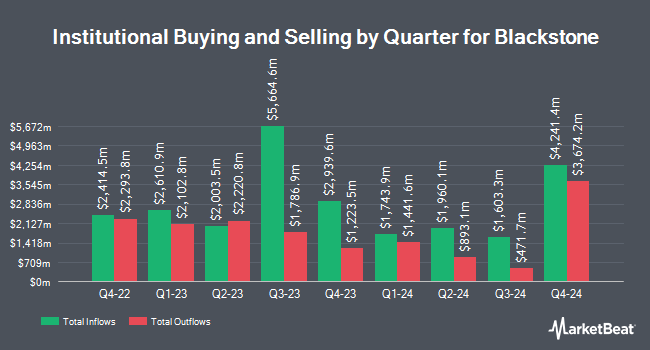

Several other large investors also recently modified their holdings of the stock. one8zero8 LLC acquired a new position in Blackstone in the fourth quarter valued at about $12,117,000. Choate Investment Advisors raised its position in Blackstone by 22.1% in the 4th quarter. Choate Investment Advisors now owns 16,842 shares of the asset manager's stock valued at $2,904,000 after purchasing an additional 3,053 shares during the last quarter. Diversified Enterprises LLC bought a new stake in shares of Blackstone during the fourth quarter worth $540,000. Natixis Advisors LLC raised its holdings in shares of Blackstone by 37.1% in the fourth quarter. Natixis Advisors LLC now owns 451,137 shares of the asset manager's stock valued at $77,785,000 after buying an additional 121,998 shares during the last quarter. Finally, Frank Rimerman Advisors LLC grew its holdings in Blackstone by 8.2% during the 4th quarter. Frank Rimerman Advisors LLC now owns 15,344 shares of the asset manager's stock worth $2,646,000 after acquiring an additional 1,166 shares during the last quarter. 70.00% of the stock is currently owned by institutional investors.

Blackstone Stock Down 0.5 %

BX traded down $0.79 during trading on Tuesday, hitting $151.29. The company had a trading volume of 3,782,352 shares, compared to its average volume of 3,278,089. The firm's 50-day moving average price is $163.26 and its 200 day moving average price is $167.59. Blackstone Inc. has a one year low of $115.82 and a one year high of $200.96. The company has a market capitalization of $110.35 billion, a PE ratio of 41.68, a PEG ratio of 1.07 and a beta of 1.55. The company has a quick ratio of 0.71, a current ratio of 0.67 and a debt-to-equity ratio of 0.61.

Blackstone (NYSE:BX - Get Free Report) last announced its earnings results on Thursday, January 30th. The asset manager reported $1.69 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.50 by $0.19. Blackstone had a return on equity of 19.58% and a net margin of 20.99%. As a group, equities analysts expect that Blackstone Inc. will post 5.87 earnings per share for the current year.

Blackstone Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, February 18th. Stockholders of record on Monday, February 10th were paid a dividend of $1.44 per share. This represents a $5.76 dividend on an annualized basis and a dividend yield of 3.81%. This is an increase from Blackstone's previous quarterly dividend of $0.86. The ex-dividend date was Monday, February 10th. Blackstone's dividend payout ratio is currently 158.68%.

Analyst Ratings Changes

Several analysts have recently commented on the stock. Citigroup reissued a "hold" rating on shares of Blackstone in a research note on Friday, February 7th. BMO Capital Markets upped their price target on Blackstone from $134.00 to $157.00 and gave the company a "market perform" rating in a research note on Thursday, December 19th. Piper Sandler upped their target price on shares of Blackstone from $168.00 to $179.00 and gave the company a "neutral" rating in a research report on Monday, December 23rd. Wells Fargo & Company cut their price objective on shares of Blackstone from $180.00 to $160.00 and set an "equal weight" rating on the stock in a report on Thursday, March 20th. Finally, TD Cowen upgraded shares of Blackstone from a "hold" rating to a "buy" rating and upped their target price for the company from $149.00 to $230.00 in a research report on Monday, December 9th. Twelve research analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, Blackstone currently has an average rating of "Hold" and a consensus price target of $171.13.

View Our Latest Stock Report on Blackstone

Insider Activity at Blackstone

In other news, Director Ruth Porat purchased 301 shares of the company's stock in a transaction on Tuesday, February 18th. The shares were purchased at an average cost of $164.85 per share, with a total value of $49,619.85. Following the completion of the transaction, the director now owns 36,829 shares of the company's stock, valued at $6,071,260.65. The trade was a 0.82 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 1.00% of the stock is owned by company insiders.

About Blackstone

(

Free Report)

Blackstone Inc is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies. The firm typically invests in early-stage companies. It also provide capital markets services.

Recommended Stories

Before you consider Blackstone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone wasn't on the list.

While Blackstone currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.