Jennison Associates LLC lowered its holdings in shares of Blackstone Inc. (NYSE:BX - Free Report) by 6.6% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 461,183 shares of the asset manager's stock after selling 32,813 shares during the quarter. Jennison Associates LLC owned 0.06% of Blackstone worth $70,621,000 at the end of the most recent quarter.

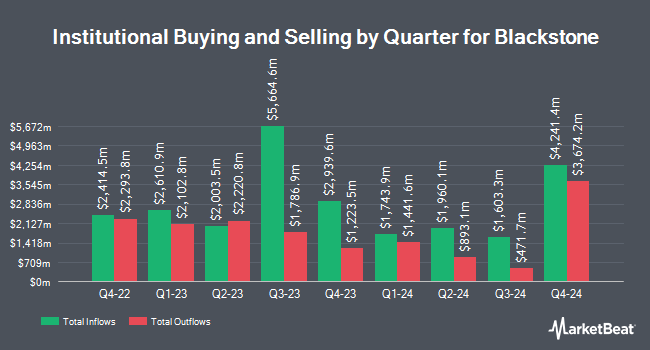

Several other institutional investors and hedge funds have also modified their holdings of the business. Sather Financial Group Inc lifted its holdings in shares of Blackstone by 202.5% in the third quarter. Sather Financial Group Inc now owns 6,050 shares of the asset manager's stock valued at $926,000 after purchasing an additional 4,050 shares in the last quarter. Portside Wealth Group LLC acquired a new position in Blackstone during the 3rd quarter worth approximately $201,000. Wealth Enhancement Advisory Services LLC raised its holdings in shares of Blackstone by 1.8% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 431,784 shares of the asset manager's stock valued at $53,455,000 after purchasing an additional 7,692 shares during the last quarter. Aljian Capital Management LLC acquired a new position in Blackstone during the third quarter worth $1,951,000. Finally, Blue Trust Inc. grew its position in Blackstone by 936.2% in the second quarter. Blue Trust Inc. now owns 5,958 shares of the asset manager's stock valued at $783,000 after purchasing an additional 5,383 shares in the last quarter. 70.00% of the stock is currently owned by institutional investors and hedge funds.

Blackstone Stock Performance

NYSE:BX opened at $187.24 on Thursday. The company has a debt-to-equity ratio of 0.58, a quick ratio of 0.71 and a current ratio of 0.71. Blackstone Inc. has a fifty-two week low of $105.51 and a fifty-two week high of $187.24. The company has a market cap of $135.19 billion, a price-to-earnings ratio of 63.58, a PEG ratio of 1.57 and a beta of 1.49. The stock has a fifty day moving average price of $163.95 and a 200-day moving average price of $141.57.

Blackstone (NYSE:BX - Get Free Report) last issued its earnings results on Thursday, October 17th. The asset manager reported $1.01 EPS for the quarter, beating the consensus estimate of $0.91 by $0.10. The company had revenue of $2.43 billion during the quarter, compared to analysts' expectations of $2.37 billion. Blackstone had a net margin of 19.46% and a return on equity of 17.53%. As a group, equities analysts anticipate that Blackstone Inc. will post 4.4 EPS for the current fiscal year.

Blackstone Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, November 4th. Investors of record on Monday, October 28th were paid a $0.86 dividend. This is an increase from Blackstone's previous quarterly dividend of $0.82. The ex-dividend date of this dividend was Monday, October 28th. This represents a $3.44 annualized dividend and a yield of 1.84%. Blackstone's dividend payout ratio is presently 118.21%.

Insider Transactions at Blackstone

In related news, Director Joseph Baratta sold 116,448 shares of the stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $150.81, for a total value of $17,561,522.88. Following the completion of the sale, the director now directly owns 799,749 shares in the company, valued at $120,610,146.69. This represents a 12.71 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, insider John G. Finley sold 42,249 shares of the stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $175.94, for a total value of $7,433,289.06. Following the completion of the sale, the insider now directly owns 387,137 shares of the company's stock, valued at approximately $68,112,883.78. The trade was a 9.84 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 1.00% of the company's stock.

Analysts Set New Price Targets

A number of research firms have weighed in on BX. Citigroup raised their price target on Blackstone from $157.00 to $170.00 and gave the company a "neutral" rating in a research note on Friday, October 18th. JPMorgan Chase & Co. boosted their price objective on shares of Blackstone from $125.00 to $146.00 and gave the stock a "neutral" rating in a research note on Friday, October 18th. Barclays lifted their price target on Blackstone from $155.00 to $174.00 and gave the stock an "equal weight" rating in a report on Friday, October 18th. Evercore ISI lifted their target price on Blackstone from $148.00 to $155.00 and gave the stock an "outperform" rating in a research note on Monday, October 14th. Finally, Morgan Stanley raised their price target on Blackstone from $164.00 to $177.00 and gave the company an "overweight" rating in a report on Thursday, October 10th. Thirteen analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat, Blackstone presently has an average rating of "Hold" and a consensus price target of $157.63.

Read Our Latest Stock Report on BX

Blackstone Company Profile

(

Free Report)

Blackstone Inc is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies. The firm typically invests in early-stage companies. It also provide capital markets services.

See Also

Before you consider Blackstone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone wasn't on the list.

While Blackstone currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.