Blackstone Mortgage Trust (NYSE:BXMT - Get Free Report) is projected to issue its Q1 2025 quarterly earnings data before the market opens on Wednesday, April 30th. Analysts expect Blackstone Mortgage Trust to post earnings of $0.29 per share and revenue of $104.69 million for the quarter.

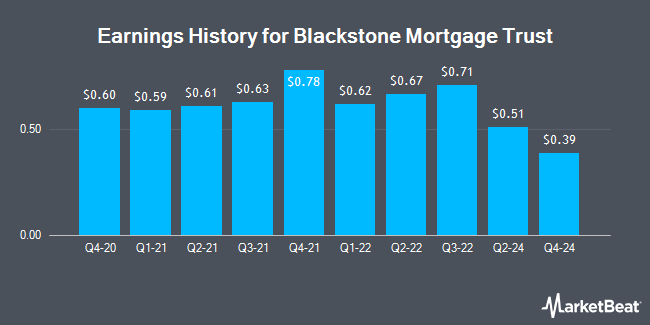

Blackstone Mortgage Trust (NYSE:BXMT - Get Free Report) last released its earnings results on Wednesday, February 12th. The real estate investment trust reported $0.39 EPS for the quarter, beating analysts' consensus estimates of ($0.87) by $1.26. Blackstone Mortgage Trust had a positive return on equity of 8.62% and a negative net margin of 11.54%.

Blackstone Mortgage Trust Stock Performance

Shares of BXMT stock opened at $18.77 on Wednesday. The stock has a 50 day moving average price of $19.66 and a 200 day moving average price of $18.83. Blackstone Mortgage Trust has a 52-week low of $16.51 and a 52-week high of $21.24. The firm has a market capitalization of $3.22 billion, a P/E ratio of -16.04 and a beta of 1.22.

Blackstone Mortgage Trust Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st were issued a $0.47 dividend. This represents a $1.88 dividend on an annualized basis and a dividend yield of 10.02%. The ex-dividend date of this dividend was Monday, March 31st. Blackstone Mortgage Trust's payout ratio is presently -160.68%.

Insider Activity at Blackstone Mortgage Trust

In other news, CEO Katharine A. Keenan sold 2,315 shares of the company's stock in a transaction on Monday, March 17th. The shares were sold at an average price of $20.70, for a total value of $47,920.50. Following the sale, the chief executive officer now directly owns 246,172 shares of the company's stock, valued at $5,095,760.40. This represents a 0.93 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders have sold a total of 5,652 shares of company stock valued at $116,971 in the last ninety days. Company insiders own 0.93% of the company's stock.

Wall Street Analyst Weigh In

BXMT has been the subject of a number of research reports. Keefe, Bruyette & Woods lowered their price objective on shares of Blackstone Mortgage Trust from $20.50 to $20.00 and set a "market perform" rating for the company in a research note on Monday, April 7th. UBS Group lowered their target price on Blackstone Mortgage Trust from $19.50 to $18.00 and set a "neutral" rating for the company in a report on Wednesday, April 16th. Finally, JPMorgan Chase & Co. dropped their target price on Blackstone Mortgage Trust from $20.00 to $18.50 and set a "neutral" rating on the stock in a research report on Wednesday, April 16th. Four analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat, Blackstone Mortgage Trust currently has a consensus rating of "Hold" and a consensus target price of $20.25.

Check Out Our Latest Stock Analysis on BXMT

Blackstone Mortgage Trust Company Profile

(

Get Free Report)

Blackstone Mortgage Trust, Inc, a real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia. The company originates and acquires senior floating rate mortgage loans that are secured by a first-priority mortgage on commercial real estate assets.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Blackstone Mortgage Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone Mortgage Trust wasn't on the list.

While Blackstone Mortgage Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.