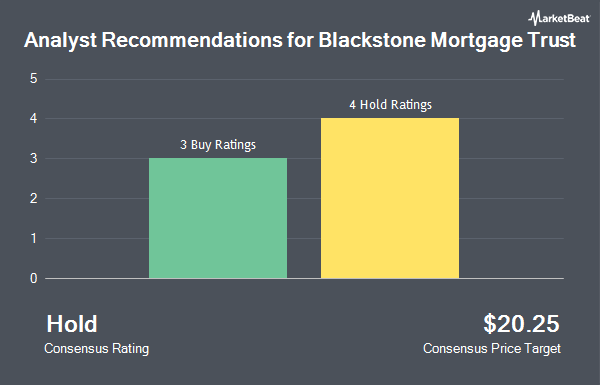

Shares of Blackstone Mortgage Trust, Inc. (NYSE:BXMT - Get Free Report) have earned an average rating of "Hold" from the seven research firms that are covering the firm, Marketbeat reports. Four research analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The average 1-year price objective among analysts that have issued a report on the stock in the last year is $20.67.

Several research firms recently commented on BXMT. Wolfe Research upgraded shares of Blackstone Mortgage Trust from a "peer perform" rating to an "outperform" rating and set a $20.00 price objective for the company in a research note on Wednesday, December 11th. Keefe, Bruyette & Woods boosted their price objective on shares of Blackstone Mortgage Trust from $18.50 to $19.50 and gave the stock a "market perform" rating in a research note on Thursday, February 13th. JPMorgan Chase & Co. upped their price target on shares of Blackstone Mortgage Trust from $17.50 to $20.00 and gave the company a "neutral" rating in a research note on Tuesday, February 18th. Finally, UBS Group upped their price target on shares of Blackstone Mortgage Trust from $18.50 to $19.50 and gave the company a "neutral" rating in a research note on Tuesday, February 25th.

Read Our Latest Research Report on BXMT

Insider Transactions at Blackstone Mortgage Trust

In other news, CEO Katharine A. Keenan sold 2,323 shares of the stock in a transaction on Monday, March 3rd. The shares were sold at an average price of $20.70, for a total value of $48,086.10. Following the sale, the chief executive officer now owns 248,487 shares in the company, valued at $5,143,680.90. This represents a 0.93 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders have sold 3,345 shares of company stock worth $68,265 over the last 90 days. 0.93% of the stock is currently owned by company insiders.

Institutional Trading of Blackstone Mortgage Trust

Hedge funds have recently added to or reduced their stakes in the company. Smartleaf Asset Management LLC boosted its holdings in Blackstone Mortgage Trust by 125.7% during the fourth quarter. Smartleaf Asset Management LLC now owns 2,162 shares of the real estate investment trust's stock worth $38,000 after buying an additional 1,204 shares in the last quarter. Huntington National Bank boosted its holdings in Blackstone Mortgage Trust by 1,672.9% during the fourth quarter. Huntington National Bank now owns 3,014 shares of the real estate investment trust's stock worth $52,000 after buying an additional 2,844 shares in the last quarter. Mountain Hill Investment Partners Corp. purchased a new stake in Blackstone Mortgage Trust during the fourth quarter worth $56,000. McIlrath & Eck LLC purchased a new stake in Blackstone Mortgage Trust during the third quarter worth $63,000. Finally, Sterling Capital Management LLC boosted its holdings in Blackstone Mortgage Trust by 814.9% during the fourth quarter. Sterling Capital Management LLC now owns 5,471 shares of the real estate investment trust's stock worth $95,000 after buying an additional 4,873 shares in the last quarter. 64.15% of the stock is owned by hedge funds and other institutional investors.

Blackstone Mortgage Trust Stock Performance

Shares of BXMT opened at $20.08 on Friday. The company has a 50 day moving average price of $19.04 and a 200-day moving average price of $18.75. Blackstone Mortgage Trust has a fifty-two week low of $16.53 and a fifty-two week high of $21.09. The stock has a market capitalization of $3.45 billion, a PE ratio of -17.16 and a beta of 1.52.

Blackstone Mortgage Trust (NYSE:BXMT - Get Free Report) last posted its quarterly earnings data on Wednesday, February 12th. The real estate investment trust reported $0.39 EPS for the quarter, topping the consensus estimate of ($0.87) by $1.26. Blackstone Mortgage Trust had a negative net margin of 11.54% and a positive return on equity of 8.62%. Equities research analysts forecast that Blackstone Mortgage Trust will post 1.65 EPS for the current year.

Blackstone Mortgage Trust Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st were paid a $0.47 dividend. The ex-dividend date of this dividend was Tuesday, December 31st. This represents a $1.88 dividend on an annualized basis and a dividend yield of 9.36%. Blackstone Mortgage Trust's payout ratio is currently -160.68%.

About Blackstone Mortgage Trust

(

Get Free ReportBlackstone Mortgage Trust, Inc, a real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia. The company originates and acquires senior floating rate mortgage loans that are secured by a first-priority mortgage on commercial real estate assets.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Blackstone Mortgage Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone Mortgage Trust wasn't on the list.

While Blackstone Mortgage Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.