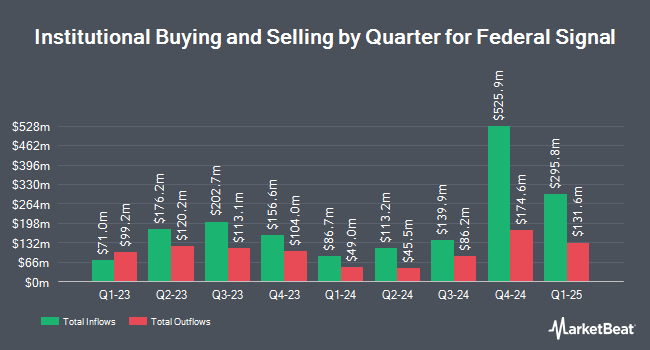

Blair William & Co. IL grew its stake in shares of Federal Signal Co. (NYSE:FSS - Free Report) by 145.8% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 37,664 shares of the conglomerate's stock after acquiring an additional 22,340 shares during the period. Blair William & Co. IL owned 0.06% of Federal Signal worth $3,480,000 at the end of the most recent reporting period.

Several other institutional investors have also recently made changes to their positions in FSS. Mather Group LLC. lifted its stake in Federal Signal by 20.1% during the fourth quarter. Mather Group LLC. now owns 889 shares of the conglomerate's stock worth $82,000 after purchasing an additional 149 shares during the last quarter. Arizona State Retirement System boosted its holdings in shares of Federal Signal by 0.9% during the fourth quarter. Arizona State Retirement System now owns 17,746 shares of the conglomerate's stock worth $1,640,000 after purchasing an additional 152 shares during the period. Albion Financial Group UT grew its position in shares of Federal Signal by 1.3% in the 4th quarter. Albion Financial Group UT now owns 12,126 shares of the conglomerate's stock worth $1,120,000 after buying an additional 153 shares during the last quarter. Signaturefd LLC increased its position in Federal Signal by 37.4% during the 4th quarter. Signaturefd LLC now owns 606 shares of the conglomerate's stock valued at $56,000 after purchasing an additional 165 shares during the period. Finally, Steward Partners Investment Advisory LLC boosted its stake in shares of Federal Signal by 15.6% during the 4th quarter. Steward Partners Investment Advisory LLC now owns 1,343 shares of the conglomerate's stock valued at $124,000 after purchasing an additional 181 shares in the last quarter. Hedge funds and other institutional investors own 92.73% of the company's stock.

Analysts Set New Price Targets

FSS has been the subject of a number of recent research reports. Raymond James reissued an "outperform" rating and set a $110.00 price target on shares of Federal Signal in a research report on Tuesday, December 24th. StockNews.com downgraded Federal Signal from a "buy" rating to a "hold" rating in a research note on Saturday, March 1st.

Read Our Latest Report on Federal Signal

Insiders Place Their Bets

In related news, CEO Jennifer L. Sherman bought 1,250 shares of the company's stock in a transaction that occurred on Friday, February 28th. The shares were purchased at an average cost of $82.32 per share, with a total value of $102,900.00. Following the completion of the acquisition, the chief executive officer now directly owns 559,183 shares in the company, valued at approximately $46,031,944.56. The trade was a 0.22 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Corporate insiders own 3.30% of the company's stock.

Federal Signal Price Performance

FSS traded down $1.70 on Friday, hitting $71.24. 880,873 shares of the company's stock traded hands, compared to its average volume of 400,118. The company has a current ratio of 2.83, a quick ratio of 1.36 and a debt-to-equity ratio of 0.19. The company's 50 day simple moving average is $86.30 and its 200-day simple moving average is $90.49. Federal Signal Co. has a one year low of $67.60 and a one year high of $102.18. The firm has a market cap of $4.35 billion, a price-to-earnings ratio of 20.65, a P/E/G ratio of 1.85 and a beta of 1.02.

Federal Signal (NYSE:FSS - Get Free Report) last released its quarterly earnings results on Wednesday, February 26th. The conglomerate reported $0.87 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.87. The company had revenue of $472.00 million for the quarter, compared to the consensus estimate of $481.90 million. Federal Signal had a net margin of 11.57% and a return on equity of 18.46%. As a group, research analysts anticipate that Federal Signal Co. will post 3.34 EPS for the current year.

Federal Signal Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, March 27th. Shareholders of record on Friday, March 14th were paid a dividend of $0.14 per share. This is a positive change from Federal Signal's previous quarterly dividend of $0.12. The ex-dividend date of this dividend was Friday, March 14th. This represents a $0.56 dividend on an annualized basis and a yield of 0.79%. Federal Signal's dividend payout ratio is presently 15.95%.

About Federal Signal

(

Free Report)

Federal Signal Corp. engages in the design and manufacture of products and integrated solutions for municipal, governmental, industrial, and commercial customers. It operates through the Environmental Solutions Group and Safety and Security Systems Group segments. The Environment Solutions Group segment is involved in the manufacture and supply of street sweeper vehicles, sewer cleaners, vacuum loader trucks, hydro-excavation trucks, and water blasting equipment.

Recommended Stories

Before you consider Federal Signal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Federal Signal wasn't on the list.

While Federal Signal currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.