Blair William & Co. IL reduced its stake in shares of BHP Group Limited (NYSE:BHP - Free Report) by 44.0% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 8,302 shares of the mining company's stock after selling 6,533 shares during the period. Blair William & Co. IL's holdings in BHP Group were worth $405,000 at the end of the most recent reporting period.

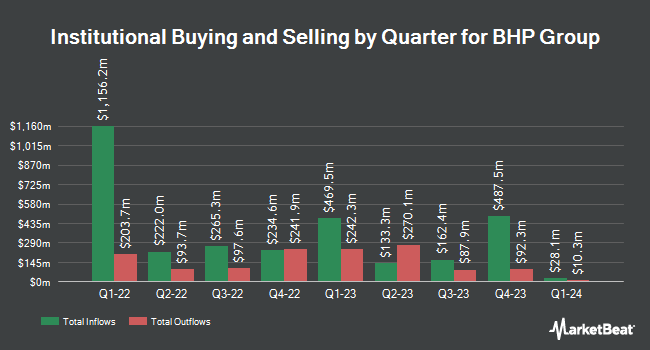

Several other large investors also recently modified their holdings of BHP. Sierra Ocean LLC bought a new position in BHP Group during the fourth quarter valued at $29,000. Versant Capital Management Inc bought a new position in shares of BHP Group during the 4th quarter worth $40,000. Union Bancaire Privee UBP SA purchased a new stake in BHP Group in the 4th quarter worth about $46,000. Newbridge Financial Services Group Inc. bought a new stake in BHP Group in the 4th quarter valued at about $54,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in BHP Group by 42.9% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,169 shares of the mining company's stock valued at $73,000 after purchasing an additional 351 shares during the last quarter. Hedge funds and other institutional investors own 3.79% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently issued reports on the stock. Jefferies Financial Group lowered their price target on shares of BHP Group from $57.00 to $53.00 and set a "hold" rating on the stock in a research report on Monday, January 6th. Clarkson Capital upgraded BHP Group to a "strong-buy" rating in a research report on Friday, February 28th. Finally, StockNews.com cut BHP Group from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, February 19th. Two investment analysts have rated the stock with a hold rating, three have assigned a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, the company has an average rating of "Buy" and an average target price of $53.00.

Read Our Latest Report on BHP Group

BHP Group Price Performance

NYSE BHP traded up $4.13 on Wednesday, hitting $44.35. The stock had a trading volume of 8,665,188 shares, compared to its average volume of 2,511,911. The firm has a 50-day moving average of $49.01 and a 200-day moving average of $51.83. The company has a debt-to-equity ratio of 0.40, a quick ratio of 1.25 and a current ratio of 1.70. BHP Group Limited has a 52-week low of $39.73 and a 52-week high of $63.21. The company has a market capitalization of $112.47 billion, a price-to-earnings ratio of 10.08 and a beta of 0.85.

BHP Group Cuts Dividend

The firm also recently disclosed a semi-annual dividend, which was paid on Thursday, March 27th. Investors of record on Friday, March 7th were paid a dividend of $1.00 per share. This represents a yield of 4.8%. The ex-dividend date was Friday, March 7th. BHP Group's dividend payout ratio is 44.77%.

BHP Group Profile

(

Free Report)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through Copper, Iron Ore, and Coal segments. It engages in the mining of copper, uranium, gold, zinc, lead, molybdenum, silver, iron ore, cobalt, and metallurgical and energy coal.

Further Reading

Before you consider BHP Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BHP Group wasn't on the list.

While BHP Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.