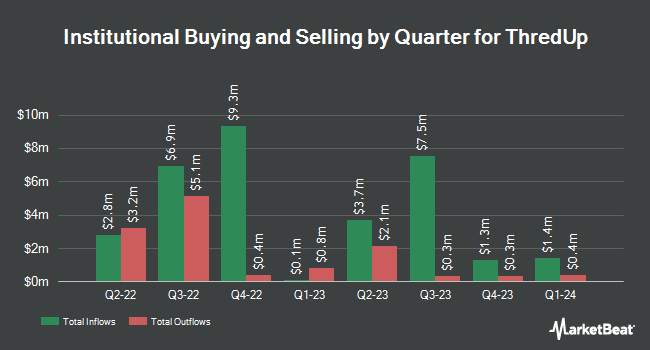

Blair William & Co. IL lessened its position in shares of ThredUp Inc. (NASDAQ:TDUP - Free Report) by 8.2% in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 2,030,276 shares of the company's stock after selling 180,794 shares during the quarter. Blair William & Co. IL owned 1.78% of ThredUp worth $2,822,000 at the end of the most recent reporting period.

Other institutional investors also recently bought and sold shares of the company. Virtu Financial LLC purchased a new stake in shares of ThredUp during the 4th quarter valued at about $33,000. Barclays PLC grew its position in ThredUp by 278.7% during the third quarter. Barclays PLC now owns 104,018 shares of the company's stock valued at $87,000 after buying an additional 76,553 shares during the period. JPMorgan Chase & Co. increased its holdings in ThredUp by 450.6% during the fourth quarter. JPMorgan Chase & Co. now owns 201,755 shares of the company's stock valued at $280,000 after buying an additional 165,115 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. purchased a new stake in ThredUp during the fourth quarter valued at approximately $348,000. Finally, State Street Corp raised its position in ThredUp by 0.9% in the third quarter. State Street Corp now owns 1,443,177 shares of the company's stock worth $1,215,000 after acquiring an additional 12,984 shares during the period. Institutional investors own 89.08% of the company's stock.

ThredUp Price Performance

Shares of NASDAQ TDUP traded up $0.11 during midday trading on Friday, reaching $2.63. The stock had a trading volume of 677,679 shares, compared to its average volume of 774,337. The company has a market capitalization of $305.59 million, a price-to-earnings ratio of -4.11 and a beta of 1.64. ThredUp Inc. has a 12-month low of $0.50 and a 12-month high of $2.99. The stock has a 50-day moving average of $2.48 and a 200-day moving average of $1.67. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.86 and a current ratio of 0.96.

Insider Buying and Selling

In other ThredUp news, Director Patricia Nakache sold 625,498 shares of the firm's stock in a transaction dated Tuesday, January 14th. The stock was sold at an average price of $1.95, for a total transaction of $1,219,721.10. Following the sale, the director now directly owns 250,956 shares of the company's stock, valued at $489,364.20. This trade represents a 71.37 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. In the last quarter, insiders sold 2,833,612 shares of company stock valued at $6,633,229. Company insiders own 34.42% of the company's stock.

Analysts Set New Price Targets

Several research firms have recently commented on TDUP. Needham & Company LLC restated a "hold" rating on shares of ThredUp in a research note on Tuesday, March 4th. Telsey Advisory Group reissued an "outperform" rating and set a $3.00 price target on shares of ThredUp in a report on Tuesday, March 4th.

Check Out Our Latest Stock Analysis on TDUP

About ThredUp

(

Free Report)

ThredUp Inc, together with its subsidiaries, operates an online resale platform in the United States and internationally. Its platform enables consumers to buy and sell primarily secondhand apparel, shoes, and accessories. ThredUp Inc was incorporated in 2009 and is headquartered in Oakland, California.

Featured Stories

Before you consider ThredUp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ThredUp wasn't on the list.

While ThredUp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.