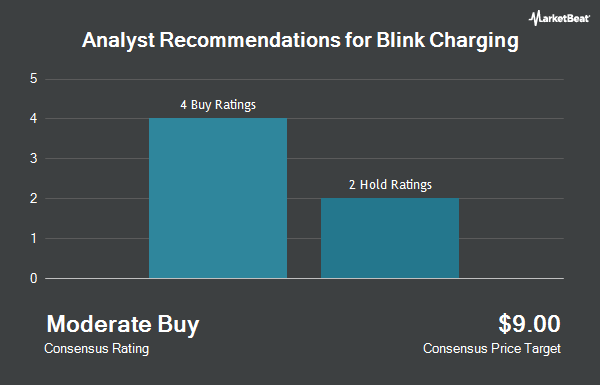

Blink Charging (NASDAQ:BLNK - Free Report) had its price objective reduced by Stifel Nicolaus from $3.50 to $2.00 in a research note issued to investors on Wednesday,Benzinga reports. Stifel Nicolaus currently has a hold rating on the stock.

Other research analysts have also issued research reports about the stock. Barclays lowered their price target on shares of Blink Charging from $3.00 to $1.50 and set an "equal weight" rating for the company in a report on Tuesday, February 4th. Roth Mkm restated a "buy" rating and issued a $3.00 target price (down previously from $4.00) on shares of Blink Charging in a report on Friday, March 14th. Needham & Company LLC reaffirmed a "hold" rating on shares of Blink Charging in a research report on Friday, March 14th. Benchmark lowered their price objective on Blink Charging from $5.00 to $2.00 and set a "buy" rating for the company in a research report on Friday, March 14th. Finally, HC Wainwright restated a "buy" rating and set a $8.00 target price on shares of Blink Charging in a research report on Friday, March 14th. Five equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat, Blink Charging presently has an average rating of "Hold" and a consensus price target of $3.17.

Get Our Latest Stock Report on Blink Charging

Blink Charging Stock Down 0.3 %

Shares of BLNK stock traded down $0.00 during trading hours on Wednesday, hitting $0.94. 1,321,754 shares of the company's stock traded hands, compared to its average volume of 4,665,725. Blink Charging has a 12 month low of $0.87 and a 12 month high of $3.75. The stock has a market cap of $94.69 million, a PE ratio of -0.62 and a beta of 2.86. The stock's 50 day simple moving average is $1.08 and its 200 day simple moving average is $1.50.

Blink Charging (NASDAQ:BLNK - Get Free Report) last announced its earnings results on Thursday, March 13th. The company reported ($0.15) EPS for the quarter, topping the consensus estimate of ($0.18) by $0.03. The firm had revenue of $30.20 million for the quarter, compared to the consensus estimate of $30.77 million. Blink Charging had a negative return on equity of 25.50% and a negative net margin of 104.02%. The business's quarterly revenue was down 29.3% compared to the same quarter last year. During the same period in the previous year, the business earned ($0.28) EPS. As a group, equities research analysts expect that Blink Charging will post -0.64 EPS for the current fiscal year.

Institutional Investors Weigh In On Blink Charging

Hedge funds have recently added to or reduced their stakes in the company. Healthcare of Ontario Pension Plan Trust Fund lifted its holdings in shares of Blink Charging by 8.9% in the 3rd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 116,415 shares of the company's stock worth $200,000 after purchasing an additional 9,551 shares in the last quarter. American Century Companies Inc. lifted its stake in shares of Blink Charging by 8.4% in the fourth quarter. American Century Companies Inc. now owns 130,783 shares of the company's stock valued at $182,000 after buying an additional 10,123 shares in the last quarter. Bank of America Corp DE grew its holdings in shares of Blink Charging by 10.0% during the fourth quarter. Bank of America Corp DE now owns 135,663 shares of the company's stock valued at $189,000 after buying an additional 12,362 shares during the last quarter. Northern Trust Corp increased its position in shares of Blink Charging by 1.7% during the fourth quarter. Northern Trust Corp now owns 794,156 shares of the company's stock worth $1,104,000 after acquiring an additional 13,336 shares in the last quarter. Finally, Intech Investment Management LLC raised its holdings in shares of Blink Charging by 59.5% in the 4th quarter. Intech Investment Management LLC now owns 48,569 shares of the company's stock worth $68,000 after acquiring an additional 18,110 shares during the last quarter. Institutional investors and hedge funds own 44.64% of the company's stock.

About Blink Charging

(

Get Free Report)

Blink Charging Co, through its subsidiaries, owns, operates, manufactures, and provides electric vehicle (EV) charging equipment and networked EV charging services in the United States and internationally. The company offers residential and commercial EV charging equipment that enable EV drivers to recharge at various location types.

Featured Stories

Before you consider Blink Charging, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blink Charging wasn't on the list.

While Blink Charging currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.