Qsemble Capital Management LP decreased its holdings in Block, Inc. (NYSE:SQ - Free Report) by 58.8% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 16,450 shares of the technology company's stock after selling 23,490 shares during the period. Qsemble Capital Management LP's holdings in Block were worth $1,104,000 as of its most recent SEC filing.

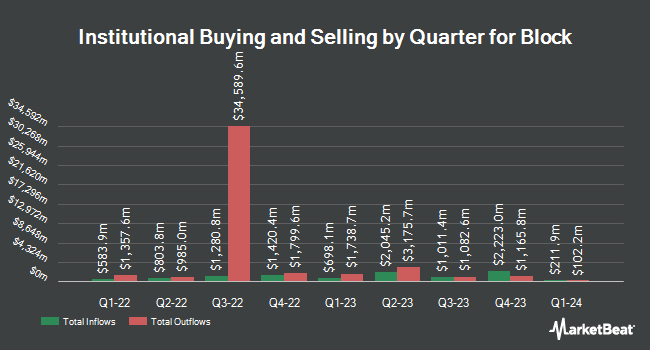

Several other hedge funds have also recently modified their holdings of the business. Baillie Gifford & Co. raised its holdings in shares of Block by 1.5% during the third quarter. Baillie Gifford & Co. now owns 10,233,102 shares of the technology company's stock valued at $686,948,000 after purchasing an additional 147,873 shares during the last quarter. Lone Pine Capital LLC grew its position in Block by 13.9% in the 2nd quarter. Lone Pine Capital LLC now owns 7,670,523 shares of the technology company's stock worth $494,672,000 after purchasing an additional 934,588 shares during the period. Charles Schwab Investment Management Inc. raised its stake in Block by 2.1% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,202,388 shares of the technology company's stock valued at $147,846,000 after buying an additional 45,472 shares during the last quarter. Dimensional Fund Advisors LP lifted its holdings in shares of Block by 17.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,157,733 shares of the technology company's stock valued at $139,143,000 after buying an additional 326,444 shares during the period. Finally, D1 Capital Partners L.P. boosted its stake in shares of Block by 76.7% in the 2nd quarter. D1 Capital Partners L.P. now owns 1,831,342 shares of the technology company's stock worth $118,103,000 after buying an additional 795,000 shares during the last quarter. Hedge funds and other institutional investors own 70.44% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts recently commented on SQ shares. UBS Group reduced their price objective on Block from $100.00 to $92.00 and set a "buy" rating for the company in a research report on Tuesday, August 27th. Keefe, Bruyette & Woods increased their price objective on shares of Block from $71.00 to $80.00 and gave the stock a "market perform" rating in a research note on Friday, November 8th. Benchmark reissued a "buy" rating and issued a $99.00 price objective on shares of Block in a report on Friday, August 2nd. Oppenheimer initiated coverage on shares of Block in a report on Tuesday, October 1st. They set a "market perform" rating for the company. Finally, Needham & Company LLC lifted their price target on shares of Block from $80.00 to $90.00 and gave the stock a "buy" rating in a research note on Friday, November 8th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and twenty-three have given a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $91.46.

Get Our Latest Research Report on SQ

Insider Buying and Selling at Block

In other news, insider Brian Grassadonia sold 1,884 shares of the business's stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $65.41, for a total transaction of $123,232.44. Following the transaction, the insider now owns 574,914 shares of the company's stock, valued at approximately $37,605,124.74. The trade was a 0.33 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CFO Amrita Ahuja sold 5,935 shares of the stock in a transaction on Wednesday, October 2nd. The shares were sold at an average price of $65.53, for a total value of $388,920.55. Following the sale, the chief financial officer now owns 255,496 shares in the company, valued at $16,742,652.88. The trade was a 2.27 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 29,053 shares of company stock worth $2,393,972 over the last 90 days. 10.49% of the stock is owned by insiders.

Block Price Performance

Shares of NYSE SQ traded up $0.64 during midday trading on Wednesday, reaching $89.65. 1,108,709 shares of the stock traded hands, compared to its average volume of 8,213,149. The company's 50 day moving average is $74.76 and its 200 day moving average is $68.32. Block, Inc. has a one year low of $55.00 and a one year high of $94.12. The company has a debt-to-equity ratio of 0.26, a current ratio of 2.07 and a quick ratio of 2.07. The stock has a market capitalization of $55.57 billion, a PE ratio of 50.02, a P/E/G ratio of 1.22 and a beta of 2.48.

About Block

(

Free Report)

Square, Inc provides payment and point-of-sale solutions in the United States and internationally. The company's commerce ecosystem includes point-of-sale software and hardware that enables sellers to turn mobile and computing devices into payment and point-of-sale solutions. It offers hardware products, including Magstripe reader, which enables swiped transactions of magnetic stripe cards; Contactless and chip reader that accepts EMV® chip cards and Near Field Communication payments; Chip card reader, which accepts EMV® chip cards and enables swiped transactions of magnetic stripe cards; Square Stand, which enables an iPad to be used as a payment terminal or full point of sale solution; and Square Register that combines its hardware, point-of-sale software, and payments technology, as well as managed payments solutions.

Featured Stories

Before you consider Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Block wasn't on the list.

While Block currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.