Mizuho Markets Americas LLC raised its holdings in Bloom Energy Co. (NYSE:BE - Free Report) by 8.2% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 410,555 shares of the company's stock after acquiring an additional 31,189 shares during the quarter. Mizuho Markets Americas LLC owned 0.18% of Bloom Energy worth $4,335,000 as of its most recent filing with the Securities and Exchange Commission.

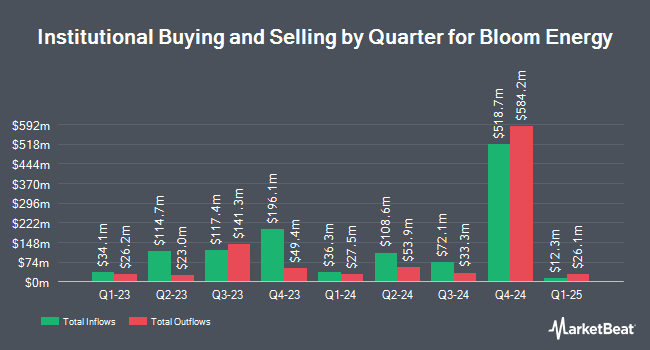

Several other hedge funds also recently made changes to their positions in the business. ORG Partners LLC acquired a new position in shares of Bloom Energy in the 2nd quarter worth $40,000. Quest Partners LLC lifted its holdings in shares of Bloom Energy by 2,780.0% in the second quarter. Quest Partners LLC now owns 3,600 shares of the company's stock valued at $44,000 after purchasing an additional 3,475 shares in the last quarter. Gilliland Jeter Wealth Management LLC acquired a new stake in shares of Bloom Energy in the second quarter worth $53,000. Mather Group LLC. purchased a new position in shares of Bloom Energy during the second quarter valued at $66,000. Finally, Emerald Mutual Fund Advisers Trust purchased a new stake in Bloom Energy in the 3rd quarter worth about $74,000. Institutional investors and hedge funds own 77.04% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently issued reports on BE. Marathon Capitl raised shares of Bloom Energy from a "hold" rating to a "strong-buy" rating in a research report on Monday, November 11th. Robert W. Baird decreased their target price on shares of Bloom Energy from $18.00 to $15.00 and set an "outperform" rating for the company in a research note on Friday, November 8th. Susquehanna upped their price target on shares of Bloom Energy from $13.00 to $16.00 and gave the stock a "positive" rating in a research note on Tuesday, November 12th. UBS Group reduced their price target on Bloom Energy from $25.00 to $23.00 and set a "buy" rating for the company in a report on Thursday, August 15th. Finally, Bank of America decreased their target price on shares of Bloom Energy from $8.00 to $7.00 and set an "underperform" rating for the company in a research report on Thursday, November 7th. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, Bloom Energy currently has a consensus rating of "Moderate Buy" and a consensus price target of $16.05.

Check Out Our Latest Research Report on BE

Bloom Energy Trading Up 59.2 %

Shares of NYSE BE opened at $21.14 on Friday. Bloom Energy Co. has a twelve month low of $8.41 and a twelve month high of $22.50. The stock has a market cap of $4.81 billion, a price-to-earnings ratio of -37.75 and a beta of 2.71. The company has a quick ratio of 3.33, a current ratio of 3.36 and a debt-to-equity ratio of 3.09. The company's fifty day moving average is $10.82 and its 200-day moving average is $12.28.

Bloom Energy Company Profile

(

Free Report)

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. The company offers Bloom Energy Server, a solid oxide technology that converts fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels into electricity through an electrochemical process without combustion.

Read More

Want to see what other hedge funds are holding BE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Bloom Energy Co. (NYSE:BE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bloom Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloom Energy wasn't on the list.

While Bloom Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.