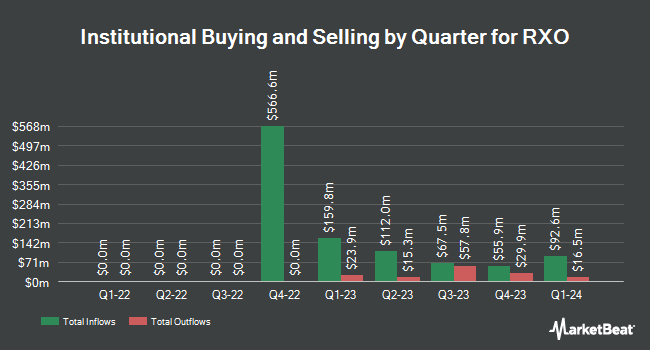

BloombergSen Inc. purchased a new position in shares of RXO, Inc. (NYSE:RXO - Free Report) during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor purchased 436,756 shares of the company's stock, valued at approximately $12,229,000. RXO makes up 0.7% of BloombergSen Inc.'s investment portfolio, making the stock its 17th biggest position. BloombergSen Inc. owned approximately 0.27% of RXO at the end of the most recent reporting period.

Several other institutional investors also recently bought and sold shares of the business. MFN Partners Management LP raised its position in shares of RXO by 11.0% during the 2nd quarter. MFN Partners Management LP now owns 17,310,856 shares of the company's stock worth $452,679,000 after purchasing an additional 1,722,301 shares during the last quarter. Vanguard Group Inc. lifted its position in shares of RXO by 0.3% in the first quarter. Vanguard Group Inc. now owns 13,294,483 shares of the company's stock valued at $290,750,000 after acquiring an additional 45,977 shares in the last quarter. Swedbank AB acquired a new stake in shares of RXO in the first quarter worth approximately $76,982,000. Douglas Lane & Associates LLC raised its stake in RXO by 2.0% in the 2nd quarter. Douglas Lane & Associates LLC now owns 2,698,525 shares of the company's stock valued at $70,566,000 after purchasing an additional 52,378 shares during the last quarter. Finally, Dimensional Fund Advisors LP grew its holdings in shares of RXO by 9.5% during the second quarter. Dimensional Fund Advisors LP now owns 2,032,929 shares of the company's stock worth $53,153,000 after buying an additional 176,041 shares in the last quarter. 92.73% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research analysts have recently weighed in on RXO shares. TD Cowen boosted their target price on RXO from $23.00 to $28.00 and gave the stock a "hold" rating in a report on Thursday, August 8th. Morgan Stanley upped their target price on RXO from $19.00 to $26.00 and gave the company an "equal weight" rating in a report on Monday, August 12th. Barclays raised their target price on RXO from $24.00 to $30.00 and gave the stock an "overweight" rating in a research note on Tuesday, July 16th. UBS Group boosted their price target on shares of RXO from $22.00 to $31.00 and gave the company a "neutral" rating in a research report on Thursday, August 8th. Finally, Susquehanna cut their price objective on shares of RXO from $20.00 to $16.00 and set a "negative" rating for the company in a research report on Thursday, September 26th. Two research analysts have rated the stock with a sell rating, nine have assigned a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $26.23.

Read Our Latest Stock Report on RXO

RXO Stock Up 3.8 %

RXO stock traded up $1.09 during trading on Friday, hitting $29.80. The company had a trading volume of 1,613,273 shares, compared to its average volume of 861,338. The company has a quick ratio of 1.17, a current ratio of 1.17 and a debt-to-equity ratio of 0.64. RXO, Inc. has a 1-year low of $17.29 and a 1-year high of $32.82. The company's 50 day simple moving average is $27.81 and its 200-day simple moving average is $25.68.

RXO (NYSE:RXO - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The company reported $0.05 EPS for the quarter, topping the consensus estimate of $0.04 by $0.01. RXO had a positive return on equity of 2.22% and a negative net margin of 0.55%. The business had revenue of $1.04 billion during the quarter, compared to analyst estimates of $956.19 million. During the same period last year, the business posted $0.05 earnings per share. The company's quarterly revenue was up 6.6% on a year-over-year basis. Sell-side analysts expect that RXO, Inc. will post 0.16 earnings per share for the current fiscal year.

RXO Profile

(

Free Report)

RXO, Inc provides full truckload freight transportation brokering services. It also offers brokered services for managed transportation, last mile, and freight forwarding. The company was incorporated in 2022 and is based in Charlotte, North Carolina.

See Also

Before you consider RXO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RXO wasn't on the list.

While RXO currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.