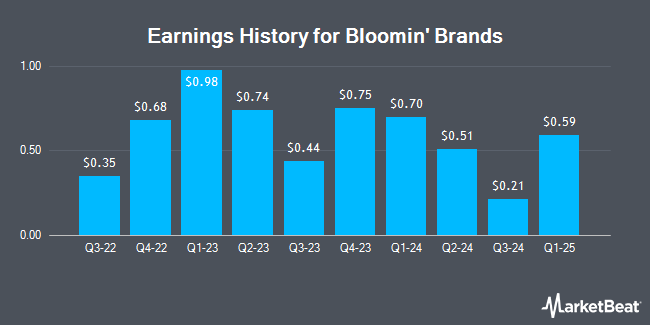

Bloomin' Brands (NASDAQ:BLMN - Get Free Report) is expected to release its earnings data before the market opens on Wednesday, February 26th. Analysts expect Bloomin' Brands to post earnings of $0.38 per share and revenue of $1.08 billion for the quarter. Persons interested in participating in the company's earnings conference call can do so using this link.

Bloomin' Brands Price Performance

BLMN stock traded down $0.17 during midday trading on Friday, reaching $11.84. The company had a trading volume of 1,608,689 shares, compared to its average volume of 1,715,688. The company has a market capitalization of $1.00 billion, a price-to-earnings ratio of -107.63 and a beta of 1.97. The stock has a 50 day moving average price of $12.03 and a 200-day moving average price of $14.47. Bloomin' Brands has a 1-year low of $10.85 and a 1-year high of $30.13. The company has a debt-to-equity ratio of 4.46, a current ratio of 0.31 and a quick ratio of 0.22.

Analyst Upgrades and Downgrades

A number of research firms recently commented on BLMN. Piper Sandler dropped their price target on Bloomin' Brands from $20.00 to $16.00 and set a "neutral" rating for the company in a research note on Monday, November 11th. Bank of America cut shares of Bloomin' Brands from a "neutral" rating to an "underperform" rating and dropped their target price for the stock from $18.00 to $13.00 in a report on Monday, January 27th. Raymond James cut shares of Bloomin' Brands from an "outperform" rating to a "market perform" rating in a report on Monday, November 11th. StockNews.com raised shares of Bloomin' Brands from a "sell" rating to a "hold" rating in a report on Tuesday. Finally, UBS Group dropped their target price on shares of Bloomin' Brands from $16.00 to $13.00 and set a "neutral" rating for the company in a report on Tuesday, January 7th. Two analysts have rated the stock with a sell rating and ten have issued a hold rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and an average price target of $16.30.

Get Our Latest Report on BLMN

About Bloomin' Brands

(

Get Free Report)

Bloomin' Brands, Inc engages in the acquisition, operation, design, and development of restaurant concepts. It operates through the U.S. and International geographical segments. The U.S. segment operates in the USA and Puerto Rico. The International segment operates in Brazil, South Korea, Hong Kong, and China.

Further Reading

Before you consider Bloomin' Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloomin' Brands wasn't on the list.

While Bloomin' Brands currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.