Blue Foundry Bancorp (NASDAQ:BLFY - Get Free Report) will likely be issuing its quarterly earnings data before the market opens on Wednesday, April 30th. Analysts expect the company to announce earnings of ($0.16) per share and revenue of $10.29 million for the quarter. Persons that are interested in participating in the company's earnings conference call can do so using this link.

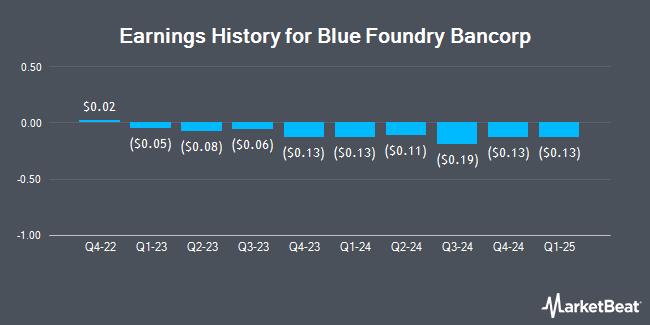

Blue Foundry Bancorp (NASDAQ:BLFY - Get Free Report) last released its quarterly earnings data on Wednesday, January 29th. The company reported ($0.13) EPS for the quarter, topping analysts' consensus estimates of ($0.17) by $0.04. Blue Foundry Bancorp had a negative net margin of 13.65% and a negative return on equity of 3.45%. On average, analysts expect Blue Foundry Bancorp to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Blue Foundry Bancorp Stock Performance

Shares of BLFY stock traded up $0.08 on Friday, hitting $8.91. The company's stock had a trading volume of 60,130 shares, compared to its average volume of 51,331. The stock's 50 day moving average is $9.35 and its 200-day moving average is $9.88. Blue Foundry Bancorp has a fifty-two week low of $7.94 and a fifty-two week high of $11.48. The company has a debt-to-equity ratio of 1.03, a quick ratio of 1.23 and a current ratio of 1.23. The company has a market capitalization of $196.88 million, a PE ratio of -15.91 and a beta of 0.64.

Analysts Set New Price Targets

Separately, Keefe, Bruyette & Woods lowered their price objective on shares of Blue Foundry Bancorp from $11.00 to $10.00 and set a "market perform" rating for the company in a research report on Thursday, January 30th.

Check Out Our Latest Report on BLFY

About Blue Foundry Bancorp

(

Get Free Report)

Blue Foundry Bancorp operates as a bank holding company for Blue Foundry Bank, a savings bank that offers various banking products and services for individuals and businesses in the United States. The company offers saving, time, and non-interest bearing deposits; demand accounts; and loans, such as one-to-four family residential property, multi-family, residential real estate, non-residential real estate, consumer, construction, and commercial and industrial loans, as well as junior liens and home equity lines of credit.

Read More

Before you consider Blue Foundry Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Foundry Bancorp wasn't on the list.

While Blue Foundry Bancorp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.