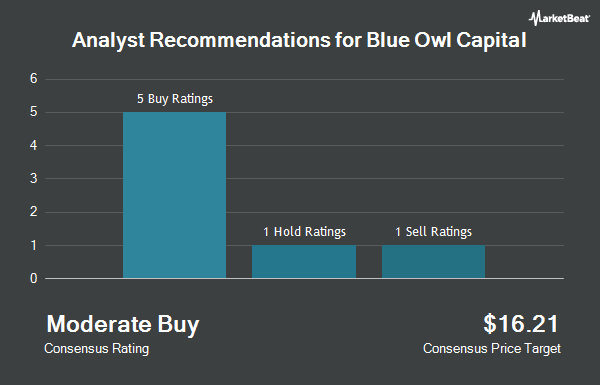

Blue Owl Capital Co. (NYSE:OBDC - Get Free Report) has earned an average recommendation of "Moderate Buy" from the nine brokerages that are currently covering the company, MarketBeat reports. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating, four have issued a buy rating and one has issued a strong buy rating on the company. The average 12-month price objective among brokerages that have updated their coverage on the stock in the last year is $16.07.

Several equities analysts recently commented on the company. Raymond James lowered Blue Owl Capital from an "outperform" rating to a "market perform" rating in a research note on Friday, August 9th. Keefe, Bruyette & Woods dropped their price target on shares of Blue Owl Capital from $16.00 to $15.50 and set a "market perform" rating for the company in a research report on Tuesday, August 20th. Truist Financial decreased their price target on shares of Blue Owl Capital from $18.00 to $17.00 and set a "buy" rating on the stock in a report on Friday, August 9th. Compass Point raised Blue Owl Capital to a "strong-buy" rating in a research report on Monday, August 19th. Finally, Royal Bank of Canada restated an "outperform" rating and set a $17.00 price target on shares of Blue Owl Capital in a research note on Tuesday, November 19th.

View Our Latest Report on OBDC

Hedge Funds Weigh In On Blue Owl Capital

Institutional investors and hedge funds have recently bought and sold shares of the stock. BOKF NA acquired a new position in shares of Blue Owl Capital during the first quarter worth $312,000. DCM Advisors LLC grew its stake in shares of Blue Owl Capital by 7.1% during the first quarter. DCM Advisors LLC now owns 24,220 shares of the company's stock valued at $373,000 after acquiring an additional 1,606 shares in the last quarter. Comerica Bank increased its position in shares of Blue Owl Capital by 12.5% during the first quarter. Comerica Bank now owns 56,397 shares of the company's stock worth $867,000 after acquiring an additional 6,288 shares during the last quarter. Citizens Financial Group Inc. RI acquired a new position in shares of Blue Owl Capital in the first quarter worth about $1,311,000. Finally, Virtu Financial LLC purchased a new position in Blue Owl Capital in the first quarter valued at about $840,000. Hedge funds and other institutional investors own 42.83% of the company's stock.

Blue Owl Capital Trading Down 0.4 %

NYSE OBDC traded down $0.05 during mid-day trading on Tuesday, reaching $15.14. 1,754,166 shares of the stock were exchanged, compared to its average volume of 1,937,543. The business's fifty day simple moving average is $14.92 and its 200 day simple moving average is $15.31. The company has a debt-to-equity ratio of 1.30, a quick ratio of 1.28 and a current ratio of 1.28. The stock has a market capitalization of $5.91 billion, a PE ratio of 9.43 and a beta of 0.86. Blue Owl Capital has a 1-year low of $13.98 and a 1-year high of $16.91.

Blue Owl Capital Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be issued a dividend of $0.37 per share. This is an increase from Blue Owl Capital's previous quarterly dividend of $0.06. This represents a $1.48 annualized dividend and a dividend yield of 9.78%. The ex-dividend date is Tuesday, December 31st. Blue Owl Capital's dividend payout ratio (DPR) is presently 91.93%.

About Blue Owl Capital

(

Get Free ReportBlue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments.

See Also

Before you consider Blue Owl Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Owl Capital wasn't on the list.

While Blue Owl Capital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.