Advisors Asset Management Inc. boosted its holdings in shares of Blue Owl Capital Co. (NYSE:OBDC - Free Report) by 16.8% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 334,775 shares of the company's stock after buying an additional 48,136 shares during the period. Advisors Asset Management Inc. owned approximately 0.09% of Blue Owl Capital worth $4,878,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

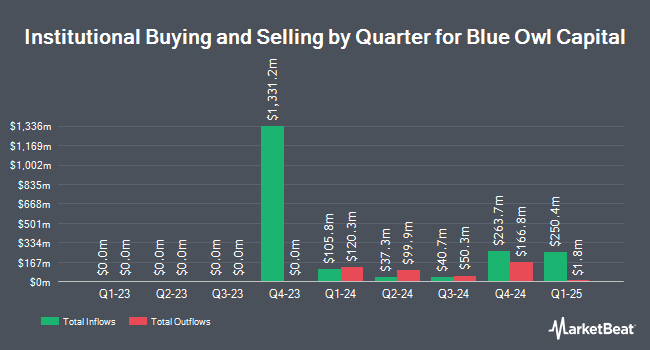

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. National Bank of Canada FI acquired a new position in shares of Blue Owl Capital in the 2nd quarter valued at $26,000. CWM LLC increased its holdings in shares of Blue Owl Capital by 98.6% in the second quarter. CWM LLC now owns 2,079 shares of the company's stock valued at $32,000 after purchasing an additional 1,032 shares during the period. Rothschild Investment LLC purchased a new position in shares of Blue Owl Capital in the second quarter worth about $61,000. Zions Bancorporation N.A. acquired a new stake in shares of Blue Owl Capital during the second quarter worth about $61,000. Finally, EverSource Wealth Advisors LLC increased its holdings in Blue Owl Capital by 604.7% in the 2nd quarter. EverSource Wealth Advisors LLC now owns 4,172 shares of the company's stock worth $65,000 after buying an additional 3,580 shares during the period. 42.83% of the stock is currently owned by hedge funds and other institutional investors.

Blue Owl Capital Price Performance

Blue Owl Capital stock traded up $0.15 during midday trading on Friday, reaching $15.22. The company had a trading volume of 1,861,666 shares, compared to its average volume of 1,937,930. Blue Owl Capital Co. has a 12-month low of $13.98 and a 12-month high of $16.91. The firm's fifty day simple moving average is $14.91 and its 200-day simple moving average is $15.34. The company has a debt-to-equity ratio of 1.30, a current ratio of 1.28 and a quick ratio of 1.28. The company has a market capitalization of $5.94 billion, a P/E ratio of 9.43 and a beta of 0.86.

Blue Owl Capital Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be given a dividend of $0.37 per share. This represents a $1.48 annualized dividend and a dividend yield of 9.72%. This is a boost from Blue Owl Capital's previous quarterly dividend of $0.06. The ex-dividend date of this dividend is Tuesday, December 31st. Blue Owl Capital's payout ratio is presently 91.93%.

Insider Buying and Selling at Blue Owl Capital

In related news, Director Edward H. Dalelio purchased 2,500 shares of the business's stock in a transaction that occurred on Tuesday, August 27th. The stock was purchased at an average price of $15.02 per share, with a total value of $37,550.00. Following the completion of the acquisition, the director now owns 9,016 shares in the company, valued at $135,420.32. This trade represents a 38.37 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through this link. 0.12% of the stock is currently owned by insiders.

Analyst Ratings Changes

Several analysts have commented on the stock. Wells Fargo & Company upped their price objective on shares of Blue Owl Capital from $14.00 to $14.50 and gave the company an "underweight" rating in a report on Tuesday, October 29th. Raymond James lowered Blue Owl Capital from an "outperform" rating to a "market perform" rating in a research note on Friday, August 9th. Truist Financial lowered their target price on Blue Owl Capital from $18.00 to $17.00 and set a "buy" rating on the stock in a research note on Friday, August 9th. Compass Point raised Blue Owl Capital to a "strong-buy" rating in a report on Monday, August 19th. Finally, Keefe, Bruyette & Woods dropped their target price on Blue Owl Capital from $16.00 to $15.50 and set a "market perform" rating on the stock in a research report on Tuesday, August 20th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating, four have given a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $16.07.

Get Our Latest Research Report on Blue Owl Capital

Blue Owl Capital Company Profile

(

Free Report)

Blue Owl Capital Corporation is a business development company. It specializes in direct and fund of fund investments. The fund makes investments in senior secured, direct lending or unsecured loans, subordinated loans or mezzanine loans and also considers equity-related securities including warrants and preferred stocks also pursues preferred equity investments, first lien, unitranche, and second lien term loans and common equity investments.

See Also

Before you consider Blue Owl Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Owl Capital wasn't on the list.

While Blue Owl Capital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.