Blue Whale Capital LLP trimmed its position in H&R Block, Inc. (NYSE:HRB - Free Report) by 31.1% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 511,482 shares of the company's stock after selling 231,018 shares during the quarter. H&R Block comprises approximately 2.5% of Blue Whale Capital LLP's holdings, making the stock its 15th biggest position. Blue Whale Capital LLP owned about 0.37% of H&R Block worth $32,505,000 at the end of the most recent reporting period.

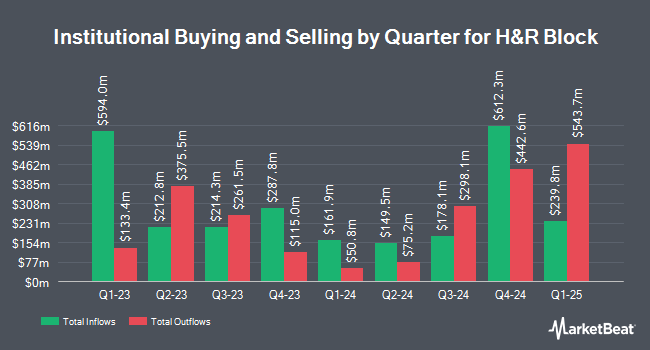

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Rockland Trust Co. raised its position in shares of H&R Block by 1.2% during the 3rd quarter. Rockland Trust Co. now owns 16,866 shares of the company's stock valued at $1,072,000 after purchasing an additional 200 shares during the period. TriaGen Wealth Management LLC lifted its position in shares of H&R Block by 2.4% in the second quarter. TriaGen Wealth Management LLC now owns 8,642 shares of the company's stock valued at $469,000 after acquiring an additional 203 shares in the last quarter. Bank of Montreal Can boosted its stake in shares of H&R Block by 1.0% in the second quarter. Bank of Montreal Can now owns 24,467 shares of the company's stock worth $1,327,000 after acquiring an additional 251 shares during the period. Axiom Advisory LLC boosted its stake in shares of H&R Block by 1.6% in the third quarter. Axiom Advisory LLC now owns 18,048 shares of the company's stock worth $1,076,000 after acquiring an additional 282 shares during the period. Finally, Park Avenue Securities LLC grew its position in shares of H&R Block by 1.9% during the third quarter. Park Avenue Securities LLC now owns 15,857 shares of the company's stock worth $1,008,000 after purchasing an additional 303 shares in the last quarter. Institutional investors own 90.14% of the company's stock.

Insider Buying and Selling at H&R Block

In other H&R Block news, CEO Jeffrey J. Jones II sold 9,722 shares of the business's stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $63.07, for a total transaction of $613,166.54. Following the completion of the transaction, the chief executive officer now owns 893,169 shares in the company, valued at $56,332,168.83. The trade was a 1.08 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, VP Kellie J. Logerwell sold 8,000 shares of the stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $64.41, for a total value of $515,280.00. Following the completion of the sale, the vice president now owns 18,474 shares in the company, valued at approximately $1,189,910.34. The trade was a 30.22 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.30% of the company's stock.

Analysts Set New Price Targets

HRB has been the subject of several recent analyst reports. The Goldman Sachs Group upped their price target on H&R Block from $39.00 to $44.00 and gave the stock a "sell" rating in a research note on Friday, August 16th. StockNews.com cut shares of H&R Block from a "buy" rating to a "hold" rating in a research note on Friday, August 16th. Finally, Barrington Research reiterated an "outperform" rating and issued a $70.00 price target on shares of H&R Block in a report on Friday, November 8th.

Read Our Latest Stock Analysis on HRB

H&R Block Price Performance

Shares of HRB traded up $1.23 during mid-day trading on Monday, hitting $59.53. 2,412,536 shares of the stock were exchanged, compared to its average volume of 1,202,014. The firm has a 50-day moving average of $61.20 and a two-hundred day moving average of $57.81. H&R Block, Inc. has a 52-week low of $42.28 and a 52-week high of $68.45. The company has a debt-to-equity ratio of 16.46, a quick ratio of 0.77 and a current ratio of 0.77. The company has a market cap of $8.16 billion, a PE ratio of 14.60, a price-to-earnings-growth ratio of 0.88 and a beta of 0.67.

H&R Block (NYSE:HRB - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The company reported ($1.17) EPS for the quarter, missing the consensus estimate of ($1.13) by ($0.04). H&R Block had a net margin of 16.19% and a negative return on equity of 212.45%. The business had revenue of $193.81 million for the quarter, compared to the consensus estimate of $188.78 million. During the same quarter last year, the business earned ($1.05) EPS. On average, equities analysts predict that H&R Block, Inc. will post 5.28 earnings per share for the current year.

H&R Block announced that its board has authorized a stock repurchase program on Thursday, August 15th that allows the company to buyback $1.50 billion in shares. This buyback authorization allows the company to purchase up to 16.7% of its stock through open market purchases. Stock buyback programs are usually an indication that the company's management believes its shares are undervalued.

H&R Block Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, January 6th. Shareholders of record on Thursday, December 5th will be given a dividend of $0.375 per share. The ex-dividend date is Thursday, December 5th. This represents a $1.50 dividend on an annualized basis and a yield of 2.52%. H&R Block's dividend payout ratio (DPR) is presently 36.59%.

H&R Block Profile

(

Free Report)

H&R Block, Inc, through its subsidiaries, provides assisted income tax return preparation and do-it-yourself (DIY) tax return preparation services and products to the general public primarily in the United States, Canada, and Australia. It offers assisted income tax return preparation and related services through a system of retail offices operated directly by the company or its franchisees.

See Also

Before you consider H&R Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&R Block wasn't on the list.

While H&R Block currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.