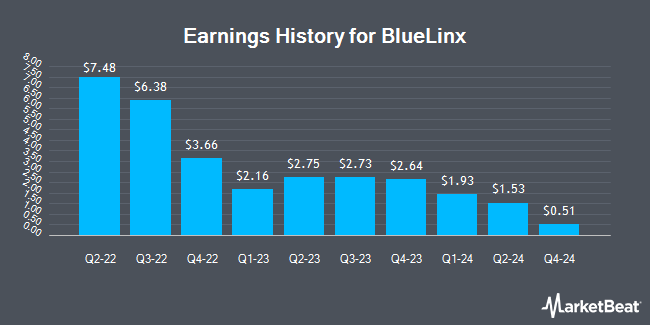

BlueLinx (NYSE:BXC - Get Free Report) is expected to release its earnings data after the market closes on Tuesday, February 18th. Analysts expect BlueLinx to post earnings of $0.52 per share for the quarter. Persons that wish to register for the company's earnings conference call can do so using this link.

BlueLinx Price Performance

BXC traded up $0.30 during midday trading on Friday, hitting $101.85. The stock had a trading volume of 39,718 shares, compared to its average volume of 57,051. The company has a market cap of $853.53 million, a P/E ratio of 29.61 and a beta of 2.04. BlueLinx has a 1 year low of $87.67 and a 1 year high of $134.79. The company has a debt-to-equity ratio of 0.88, a quick ratio of 3.26 and a current ratio of 4.58. The business has a fifty day moving average of $107.62 and a 200 day moving average of $108.16.

About BlueLinx

(

Get Free Report)

BlueLinx Holdings Inc, together with its subsidiaries, engages in the distribution of residential and commercial building products in the United States. It distributes specialty products, including engineered wood, siding, millwork, outdoor living, specialty lumber and panels, and industrial products; and structural products, such as lumber, plywood, oriented strand boards, rebars and remesh, as well as other wood products that are used for structural support in construction projects.

Featured Stories

Before you consider BlueLinx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BlueLinx wasn't on the list.

While BlueLinx currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.