Blueprint Investment Partners LLC purchased a new position in United Parcel Service, Inc. (NYSE:UPS - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 2,183 shares of the transportation company's stock, valued at approximately $275,000.

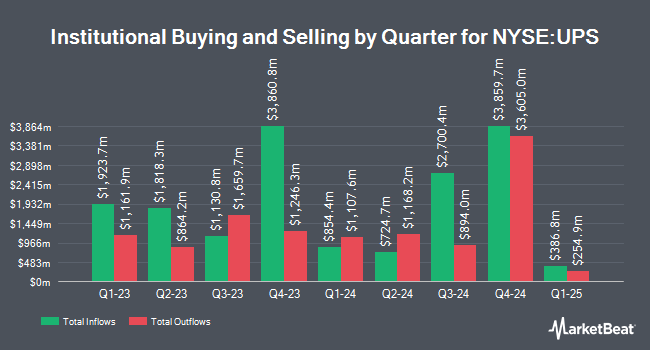

Other large investors have also modified their holdings of the company. Principal Financial Group Inc. grew its holdings in United Parcel Service by 4.3% during the 3rd quarter. Principal Financial Group Inc. now owns 829,280 shares of the transportation company's stock worth $113,064,000 after acquiring an additional 33,989 shares in the last quarter. Onyx Bridge Wealth Group LLC purchased a new stake in shares of United Parcel Service during the 4th quarter worth $461,000. Synovus Financial Corp grew its stake in shares of United Parcel Service by 8.6% during the third quarter. Synovus Financial Corp now owns 87,531 shares of the transportation company's stock worth $11,934,000 after purchasing an additional 6,941 shares in the last quarter. HF Advisory Group LLC purchased a new position in United Parcel Service in the fourth quarter valued at $1,305,000. Finally, Allspring Global Investments Holdings LLC raised its stake in United Parcel Service by 27.2% in the fourth quarter. Allspring Global Investments Holdings LLC now owns 131,623 shares of the transportation company's stock valued at $16,304,000 after buying an additional 28,108 shares in the last quarter. Hedge funds and other institutional investors own 60.26% of the company's stock.

United Parcel Service Stock Performance

NYSE UPS traded down $5.79 during trading hours on Tuesday, hitting $110.01. 9,266,873 shares of the stock were exchanged, compared to its average volume of 4,496,863. United Parcel Service, Inc. has a 12-month low of $109.40 and a 12-month high of $157.99. The stock has a 50-day moving average of $119.95 and a 200 day moving average of $126.92. The company has a market cap of $93.97 billion, a price-to-earnings ratio of 16.27, a price-to-earnings-growth ratio of 1.55 and a beta of 0.94. The company has a quick ratio of 1.14, a current ratio of 1.17 and a debt-to-equity ratio of 1.16.

United Parcel Service (NYSE:UPS - Get Free Report) last issued its earnings results on Thursday, January 30th. The transportation company reported $2.75 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.52 by $0.23. United Parcel Service had a return on equity of 39.13% and a net margin of 6.35%. During the same quarter in the prior year, the business posted $2.47 earnings per share. As a group, equities research analysts forecast that United Parcel Service, Inc. will post 7.95 earnings per share for the current year.

United Parcel Service Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, March 6th. Stockholders of record on Tuesday, February 18th were paid a dividend of $1.64 per share. The ex-dividend date was Tuesday, February 18th. This is a boost from United Parcel Service's previous quarterly dividend of $1.63. This represents a $6.56 dividend on an annualized basis and a dividend yield of 5.96%. United Parcel Service's dividend payout ratio is 97.04%.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on the company. Baird R W downgraded United Parcel Service from a "strong-buy" rating to a "hold" rating in a report on Friday, January 31st. Truist Financial began coverage on shares of United Parcel Service in a research report on Thursday, March 13th. They issued a "buy" rating and a $140.00 target price on the stock. Morgan Stanley cut their price target on shares of United Parcel Service from $100.00 to $82.00 and set an "underweight" rating on the stock in a research note on Friday, January 31st. Bank of America decreased their price objective on shares of United Parcel Service from $133.00 to $129.00 and set a "buy" rating for the company in a research note on Tuesday. Finally, Deutsche Bank Aktiengesellschaft initiated coverage on United Parcel Service in a research report on Friday, March 7th. They set a "hold" rating and a $119.00 target price on the stock. Two research analysts have rated the stock with a sell rating, nine have issued a hold rating, fourteen have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, United Parcel Service has a consensus rating of "Moderate Buy" and a consensus price target of $137.91.

Get Our Latest Analysis on United Parcel Service

About United Parcel Service

(

Free Report)

United Parcel Service, Inc, a package delivery company, provides transportation and delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of express letters, documents, small packages, and palletized freight through air and ground services in the United States.

See Also

Before you consider United Parcel Service, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Parcel Service wasn't on the list.

While United Parcel Service currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.