Blueshift Asset Management LLC raised its position in Monolithic Power Systems, Inc. (NASDAQ:MPWR - Free Report) by 184.1% during the fourth quarter, according to its most recent 13F filing with the SEC. The fund owned 1,318 shares of the semiconductor company's stock after buying an additional 854 shares during the period. Blueshift Asset Management LLC's holdings in Monolithic Power Systems were worth $780,000 as of its most recent filing with the SEC.

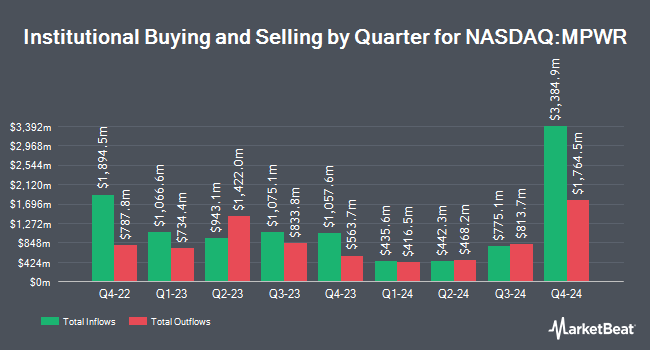

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Tradewinds Capital Management LLC boosted its holdings in Monolithic Power Systems by 120.0% in the fourth quarter. Tradewinds Capital Management LLC now owns 44 shares of the semiconductor company's stock valued at $26,000 after acquiring an additional 24 shares during the last quarter. OFI Invest Asset Management bought a new position in shares of Monolithic Power Systems in the 4th quarter valued at about $27,000. Golden State Wealth Management LLC acquired a new stake in shares of Monolithic Power Systems during the 4th quarter worth approximately $39,000. AlphaQuest LLC bought a new stake in shares of Monolithic Power Systems during the fourth quarter worth approximately $41,000. Finally, Versant Capital Management Inc lifted its holdings in Monolithic Power Systems by 60.3% in the fourth quarter. Versant Capital Management Inc now owns 109 shares of the semiconductor company's stock valued at $64,000 after buying an additional 41 shares during the period. 93.46% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Monolithic Power Systems

In related news, EVP Maurice Sciammas sold 7,000 shares of the stock in a transaction that occurred on Friday, February 7th. The stock was sold at an average price of $701.98, for a total transaction of $4,913,860.00. Following the completion of the transaction, the executive vice president now directly owns 16,015 shares of the company's stock, valued at approximately $11,242,209.70. This represents a 30.41 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 3.70% of the company's stock.

Analysts Set New Price Targets

A number of analysts have commented on MPWR shares. KeyCorp lifted their target price on shares of Monolithic Power Systems from $700.00 to $850.00 and gave the stock an "overweight" rating in a report on Friday, February 7th. Needham & Company LLC boosted their target price on Monolithic Power Systems from $600.00 to $800.00 and gave the stock a "buy" rating in a research report on Friday, February 7th. Wells Fargo & Company reduced their price objective on shares of Monolithic Power Systems from $710.00 to $665.00 and set an "equal weight" rating on the stock in a research note on Friday. Oppenheimer reaffirmed an "outperform" rating and issued a $800.00 target price on shares of Monolithic Power Systems in a research note on Friday. Finally, Rosenblatt Securities reduced their price target on shares of Monolithic Power Systems from $800.00 to $750.00 and set a "neutral" rating on the stock in a research report on Friday. Two analysts have rated the stock with a hold rating and ten have given a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $851.58.

Get Our Latest Report on MPWR

Monolithic Power Systems Trading Up 6.3 %

Shares of MPWR stock traded up $36.95 on Monday, hitting $627.93. 1,170,829 shares of the stock were exchanged, compared to its average volume of 685,730. The firm has a market capitalization of $30.06 billion, a P/E ratio of 17.08, a price-to-earnings-growth ratio of 2.60 and a beta of 1.03. Monolithic Power Systems, Inc. has a fifty-two week low of $546.71 and a fifty-two week high of $959.64. The business has a 50-day moving average of $636.30 and a 200 day moving average of $705.59.

Monolithic Power Systems (NASDAQ:MPWR - Get Free Report) last issued its quarterly earnings results on Thursday, February 6th. The semiconductor company reported $3.17 earnings per share for the quarter, missing the consensus estimate of $4.01 by ($0.84). Monolithic Power Systems had a return on equity of 20.36% and a net margin of 80.95%. As a group, research analysts forecast that Monolithic Power Systems, Inc. will post 13.2 EPS for the current fiscal year.

Monolithic Power Systems Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, April 15th. Shareholders of record on Monday, March 31st will be given a dividend of $1.56 per share. The ex-dividend date of this dividend is Monday, March 31st. This is a boost from Monolithic Power Systems's previous quarterly dividend of $1.25. This represents a $6.24 annualized dividend and a yield of 0.99%. Monolithic Power Systems's payout ratio is 16.97%.

Monolithic Power Systems Profile

(

Free Report)

Monolithic Power Systems, Inc engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets. The company provides direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as cloud-based CPU servers, server artificial intelligence applications, storage applications, commercial notebooks, digital cockpit, power sources, home appliances, 4G and 5G infrastructure, and satellite communications applications.

Further Reading

Before you consider Monolithic Power Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monolithic Power Systems wasn't on the list.

While Monolithic Power Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.