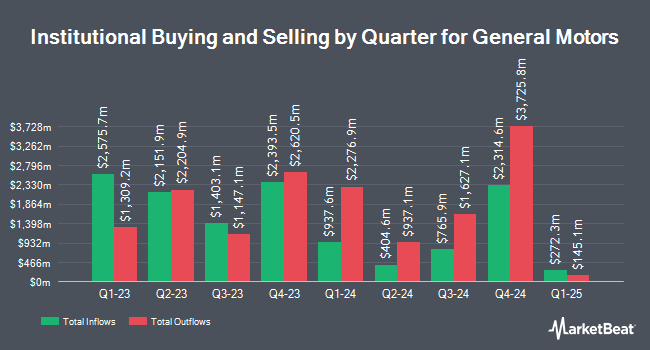

Blueshift Asset Management LLC raised its holdings in General Motors (NYSE:GM - Free Report) TSE: GMM.U by 229.0% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 56,950 shares of the auto manufacturer's stock after purchasing an additional 39,641 shares during the quarter. Blueshift Asset Management LLC's holdings in General Motors were worth $2,554,000 as of its most recent filing with the SEC.

A number of other institutional investors also recently bought and sold shares of GM. Strategic Investment Solutions Inc. IL purchased a new stake in shares of General Motors in the second quarter valued at about $25,000. Catalyst Capital Advisors LLC purchased a new stake in shares of General Motors in the third quarter valued at about $27,000. Wellington Shields Capital Management LLC purchased a new stake in shares of General Motors in the second quarter valued at about $28,000. Truvestments Capital LLC purchased a new stake in shares of General Motors in the third quarter valued at about $27,000. Finally, Fortitude Family Office LLC boosted its holdings in shares of General Motors by 56.1% in the second quarter. Fortitude Family Office LLC now owns 626 shares of the auto manufacturer's stock valued at $29,000 after acquiring an additional 225 shares in the last quarter. 92.67% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of analysts recently commented on GM shares. Royal Bank of Canada boosted their price objective on shares of General Motors from $58.00 to $65.00 and gave the stock an "outperform" rating in a report on Wednesday, October 23rd. Barclays boosted their price objective on shares of General Motors from $64.00 to $70.00 and gave the stock an "overweight" rating in a report on Wednesday, October 23rd. Morgan Stanley downgraded shares of General Motors from an "equal weight" rating to an "underweight" rating and decreased their price objective for the stock from $47.00 to $42.00 in a report on Wednesday, September 25th. JPMorgan Chase & Co. boosted their price objective on shares of General Motors from $64.00 to $70.00 and gave the stock an "overweight" rating in a report on Wednesday, October 23rd. Finally, UBS Group boosted their price objective on shares of General Motors from $58.00 to $62.00 and gave the stock a "buy" rating in a report on Wednesday, October 23rd. Four research analysts have rated the stock with a sell rating, seven have given a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $56.92.

Check Out Our Latest Report on General Motors

Insider Transactions at General Motors

In related news, EVP Craig B. Glidden sold 383,142 shares of the firm's stock in a transaction on Monday, November 18th. The shares were sold at an average price of $56.63, for a total transaction of $21,697,331.46. Following the completion of the sale, the executive vice president now directly owns 122,465 shares of the company's stock, valued at approximately $6,935,192.95. This trade represents a 75.78 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Mary T. Barra sold 506,824 shares of the firm's stock in a transaction on Wednesday, October 23rd. The shares were sold at an average price of $53.33, for a total transaction of $27,028,923.92. Following the sale, the chief executive officer now directly owns 694,548 shares of the company's stock, valued at approximately $37,040,244.84. The trade was a 42.19 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 1,030,475 shares of company stock valued at $56,509,286 over the last 90 days. Corporate insiders own 0.72% of the company's stock.

General Motors Trading Up 1.3 %

GM stock traded up $0.71 on Wednesday, hitting $55.50. 11,311,328 shares of the company were exchanged, compared to its average volume of 14,945,132. General Motors has a twelve month low of $28.33 and a twelve month high of $61.24. The company has a debt-to-equity ratio of 1.24, a current ratio of 1.21 and a quick ratio of 1.03. The business's fifty day moving average is $51.15 and its two-hundred day moving average is $47.88. The stock has a market capitalization of $61.03 billion, a price-to-earnings ratio of 5.84, a price-to-earnings-growth ratio of 0.45 and a beta of 1.40.

General Motors (NYSE:GM - Get Free Report) TSE: GMM.U last released its quarterly earnings data on Tuesday, October 22nd. The auto manufacturer reported $2.96 earnings per share (EPS) for the quarter, topping the consensus estimate of $2.49 by $0.47. General Motors had a net margin of 6.06% and a return on equity of 16.30%. The company had revenue of $48.76 billion during the quarter, compared to analyst estimates of $44.67 billion. During the same quarter in the prior year, the business earned $2.28 earnings per share. The business's quarterly revenue was up 10.5% compared to the same quarter last year. As a group, research analysts forecast that General Motors will post 10.35 earnings per share for the current year.

General Motors Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Friday, December 6th will be given a $0.12 dividend. This represents a $0.48 annualized dividend and a dividend yield of 0.86%. The ex-dividend date is Friday, December 6th. General Motors's payout ratio is currently 5.12%.

General Motors Company Profile

(

Free Report)

General Motors Company designs, builds, and sells trucks, crossovers, cars, and automobile parts; and provide software-enabled services and subscriptions worldwide. The company operates through GM North America, GM International, Cruise, and GM Financial segments. It markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Baojun, and Wuling brand names.

Featured Articles

Before you consider General Motors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Motors wasn't on the list.

While General Motors currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.