Blueshift Asset Management LLC lessened its position in shares of CVS Health Co. (NYSE:CVS - Free Report) by 78.4% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 6,038 shares of the pharmacy operator's stock after selling 21,871 shares during the quarter. Blueshift Asset Management LLC's holdings in CVS Health were worth $380,000 at the end of the most recent quarter.

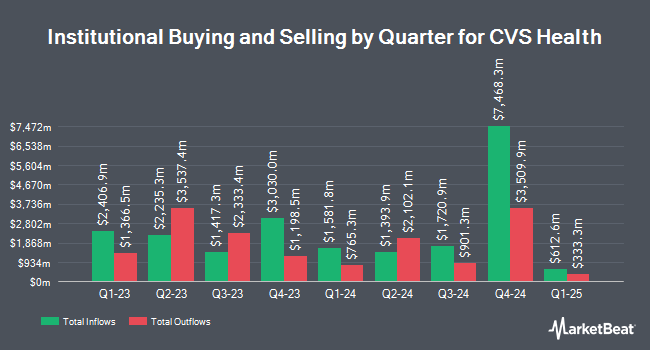

Several other hedge funds and other institutional investors have also made changes to their positions in CVS. MidAtlantic Capital Management Inc. acquired a new position in shares of CVS Health in the 3rd quarter valued at approximately $25,000. Livelsberger Financial Advisory acquired a new stake in shares of CVS Health in the third quarter valued at $31,000. Reston Wealth Management LLC acquired a new stake in shares of CVS Health during the third quarter worth $32,000. Kathleen S. Wright Associates Inc. acquired a new position in CVS Health during the third quarter valued at $33,000. Finally, First Community Trust NA raised its position in CVS Health by 116.2% during the second quarter. First Community Trust NA now owns 562 shares of the pharmacy operator's stock valued at $33,000 after buying an additional 302 shares during the period. Institutional investors and hedge funds own 80.66% of the company's stock.

Analyst Ratings Changes

Several brokerages have weighed in on CVS. Truist Financial reaffirmed a "buy" rating and issued a $67.00 target price (down from $76.00) on shares of CVS Health in a research report on Wednesday, November 20th. Cantor Fitzgerald restated a "neutral" rating and set a $62.00 target price on shares of CVS Health in a research note on Tuesday, October 1st. StockNews.com downgraded CVS Health from a "hold" rating to a "sell" rating in a research note on Thursday, November 14th. UBS Group upped their price target on CVS Health from $60.00 to $62.00 and gave the company a "neutral" rating in a report on Thursday, November 7th. Finally, Piper Sandler dropped their target price on CVS Health from $72.00 to $64.00 and set an "overweight" rating for the company in a report on Monday. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and thirteen have given a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $70.33.

Ad The TradingPub

Free ebook reveals our #1 chart pattern for 2020, 2021, 2022, 2023 and 2024.

It's time to get smart…

We think many good traders get caught up in the wrong stocks and ultimately burn up their trading accounts, which is why we want to share something special with you…

You see, our top technical trader just published a new e-book sharing his #1 stock pattern for the last 4 years…

It’s the same pattern that’s helped him grow his model portfolio by an average of 85% per year since 2020, and he’s currently giving away digital copies for free.

Inside, he’ll walk you through his #1 pattern, and show you why it forms.

As you’ll see, it’s all thanks to the algorithmic anomaly caused by Wall Street’s trading algorithms…

It's the main reason, this pattern paid out more than 72% of the time.

So, to claim your free digital copy today, simply follow this link and enter your email address.

Get Our Latest Stock Analysis on CVS

CVS Health Price Performance

Shares of CVS traded down $0.14 during mid-day trading on Friday, reaching $59.82. 3,947,461 shares of the stock traded hands, compared to its average volume of 11,314,412. The firm has a fifty day moving average price of $59.33 and a 200 day moving average price of $58.73. The company has a market cap of $75.28 billion, a price-to-earnings ratio of 15.22, a price-to-earnings-growth ratio of 1.02 and a beta of 0.55. The company has a current ratio of 0.80, a quick ratio of 0.59 and a debt-to-equity ratio of 0.80. CVS Health Co. has a 1 year low of $52.71 and a 1 year high of $83.25.

CVS Health (NYSE:CVS - Get Free Report) last announced its earnings results on Wednesday, November 6th. The pharmacy operator reported $1.09 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.08 by $0.01. The company had revenue of $95.43 billion during the quarter, compared to analyst estimates of $92.72 billion. CVS Health had a net margin of 1.36% and a return on equity of 10.72%. The firm's quarterly revenue was up 6.3% compared to the same quarter last year. During the same period in the previous year, the business earned $2.21 earnings per share. As a group, equities research analysts predict that CVS Health Co. will post 5.37 earnings per share for the current year.

CVS Health Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, November 1st. Investors of record on Monday, October 21st were paid a $0.665 dividend. This represents a $2.66 dividend on an annualized basis and a yield of 4.45%. The ex-dividend date was Monday, October 21st. CVS Health's payout ratio is currently 67.51%.

About CVS Health

(

Free Report)

CVS Health Corporation provides health solutions in the United States. It operates through Health Care Benefits, Health Services, and Pharmacy & Consumer Wellness segments. The Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services.

Read More

Before you consider CVS Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVS Health wasn't on the list.

While CVS Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.