Blueshift Asset Management LLC purchased a new position in HubSpot, Inc. (NYSE:HUBS - Free Report) in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 1,002 shares of the software maker's stock, valued at approximately $533,000.

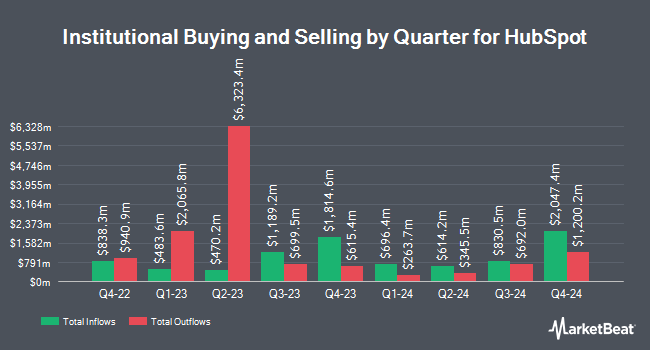

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Massachusetts Financial Services Co. MA lifted its position in shares of HubSpot by 17.9% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 571,274 shares of the software maker's stock worth $303,689,000 after purchasing an additional 86,688 shares during the last quarter. Marshall Wace LLP raised its stake in HubSpot by 88.7% in the second quarter. Marshall Wace LLP now owns 241,557 shares of the software maker's stock valued at $142,468,000 after buying an additional 113,555 shares in the last quarter. TimesSquare Capital Management LLC lifted its holdings in HubSpot by 49.5% during the 3rd quarter. TimesSquare Capital Management LLC now owns 207,842 shares of the software maker's stock worth $110,489,000 after buying an additional 68,827 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its position in shares of HubSpot by 2.3% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 194,538 shares of the software maker's stock worth $103,416,000 after acquiring an additional 4,331 shares in the last quarter. Finally, Fiera Capital Corp increased its holdings in shares of HubSpot by 1.2% in the 2nd quarter. Fiera Capital Corp now owns 166,519 shares of the software maker's stock valued at $98,211,000 after acquiring an additional 2,019 shares during the last quarter. Institutional investors and hedge funds own 90.39% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts recently weighed in on the company. Royal Bank of Canada boosted their target price on HubSpot from $700.00 to $750.00 and gave the stock an "outperform" rating in a research note on Thursday, November 7th. Raymond James reduced their price objective on shares of HubSpot from $725.00 to $675.00 and set an "outperform" rating for the company in a research report on Thursday, August 8th. Canaccord Genuity Group increased their target price on shares of HubSpot from $600.00 to $710.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Stifel Nicolaus lifted their price target on shares of HubSpot from $600.00 to $625.00 and gave the stock a "buy" rating in a research note on Tuesday, October 8th. Finally, KeyCorp upgraded shares of HubSpot from an "underweight" rating to a "sector weight" rating and set a $460.00 price objective for the company in a research note on Thursday, August 8th. Five research analysts have rated the stock with a hold rating and eighteen have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $672.68.

View Our Latest Stock Analysis on HubSpot

HubSpot Stock Performance

NYSE:HUBS traded down $7.07 during mid-day trading on Thursday, reaching $722.76. The stock had a trading volume of 234,049 shares, compared to its average volume of 592,824. The business has a 50 day simple moving average of $589.38 and a 200 day simple moving average of $554.35. HubSpot, Inc. has a twelve month low of $434.84 and a twelve month high of $754.56. The firm has a market capitalization of $37.31 billion, a price-to-earnings ratio of -2,674.42, a PEG ratio of 88.96 and a beta of 1.63.

HubSpot (NYSE:HUBS - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The software maker reported $2.18 EPS for the quarter, beating the consensus estimate of $1.91 by $0.27. HubSpot had a negative return on equity of 1.16% and a negative net margin of 0.56%. The business had revenue of $669.72 million during the quarter, compared to analysts' expectations of $646.97 million. During the same period last year, the firm earned ($0.04) EPS. The company's quarterly revenue was up 20.1% compared to the same quarter last year. As a group, sell-side analysts expect that HubSpot, Inc. will post 0.4 earnings per share for the current year.

Insiders Place Their Bets

In other news, CEO Yamini Rangan sold 116 shares of HubSpot stock in a transaction that occurred on Wednesday, September 4th. The shares were sold at an average price of $491.19, for a total transaction of $56,978.04. Following the completion of the sale, the chief executive officer now directly owns 67,203 shares in the company, valued at approximately $33,009,441.57. This trade represents a 0.17 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CFO Kathryn Bueker sold 1,136 shares of the company's stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $525.84, for a total value of $597,354.24. Following the completion of the sale, the chief financial officer now owns 41,259 shares in the company, valued at approximately $21,695,632.56. This represents a 2.68 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 44,391 shares of company stock worth $29,101,488. Corporate insiders own 4.50% of the company's stock.

HubSpot Company Profile

(

Free Report)

HubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Featured Stories

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report