North American Construction Group (TSE:NOA - Get Free Report) NYSE: NOA had its target price reduced by equities research analysts at BMO Capital Markets from C$35.00 to C$34.00 in a report issued on Thursday,BayStreet.CA reports. BMO Capital Markets' price objective points to a potential upside of 45.18% from the stock's current price.

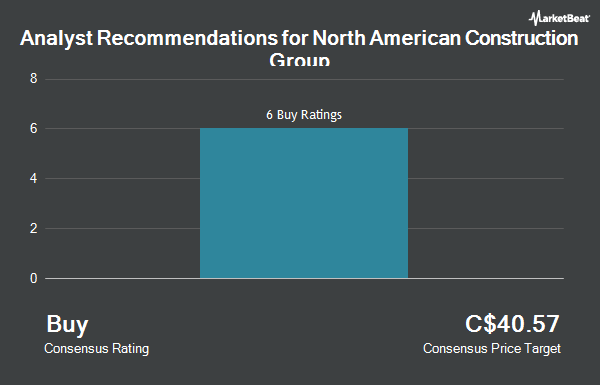

NOA has been the subject of several other research reports. Cibc World Mkts upgraded shares of North American Construction Group from a "hold" rating to a "strong-buy" rating in a report on Thursday, December 5th. Canaccord Genuity Group upped their price objective on shares of North American Construction Group from C$32.00 to C$33.00 in a research note on Friday, December 6th. National Bankshares cut their target price on North American Construction Group from C$45.00 to C$44.00 and set an "outperform" rating on the stock in a research report on Thursday, January 30th. CIBC raised North American Construction Group from a "neutral" rating to an "outperform" rating and upped their target price for the company from C$30.00 to C$38.00 in a research report on Thursday, December 5th. Finally, Raymond James upgraded North American Construction Group from an "outperform" rating to a "strong-buy" rating and set a C$40.00 price target on the stock in a research note on Thursday, January 30th. Six investment analysts have rated the stock with a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat, North American Construction Group has a consensus rating of "Buy" and an average price target of C$37.38.

Read Our Latest Report on North American Construction Group

North American Construction Group Stock Up 1.4 %

Shares of TSE:NOA traded up C$0.32 on Thursday, hitting C$23.42. 53,326 shares of the company's stock were exchanged, compared to its average volume of 84,569. The company has a debt-to-equity ratio of 212.25, a quick ratio of 0.79 and a current ratio of 1.13. North American Construction Group has a 1-year low of C$21.88 and a 1-year high of C$31.91. The company has a market capitalization of C$626.88 million, a PE ratio of 11.01, a P/E/G ratio of 0.79 and a beta of 1.59. The firm's 50-day moving average is C$26.52 and its 200 day moving average is C$27.03.

Insider Activity

In other news, Director Martin Robert Ferron sold 6,209 shares of North American Construction Group stock in a transaction dated Wednesday, January 1st. The shares were sold at an average price of C$31.60, for a total value of C$196,204.40. Corporate insiders own 8.93% of the company's stock.

About North American Construction Group

(

Get Free Report)

North American Construction Group Ltd. provides mining and heavy civil construction services to customers in the resource development and industrial construction sectors in Australia, Canada, and the United States. The company operates Heavy Equipment - Canada, Heavy Equipment - Australia, and Other segments.

Featured Stories

Before you consider North American Construction Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and North American Construction Group wasn't on the list.

While North American Construction Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.