Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) had its price target raised by stock analysts at BMO Capital Markets from $215.00 to $245.00 in a research report issued on Monday,Benzinga reports. The brokerage currently has a "market perform" rating on the technology company's stock. BMO Capital Markets' price objective suggests a potential upside of 15.33% from the stock's current price.

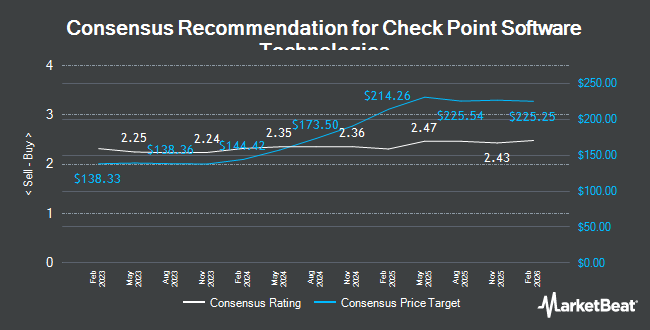

Other analysts have also issued research reports about the stock. Truist Financial reiterated a "buy" rating and set a $250.00 price target (up previously from $220.00) on shares of Check Point Software Technologies in a research report on Friday, January 31st. Jefferies Financial Group increased their price target on shares of Check Point Software Technologies from $220.00 to $225.00 and gave the stock a "buy" rating in a research report on Thursday, December 19th. Royal Bank of Canada increased their price target on shares of Check Point Software Technologies from $187.00 to $215.00 and gave the stock a "sector perform" rating in a research report on Friday, January 31st. Stifel Nicolaus increased their price target on shares of Check Point Software Technologies from $190.00 to $220.00 and gave the stock a "hold" rating in a research report on Friday, January 31st. Finally, Cantor Fitzgerald reiterated a "neutral" rating and set a $200.00 price target on shares of Check Point Software Technologies in a research report on Monday, January 27th. Nineteen analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to data from MarketBeat, Check Point Software Technologies presently has a consensus rating of "Hold" and a consensus price target of $215.59.

Check Out Our Latest Stock Analysis on CHKP

Check Point Software Technologies Stock Down 2.1 %

Shares of CHKP traded down $4.55 during mid-day trading on Monday, hitting $212.44. 1,050,188 shares of the company's stock were exchanged, compared to its average volume of 891,495. Check Point Software Technologies has a 52 week low of $145.75 and a 52 week high of $226.02. The stock's 50-day simple moving average is $190.61 and its 200-day simple moving average is $188.75. The firm has a market cap of $23.36 billion, a price-to-earnings ratio of 28.44, a price-to-earnings-growth ratio of 3.41 and a beta of 0.65.

Hedge Funds Weigh In On Check Point Software Technologies

A number of hedge funds have recently modified their holdings of CHKP. Dimensional Fund Advisors LP acquired a new position in shares of Check Point Software Technologies during the second quarter worth $2,079,000. Millennium Management LLC raised its stake in Check Point Software Technologies by 20.6% during the second quarter. Millennium Management LLC now owns 44,101 shares of the technology company's stock worth $7,277,000 after buying an additional 7,523 shares during the last quarter. B. Riley Wealth Advisors Inc. bought a new position in Check Point Software Technologies during the second quarter worth $250,000. Sanctuary Advisors LLC bought a new position in Check Point Software Technologies during the second quarter worth $703,000. Finally, Diversified Trust Co raised its stake in Check Point Software Technologies by 23.9% during the third quarter. Diversified Trust Co now owns 20,778 shares of the technology company's stock worth $4,006,000 after buying an additional 4,002 shares during the last quarter. Institutional investors and hedge funds own 98.51% of the company's stock.

About Check Point Software Technologies

(

Get Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Featured Stories

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.