Paycor HCM (NASDAQ:PYCR - Get Free Report) had its price target increased by stock analysts at BMO Capital Markets from $15.00 to $19.00 in a note issued to investors on Thursday, MarketBeat.com reports. The firm presently has a "market perform" rating on the stock. BMO Capital Markets' price target indicates a potential upside of 10.92% from the stock's current price.

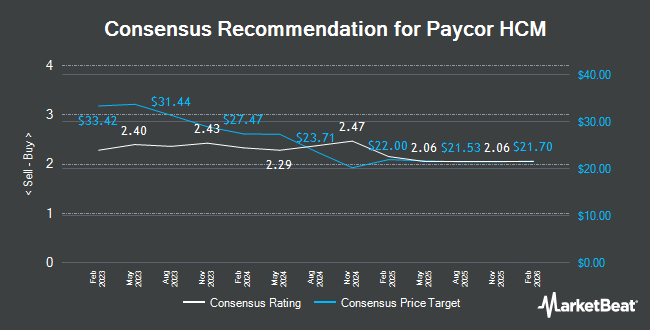

Several other research analysts have also commented on the company. Truist Financial cut their price objective on Paycor HCM from $33.00 to $20.00 and set a "buy" rating for the company in a report on Tuesday, August 13th. BTIG Research decreased their price target on shares of Paycor HCM from $26.00 to $20.00 and set a "buy" rating on the stock in a report on Thursday, August 15th. Needham & Company LLC dropped their price objective on shares of Paycor HCM from $42.00 to $20.00 and set a "buy" rating for the company in a report on Thursday, August 15th. Jefferies Financial Group increased their target price on Paycor HCM from $13.00 to $15.00 and gave the company a "hold" rating in a research note on Tuesday, October 22nd. Finally, JPMorgan Chase & Co. dropped their price target on Paycor HCM from $19.00 to $17.00 and set a "neutral" rating for the company in a research note on Thursday, August 15th. Nine equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $19.41.

Get Our Latest Stock Report on PYCR

Paycor HCM Stock Up 2.6 %

PYCR traded up $0.44 during trading hours on Thursday, hitting $17.13. The stock had a trading volume of 2,861,847 shares, compared to its average volume of 945,378. Paycor HCM has a 1 year low of $10.92 and a 1 year high of $22.65. The company's fifty day simple moving average is $14.17 and its 200 day simple moving average is $13.74. The stock has a market cap of $3.06 billion, a PE ratio of -65.65, a price-to-earnings-growth ratio of 4.87 and a beta of 0.42.

Paycor HCM (NASDAQ:PYCR - Get Free Report) last released its quarterly earnings data on Wednesday, August 14th. The company reported $0.11 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.09 by $0.02. Paycor HCM had a positive return on equity of 2.98% and a negative net margin of 9.00%. The company had revenue of $164.80 million for the quarter, compared to analyst estimates of $161.14 million. During the same period in the previous year, the company posted ($0.01) EPS. The firm's revenue for the quarter was up 17.7% compared to the same quarter last year. As a group, equities analysts expect that Paycor HCM will post 0.25 EPS for the current year.

Insider Activity

In related news, Director Jeremy Rishel sold 3,723 shares of the company's stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $14.02, for a total value of $52,196.46. Following the sale, the director now owns 21,218 shares in the company, valued at $297,476.36. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. 1.39% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Paycor HCM

Several hedge funds and other institutional investors have recently bought and sold shares of PYCR. Advisors Asset Management Inc. raised its holdings in shares of Paycor HCM by 52.4% during the first quarter. Advisors Asset Management Inc. now owns 3,424 shares of the company's stock valued at $67,000 after purchasing an additional 1,178 shares during the last quarter. Covestor Ltd grew its position in Paycor HCM by 29.4% in the 3rd quarter. Covestor Ltd now owns 5,322 shares of the company's stock worth $76,000 after purchasing an additional 1,210 shares during the period. Rhumbline Advisers raised its stake in Paycor HCM by 2.3% during the 2nd quarter. Rhumbline Advisers now owns 67,959 shares of the company's stock valued at $863,000 after buying an additional 1,560 shares during the last quarter. Fiera Capital Corp lifted its holdings in shares of Paycor HCM by 0.9% during the 2nd quarter. Fiera Capital Corp now owns 190,677 shares of the company's stock valued at $2,422,000 after buying an additional 1,629 shares during the period. Finally, Raymond James & Associates boosted its stake in shares of Paycor HCM by 0.6% in the 3rd quarter. Raymond James & Associates now owns 328,827 shares of the company's stock worth $4,666,000 after buying an additional 1,834 shares during the last quarter. Institutional investors own 36.76% of the company's stock.

About Paycor HCM

(

Get Free Report)

Paycor HCM, Inc, together with its subsidiaries, provides software-as-a-service (SaaS) human capital management (HCM) solutions for small and medium-sized businesses (SMBs) primarily in the United States. It offers cloud-native platform to address the comprehensive people management needs of SMB leaders.

Read More

Before you consider Paycor HCM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paycor HCM wasn't on the list.

While Paycor HCM currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.