BNC Wealth Management LLC bought a new stake in shares of Zscaler, Inc. (NASDAQ:ZS - Free Report) in the 3rd quarter, according to the company in its most recent filing with the SEC. The fund bought 3,382 shares of the company's stock, valued at approximately $578,000.

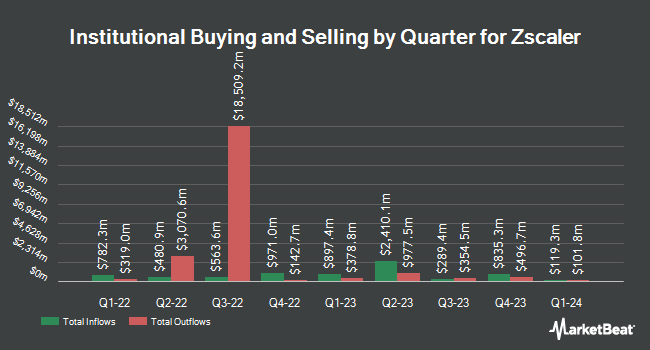

Several other institutional investors and hedge funds also recently made changes to their positions in ZS. Quest Partners LLC bought a new stake in shares of Zscaler during the 2nd quarter valued at $28,000. Asset Dedication LLC increased its position in shares of Zscaler by 436.8% in the 2nd quarter. Asset Dedication LLC now owns 204 shares of the company's stock valued at $39,000 after buying an additional 166 shares in the last quarter. American Capital Advisory LLC bought a new stake in shares of Zscaler in the 2nd quarter valued at $50,000. GAMMA Investing LLC increased its position in shares of Zscaler by 21.3% in the 2nd quarter. GAMMA Investing LLC now owns 382 shares of the company's stock valued at $73,000 after buying an additional 67 shares in the last quarter. Finally, Quarry LP increased its position in shares of Zscaler by 613.0% in the 2nd quarter. Quarry LP now owns 385 shares of the company's stock valued at $74,000 after buying an additional 331 shares in the last quarter. Institutional investors own 46.45% of the company's stock.

Zscaler Price Performance

ZS stock traded up $2.90 during midday trading on Thursday, reaching $195.93. The company had a trading volume of 510,034 shares, compared to its average volume of 2,034,596. Zscaler, Inc. has a 1-year low of $153.45 and a 1-year high of $259.61. The stock has a 50 day moving average price of $179.15 and a 200-day moving average price of $181.24. The company has a market capitalization of $29.88 billion, a price-to-earnings ratio of -482.56 and a beta of 0.82.

Zscaler (NASDAQ:ZS - Get Free Report) last issued its earnings results on Tuesday, September 3rd. The company reported ($0.05) earnings per share for the quarter, beating analysts' consensus estimates of ($0.14) by $0.09. The firm had revenue of $592.90 million for the quarter, compared to the consensus estimate of $567.46 million. Zscaler had a negative return on equity of 3.46% and a negative net margin of 2.66%. The company's revenue was up 30.3% compared to the same quarter last year. During the same quarter last year, the business posted ($0.17) EPS. As a group, research analysts anticipate that Zscaler, Inc. will post -0.95 earnings per share for the current year.

Insider Transactions at Zscaler

In other Zscaler news, CEO Jagtar Singh Chaudhry sold 2,852 shares of the stock in a transaction dated Tuesday, September 17th. The stock was sold at an average price of $171.28, for a total value of $488,490.56. Following the completion of the transaction, the chief executive officer now directly owns 361,432 shares in the company, valued at approximately $61,906,072.96. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In related news, Director Andrew William Fraser Brown sold 8,000 shares of the stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $174.10, for a total value of $1,392,800.00. Following the completion of the sale, the director now directly owns 25,907 shares in the company, valued at $4,510,408.70. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Jagtar Singh Chaudhry sold 2,852 shares of the firm's stock in a transaction on Tuesday, September 17th. The stock was sold at an average price of $171.28, for a total value of $488,490.56. Following the transaction, the chief executive officer now directly owns 361,432 shares of the company's stock, valued at approximately $61,906,072.96. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 30,502 shares of company stock worth $5,256,651. Corporate insiders own 19.20% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on ZS. BMO Capital Markets lowered their price objective on shares of Zscaler from $208.00 to $197.00 and set an "outperform" rating for the company in a research report on Wednesday, September 4th. Morgan Stanley upped their target price on shares of Zscaler from $202.00 to $215.00 and gave the stock an "equal weight" rating in a research note on Monday, August 26th. Rosenblatt Securities reaffirmed a "neutral" rating and issued a $190.00 target price on shares of Zscaler in a research note on Wednesday, September 4th. Wedbush reduced their target price on shares of Zscaler from $260.00 to $220.00 and set an "outperform" rating for the company in a research note on Wednesday, September 4th. Finally, Robert W. Baird reduced their target price on shares of Zscaler from $260.00 to $225.00 and set an "outperform" rating for the company in a research note on Wednesday, September 4th. Ten analysts have rated the stock with a hold rating, twenty-three have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $216.73.

Get Our Latest Stock Analysis on ZS

About Zscaler

(

Free Report)

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds.

Recommended Stories

Before you consider Zscaler, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zscaler wasn't on the list.

While Zscaler currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.