BNP PARIBAS ASSET MANAGEMENT Holding S.A. raised its holdings in Prologis, Inc. (NYSE:PLD - Free Report) by 9.0% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 197,854 shares of the real estate investment trust's stock after purchasing an additional 16,310 shares during the quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A.'s holdings in Prologis were worth $24,985,000 as of its most recent filing with the Securities and Exchange Commission.

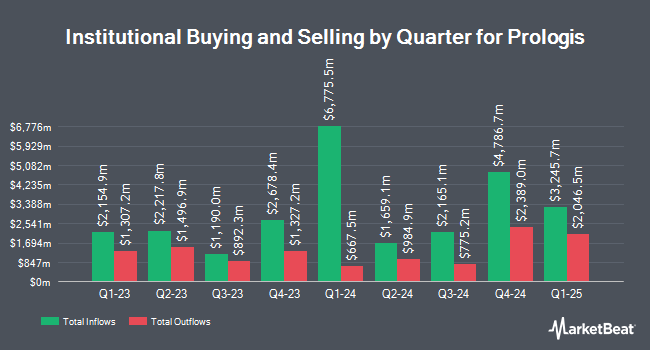

A number of other institutional investors also recently added to or reduced their stakes in the business. King Luther Capital Management Corp boosted its holdings in Prologis by 165.3% in the 3rd quarter. King Luther Capital Management Corp now owns 58,895 shares of the real estate investment trust's stock valued at $7,437,000 after purchasing an additional 36,693 shares in the last quarter. Cornerstone Advisors LLC lifted its position in shares of Prologis by 263.6% during the 3rd quarter. Cornerstone Advisors LLC now owns 8,000 shares of the real estate investment trust's stock valued at $1,010,000 after acquiring an additional 5,800 shares during the period. Moors & Cabot Inc. lifted its position in shares of Prologis by 6.0% during the 3rd quarter. Moors & Cabot Inc. now owns 2,096 shares of the real estate investment trust's stock valued at $265,000 after acquiring an additional 119 shares during the period. Hilton Capital Management LLC lifted its position in shares of Prologis by 56.7% during the 3rd quarter. Hilton Capital Management LLC now owns 73,159 shares of the real estate investment trust's stock valued at $9,239,000 after acquiring an additional 26,459 shares during the period. Finally, Commerce Bank lifted its position in shares of Prologis by 41.3% during the 3rd quarter. Commerce Bank now owns 610,228 shares of the real estate investment trust's stock valued at $77,060,000 after acquiring an additional 178,498 shares during the period. Hedge funds and other institutional investors own 93.50% of the company's stock.

Prologis Stock Up 1.6 %

PLD stock traded up $1.83 during trading on Friday, reaching $115.80. The stock had a trading volume of 2,432,985 shares, compared to its average volume of 3,529,268. Prologis, Inc. has a 1-year low of $101.11 and a 1-year high of $137.52. The company has a current ratio of 0.43, a quick ratio of 0.43 and a debt-to-equity ratio of 0.56. The company has a market capitalization of $107.25 billion, a P/E ratio of 34.97, a PEG ratio of 3.00 and a beta of 1.08. The firm has a fifty day moving average price of $119.75 and a 200 day moving average price of $118.32.

Prologis (NYSE:PLD - Get Free Report) last issued its earnings results on Wednesday, October 16th. The real estate investment trust reported $1.08 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.37 by ($0.29). The company had revenue of $1.90 billion during the quarter, compared to analyst estimates of $1.91 billion. Prologis had a net margin of 39.08% and a return on equity of 5.34%. The business's revenue for the quarter was up 6.9% compared to the same quarter last year. During the same quarter last year, the company posted $1.30 EPS. On average, equities analysts anticipate that Prologis, Inc. will post 5.45 earnings per share for the current year.

Prologis Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Monday, September 16th were given a $0.96 dividend. This represents a $3.84 annualized dividend and a yield of 3.32%. The ex-dividend date was Monday, September 16th. Prologis's dividend payout ratio (DPR) is 116.01%.

Analysts Set New Price Targets

PLD has been the subject of a number of research reports. Truist Financial lifted their price target on shares of Prologis from $125.00 to $137.00 and gave the company a "buy" rating in a research report on Monday, August 5th. Scotiabank cut their price objective on Prologis from $142.00 to $136.00 and set a "sector outperform" rating for the company in a research report on Friday, October 25th. Barclays lifted their price objective on Prologis from $131.00 to $132.00 and gave the stock an "overweight" rating in a research report on Monday, November 18th. Morgan Stanley lifted their price objective on Prologis from $132.00 to $133.00 and gave the stock an "overweight" rating in a research report on Wednesday, August 14th. Finally, Bank of America restated a "neutral" rating and set a $128.00 price objective on shares of Prologis in a research report on Monday, August 12th. Eight investment analysts have rated the stock with a hold rating, eight have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, Prologis has a consensus rating of "Moderate Buy" and an average price target of $131.25.

Check Out Our Latest Stock Report on Prologis

About Prologis

(

Free Report)

Prologis, Inc is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At March 31, 2024, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (115 million square meters) in 19 countries.

Recommended Stories

Before you consider Prologis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prologis wasn't on the list.

While Prologis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.