BNP Paribas Financial Markets boosted its position in Tilray Inc (NASDAQ:TLRY - Free Report) by 1,314.1% in the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 1,819,494 shares of the company's stock after purchasing an additional 1,690,827 shares during the quarter. BNP Paribas Financial Markets owned approximately 0.20% of Tilray worth $3,202,000 at the end of the most recent reporting period.

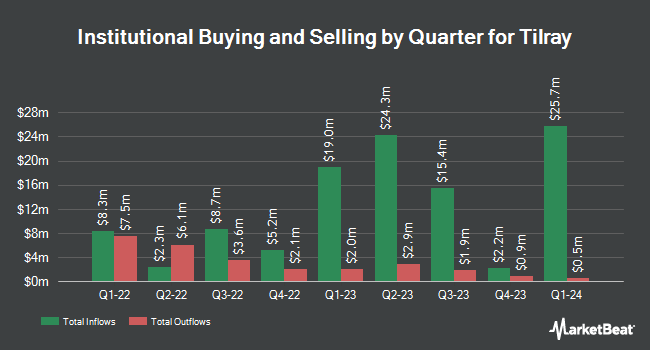

Several other hedge funds have also modified their holdings of the company. Prospect Financial Services LLC purchased a new stake in shares of Tilray during the 2nd quarter valued at $26,000. Ferguson Wellman Capital Management Inc. purchased a new stake in Tilray in the third quarter valued at about $26,000. Signature Estate & Investment Advisors LLC acquired a new stake in Tilray in the second quarter worth about $29,000. Jeppson Wealth Management LLC purchased a new stake in shares of Tilray during the second quarter worth about $33,000. Finally, Vanguard Capital Wealth Advisors acquired a new position in shares of Tilray during the second quarter valued at about $34,000. 9.35% of the stock is owned by hedge funds and other institutional investors.

Tilray Stock Performance

Tilray stock traded down $0.02 during trading hours on Friday, hitting $1.28. 34,239,156 shares of the stock traded hands, compared to its average volume of 25,541,162. Tilray Inc has a 1 year low of $1.26 and a 1 year high of $2.97. The stock has a market capitalization of $1.16 billion, a price-to-earnings ratio of -4.74 and a beta of 2.08. The company has a debt-to-equity ratio of 0.08, a current ratio of 2.47 and a quick ratio of 1.57. The firm's 50 day moving average price is $1.53 and its 200-day moving average price is $1.70.

Tilray (NASDAQ:TLRY - Get Free Report) last posted its quarterly earnings results on Thursday, October 10th. The company reported ($0.04) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.04). The company had revenue of $200.00 million during the quarter, compared to analyst estimates of $218.70 million. Tilray had a negative net margin of 26.79% and a negative return on equity of 2.00%. Tilray's revenue for the quarter was up 13.0% compared to the same quarter last year. During the same period last year, the firm posted ($0.10) EPS. As a group, equities analysts expect that Tilray Inc will post -0.14 EPS for the current fiscal year.

Insider Activity at Tilray

In related news, CFO Carl A. Merton acquired 26,000 shares of the stock in a transaction on Friday, November 15th. The shares were acquired at an average price of $1.36 per share, for a total transaction of $35,360.00. Following the transaction, the chief financial officer now owns 26,000 shares in the company, valued at approximately $35,360. This trade represents a ∞ increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.87% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

Separately, Roth Mkm lowered their target price on shares of Tilray from $2.00 to $1.75 and set a "neutral" rating for the company in a research note on Friday, October 11th.

Read Our Latest Analysis on Tilray

About Tilray

(

Free Report)

Tilray, Inc engages in the research, cultivation, processing, and distribution of medical cannabis. The company offers its products in Argentina, Australia, Canada, Chile, Croatia, Cyprus, the Czech Republic, Germany, New Zealand, and South Africa. Tilray, Inc is headquartered in Canada.

Read More

Before you consider Tilray, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tilray wasn't on the list.

While Tilray currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.