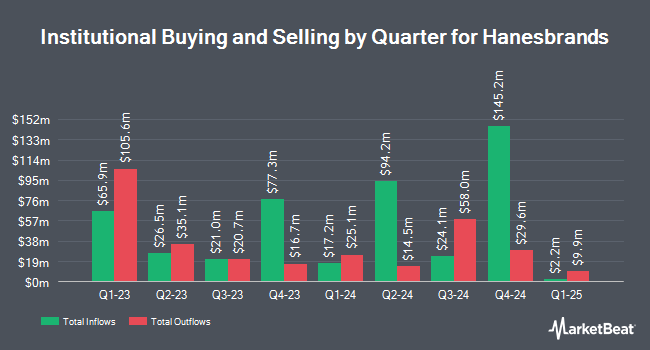

BNP Paribas Financial Markets raised its holdings in shares of Hanesbrands Inc. (NYSE:HBI - Free Report) by 388.9% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 742,314 shares of the textile maker's stock after buying an additional 590,493 shares during the period. BNP Paribas Financial Markets owned about 0.21% of Hanesbrands worth $5,456,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. FMR LLC raised its stake in shares of Hanesbrands by 203.5% during the third quarter. FMR LLC now owns 115,833 shares of the textile maker's stock valued at $851,000 after purchasing an additional 77,669 shares during the period. The Manufacturers Life Insurance Company boosted its holdings in Hanesbrands by 4.5% in the third quarter. The Manufacturers Life Insurance Company now owns 184,714 shares of the textile maker's stock worth $1,358,000 after purchasing an additional 7,897 shares during the period. Charles Schwab Investment Management Inc. boosted its holdings in Hanesbrands by 0.3% in the third quarter. Charles Schwab Investment Management Inc. now owns 4,382,574 shares of the textile maker's stock worth $32,212,000 after purchasing an additional 11,074 shares during the period. Landscape Capital Management L.L.C. acquired a new position in Hanesbrands in the third quarter worth $785,000. Finally, Intech Investment Management LLC boosted its holdings in Hanesbrands by 628.2% in the third quarter. Intech Investment Management LLC now owns 74,766 shares of the textile maker's stock worth $550,000 after purchasing an additional 64,499 shares during the period. 80.31% of the stock is owned by institutional investors and hedge funds.

Hanesbrands Price Performance

Shares of HBI stock traded down $0.08 during trading hours on Wednesday, hitting $8.59. 1,571,979 shares of the company's stock were exchanged, compared to its average volume of 7,684,974. The stock's 50-day moving average is $7.63 and its 200-day moving average is $6.32. The company has a debt-to-equity ratio of 21.50, a current ratio of 1.49 and a quick ratio of 0.90. The stock has a market cap of $3.03 billion, a price-to-earnings ratio of -13.14 and a beta of 1.64. Hanesbrands Inc. has a 52 week low of $3.70 and a 52 week high of $9.10.

Hanesbrands (NYSE:HBI - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The textile maker reported $0.15 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.11 by $0.04. Hanesbrands had a positive return on equity of 44.72% and a negative net margin of 5.24%. The business had revenue of $937.10 million for the quarter, compared to analysts' expectations of $936.47 million. During the same quarter last year, the business earned $0.10 earnings per share. The firm's quarterly revenue was down 2.5% compared to the same quarter last year. As a group, research analysts forecast that Hanesbrands Inc. will post 0.39 EPS for the current year.

Analyst Upgrades and Downgrades

Several brokerages have recently issued reports on HBI. UBS Group raised shares of Hanesbrands from a "neutral" rating to a "buy" rating and boosted their price target for the company from $9.00 to $11.00 in a report on Tuesday, November 26th. Stifel Nicolaus boosted their price target on shares of Hanesbrands from $4.50 to $6.00 and gave the stock a "hold" rating in a research report on Monday, August 12th. Finally, Barclays boosted their price objective on Hanesbrands from $6.00 to $7.00 and gave the stock an "equal weight" rating in a report on Monday, November 11th. Four analysts have rated the stock with a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $6.90.

Read Our Latest Analysis on HBI

Hanesbrands Profile

(

Free Report)

Hanesbrands Inc, a consumer goods company, designs, manufactures, sources, and sells a range of range of innerwear apparels for men, women, and children in the Americas, Europe, the Asia pacific, and internationally. The company operates through three segments: Innerwear, Activewear, and International.

Recommended Stories

Before you consider Hanesbrands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hanesbrands wasn't on the list.

While Hanesbrands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.