BNP Paribas Financial Markets trimmed its stake in Blue Bird Co. (NASDAQ:BLBD - Free Report) by 17.9% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 149,338 shares of the company's stock after selling 32,514 shares during the quarter. BNP Paribas Financial Markets owned approximately 0.46% of Blue Bird worth $7,162,000 at the end of the most recent reporting period.

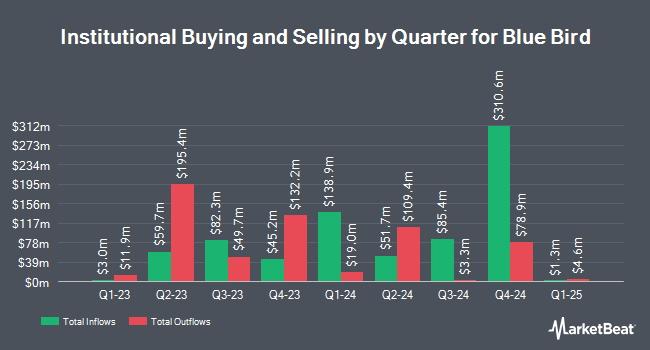

Other institutional investors have also recently made changes to their positions in the company. Vanguard Group Inc. lifted its position in shares of Blue Bird by 36.0% in the first quarter. Vanguard Group Inc. now owns 1,911,645 shares of the company's stock valued at $73,292,000 after buying an additional 505,727 shares during the last quarter. FMR LLC grew its holdings in Blue Bird by 268.0% in the 3rd quarter. FMR LLC now owns 1,841,745 shares of the company's stock valued at $88,330,000 after buying an additional 1,341,259 shares in the last quarter. Deroy & Devereaux Private Investment Counsel Inc. increased its position in Blue Bird by 0.4% during the 3rd quarter. Deroy & Devereaux Private Investment Counsel Inc. now owns 635,920 shares of the company's stock worth $30,499,000 after buying an additional 2,598 shares during the period. Renaissance Technologies LLC lifted its holdings in shares of Blue Bird by 81.7% during the second quarter. Renaissance Technologies LLC now owns 509,422 shares of the company's stock worth $27,432,000 after buying an additional 229,004 shares in the last quarter. Finally, Dimensional Fund Advisors LP boosted its position in shares of Blue Bird by 30.8% in the second quarter. Dimensional Fund Advisors LP now owns 323,179 shares of the company's stock valued at $17,405,000 after acquiring an additional 76,036 shares during the period. Institutional investors and hedge funds own 93.59% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have issued reports on BLBD. Needham & Company LLC reissued a "buy" rating and issued a $66.00 price objective on shares of Blue Bird in a report on Tuesday, November 26th. BTIG Research started coverage on shares of Blue Bird in a research report on Wednesday, October 9th. They set a "buy" rating and a $55.00 price target on the stock. Bank of America lowered their price objective on shares of Blue Bird from $66.00 to $63.50 and set a "buy" rating for the company in a research report on Tuesday, November 26th. Roth Mkm lowered Blue Bird from a "buy" rating to a "neutral" rating and set a $48.00 price target on the stock. in a research note on Thursday, October 3rd. Finally, Roth Capital downgraded Blue Bird from a "strong-buy" rating to a "hold" rating in a research report on Thursday, October 3rd. Two equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. Based on data from MarketBeat.com, Blue Bird has a consensus rating of "Moderate Buy" and an average target price of $60.64.

Read Our Latest Stock Report on BLBD

Blue Bird Trading Down 2.1 %

Shares of Blue Bird stock traded down $0.88 during trading on Tuesday, hitting $41.55. The company's stock had a trading volume of 389,812 shares, compared to its average volume of 623,071. The stock has a market cap of $1.34 billion, a price-to-earnings ratio of 13.34, a price-to-earnings-growth ratio of 1.03 and a beta of 1.59. Blue Bird Co. has a 52 week low of $19.30 and a 52 week high of $59.40. The stock has a 50-day moving average price of $43.01 and a two-hundred day moving average price of $48.41. The company has a debt-to-equity ratio of 0.56, a current ratio of 1.37 and a quick ratio of 0.83.

Insiders Place Their Bets

In other news, President Britton Smith sold 2,508 shares of the company's stock in a transaction on Thursday, September 12th. The shares were sold at an average price of $49.81, for a total value of $124,923.48. Following the sale, the president now directly owns 80,617 shares of the company's stock, valued at approximately $4,015,532.77. This represents a 3.02 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Company insiders own 2.10% of the company's stock.

About Blue Bird

(

Free Report)

Blue Bird Corporation, together with its subsidiaries, designs, engineers, manufactures, and sells school buses in the United States, Canada, and internationally. The company operates through two segments, Bus and Parts. It offers Type C, Type D, and specialty buses; and alternative power options through its propane powered, gasoline powered, compressed natural gas powered, and electric powered school buses, as well as diesel engines.

See Also

Before you consider Blue Bird, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Bird wasn't on the list.

While Blue Bird currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.